Piggly Wiggly

The first self-service grocery started in 1916 in Memphis, TN. Its called Piggly-Wiggly and that push for innovation, profits and growth is a good place to start today, as markets celebrate another quiet session with the start of the Lunar New Year of the Pig, the appetite for risk rises. Selling volatility, buying equities, giving up on JPY and Gold as place-holders – all that shows up on the trading tape. What hasn’t maybe more important – rates are treading water – as central bankers do their best to remain neutral or even pullback normalization talk. The RBA meeting today brought out “downside risks” from the global economy. The BOE, RBI, and others ahead will likely to the same. The weakness in Australia looks notable given a big drop in imports, weak retail sales, and a sharp drop in the Service PMI. The gains in the A$ overnight and the rally up in equities maybe less sustainable than those looking for the RBA to give in to another easing should things get worse. The same logic flows over to Europe where Italy and France are the weakest links to any growth. The Service PMI stories highlight the troubles in Europe and make it hard to believe in the EUR to 1.20 instead of 1.10. The political pressures in both the US and Europe are rising with the drop in growth and demand. This puts the race to the bottom back into the thinking of FX with JPY, EUR, and USD all playing for last place. The EUR seems to be in the best position for a 1.13 test and break unless something happens tonight with Trump and the State of the Union. While we maybe celebrating the post Superbowl, start of Chinese New Year, the Piggly- wiggly moment of truth has yet to be seen in valuations, rates or risk.

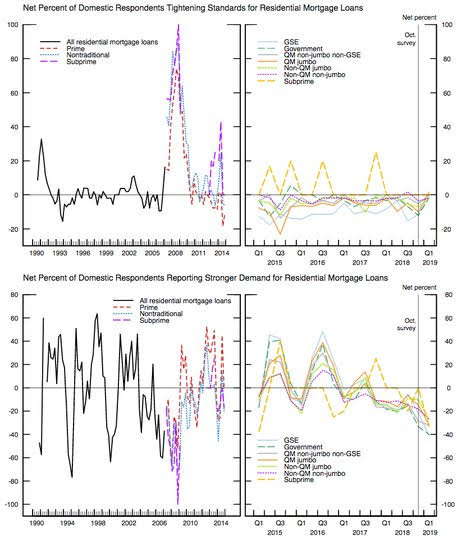

Question for the Day: Does the US Senior Loan Officer survey suggest the FOMC is too tight? The demand for mortgages fell notably as did demand for auto loans. The willingness of banks to lend also dropped. The interest rate sensitive parts of the economy are showing the effects of 9 Fed hikes. The dinner between Trump and Powell clearly had some crow on the plate. There is something to consider in the latest Fed Senior Loan Officer survey that suggests trouble to remain in the US 1Q growth beyond government shut-downs and US trade policy issues.

What Happened?

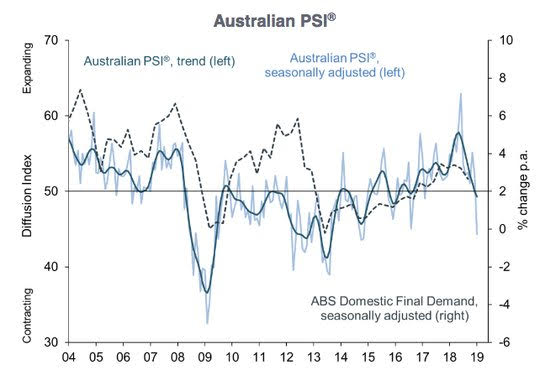

- Australia January CBA final Services PMI 51 from 52.7 – same as flash – weakest since May 2016. The composite PMI slips to 51.3 from 52.9 – weaker than 51.5 expected. Demand at home slowed while foreign held, but overall new work weighed on activity.

- Australia January AIG Services PMI 44.3 from 52.1 – much weaker than 51 expected. The trend for PSI fell 0.7 to 49.3. Weakness came from retail trade -5.2 to 39.9, wholesale trade -1.3 to 43.3, with hospitality -0.7 to 55.1 and health/education -1.8 to 51.7. Overall, new orders fell 12.6 to 45.4, but employment rose 2 to 47.5 with wages -7.4 to 55.2.

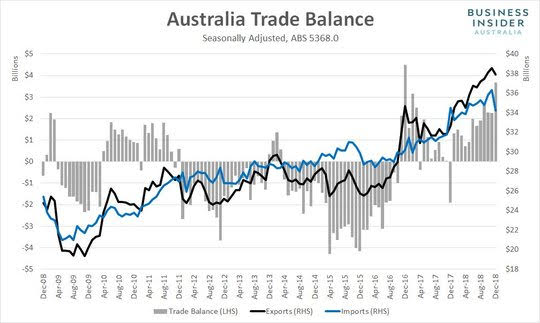

- Australia December trade surplus A$3.681bn after revised A$2.256bn (up from A$1.925bn) - more than the A$2.25bn expected. Exports fell 1.6% to A$37.924bn after +1% gain - weaker than the +1% expected; while imports fell 5.7% to A$34.244bn – biggest drop on record after +2% gain- weaker than the +1% expected. Imports of aircraft, transport equipment and fuel all fell.

- Australia December retail sales -0.4% m/m after revised +0.5% m/m (pre 0.4%) – weaker than the -0.1% m/m expected. The ABS noted: "Household goods (-2.8 per cent) and Clothing and footwear (-2.4 per cent) led the falls after strong rises in November from Black Friday promotions," said Ben James, Director of Quarterly Economy Wide Surveys. "There were also falls in Department stores (-1.1 per cent) and Other retailing (-0.1 per cent)."

- Australia RBA keeps rates unchanged at 1.5%- as expected– continues neutral bias but sees rising downside risks - “The outlook for global growth remains reasonable, although downside risks have increased. The trade tensions are affecting global trade and some investment decisions. Growth in the Chinese economy has continued to slow…” Lowe also noted that he expects GDP to grow by “around 3% this year and by a little less in 2020 due to slower growth in exports of resources.”

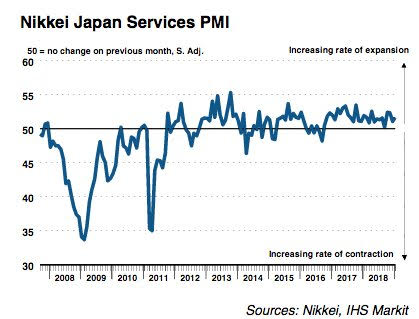

- Japan January Nikkei Services PMI 51.6 from 51 – better than 51.8 expected. Domestic new orders more than offset declines in export orders. Employment was higher with demand but backlogs for work continued – now at 15-month highs and output prices rise despite lower inputs. Confidence improved. However, the Composite PMI fell to 50.9 from 52with manufacturing the drag seeing the first output drop since July 2016.

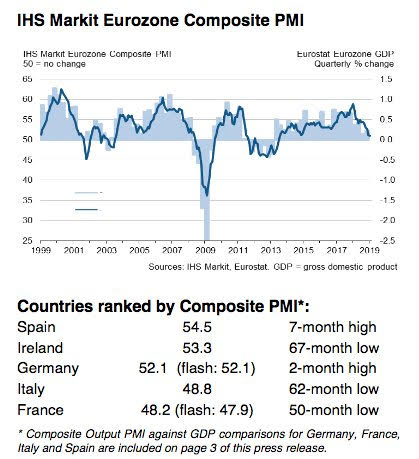

- Eurozone January Services PMI 51.2 from 51.2 – better than 50.8 flash. The composite PMI 51 from 51.1 – better than 50.7 flash – lowest in 5 ½ years. Weakness in France and Italy stood out. Also notable, business confidence rose to 3-month highs but with trade, Brexit and political tensions still cited as concerns. IHS sees 1Q GDP growing at 0.1% q/q – setting up for the worst performance since 2013.

- Spain Services PMI 54.7 from 54 – better than the 53 expected.Best activity in 7-months, job creation at 6-month highs. Confidence higher.

- Italy Services PMI 49.7 from 50.5 – weaker than the 50 expected. Employment drops for first time since Sep 2016. Activity dips with new orders slowing.

- France Services final PMI 47.8 from 49 – better than 47.5 flash.The composite PMI 48.2 from 48.7 – better than 47.9 flash. Both orders and activity lower, job creation at 2-year lows

- German Services PMI 53 from 51.8 – weaker than 53.1 flash.The composite PMI 52.1 from 51.6 – same as 52.1 flash. Activity rose, orders slow and input inflation at 8-year highs

- UK January Services PMI 50.1 from revised 51.2 (pre 51.1) - weaker than 51 expected – worst in 2 ½ years. New orders fell for the first time in 2 ½ years. Staffing drops for the first time since 2012. Stronger input inflation persists. Political uncertainty and Brexit cited. The UK Composite PMI drops to 50.3 from 51.5 – lowest since Aug 2016

- Eurozone December retail sales -1.6% m/m, 0.8% y/y after revised 0.8% m/m, 1.8% y/y (pre 0.1% m/m, 1.1% y/y) - as expected. Non-food sales fell 2.7% while food/drink fell 0.3% m/m and fuel rose 0.5% m/m. Weakest sales by nations – Germany -4.3%, Sweden -2.5% while Austria up 0.7% and Portugal up 0.6% m/m.

- Spain January consumer confidence jumps to 93.8 from 90.9 – better than the 91.5 expected.

Market Recap:

Equities: The US S&P500 futures are up 0.2% after a 0.68% gain. The Stoxx Europe 600 is up 0.95% while the MSCI Asia Pacific was mixed in thin holiday trading. Australia up on bank relief over commission report.

- Japan Nikkei off 0.19% to 20,844.45

- Korea Kospi closed for holiday

- Hong Kong Hang Seng closed for holiday

- China Shanghai Composite closed for holiday

- Australia ASX up 1.76% to 6,068.10

- India NSE50 up 0.20% to 10,934.35

- UK FTSE so far up 1.40% to 7,133

- German DAX so far up 1.20% to 11,313

- French CAC40 so far up 1.00% to 5,051

- Italian FTSE so far up 1.1% to 19,827

Fixed Income: Risk-on and thin markets from Asia combine to put selling into play but weaker data and central bank speeches and meetings offset. German 10-year Bund yields up 1bps to 0.19%, France up 1bps to 0.60%, UK Gilts off 1bps to 1.27% while periphery gains with Italy off 2bps to 2.73%, Spain flat at 1.25%, Portugal flat at 1.68% and Greece off 1bps to 3.89%.

- US Bonds lower waiting for more data, more supply– 2Y up 1bps to 2.54%, 5Y up 1bps to 2.54%, 10Y up 1bps to 2.73% and 30Y up 1bps to 3.07%.

- Japan JGBs mixed with curve flatter after good 10Y sale– The MOF sold Y1.77trn of 10-year 0.1% (#353) JGB at -0.013% with 4.8 cover- previously +0.015%. 2Y up 1bps to -0.16%, 5Y up 1bps to -0.16%, 10Y up 1bps to -0.01%, 30Y flat at 0.61%.

- Australian bonds sold after RBA despite weak retail sales, big import drop in trade– 3Y up 4bps to 1.78%, 10Y up 4bps to 2.27%.

Foreign Exchange: The US dollar index is up 0.1% to 95.95. In EM, USD is mostly weaker - for EMEA: RUB up 0.1% to 65.478, ZAR up 0.4% to 13.365, TRY up 0.3% to 15.198; while in Asia markets holiday thin - INR up 0.15% to 71.56, KRW up 0.1% to 1115.75.

- EUR: 1.1415 off 0.2%.Range 1.1412-1.1441 with 1.13-1.15 the keys still and focus on US rates/growth/politics.

- JPY: 109.95 up 0.1%.Range 109.78-110.04 with 110.20-50 next key resistance. EUR/JPY 125.55 off 0.1%.

- GBP: 1.3000 off 0.3%.Range 1.2997-1.3051 with EUR/GBP .8780 up 0.1% - all about politics, BOE and growth doubts with 1.2850 back in play.

- AUD: .7250 up 0.3%.Range .7194-.7265 with RBA on hold, trade surplus surprise and weaker Service PMI – A$ up limited by .7350-.74 but crosses driving. NZD .6900 up 0.2%.

- CAD: 1.3110 flat. Range 1.3102-1.3222 with focus on BOC and oil as drivers and 1.3050-1.3250 consolidation.

- CHF: 1.0015 up 0.4%.Range .9971-1.0021 with 1.00 break key for 1.02 test – SNB happy with 1.15 key on cross. EUR/CHF 1.1435 up 0.25%.

Commodities: Oil up, Gold down, Copper up 0.1% to $2.7725

- Oil: $54.84 up 0.5%. Range $54.38-$55.21 with Brent up 0.2% to $62.64 – consolidation with focus on API and global demand.

- Gold: $1318 off 0.1%. Range $1314.80-$1319.50 with focus on $1310-$1325 and USD as driver. Silver off 0.1% to $15.87, Platinum up 0.15% to $824.10 and Palladium up 0.35% to $1335.

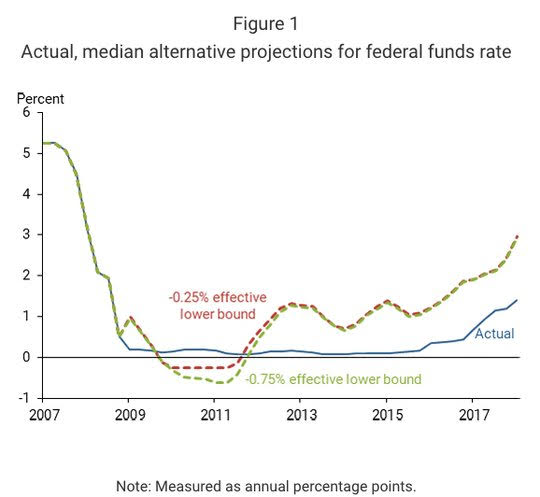

Conclusions: Is the Fed going to play with the zero bound in the next recession? The biggest fear for longer-term investors is how to prepare for the next US recession and play out the scenarios for FOMC reactions. The length and depth of the next downturn in the US is widely expected to be modest and different than that of the 2008 great recession. However, the view of U vs. a V recovery rests on the reaction function of the central bank. The ability for the Fed to do more QE or have a 2.5% cushion to cut maybe important but some think its not enough given the size of US debt. The worst-case scenario revolves around outside shocks to the system. For those interested in such gloomy thinking, read the San Fran Fed economic letter out yesterday – How much could negative rates have helped the recovery?

Economic Calendar:

- 0830 am Canada Dec trade deficit C$2.06bnp C$1.7bn e

- 0945 am US Jan final Services PMI 54.4p 54.2e / composite 54.4p 54.5e

- 1000 am US Jan Services ISM 58p 57e

- 1000 am US Feb IBD/TIPP economic optimism 52.3p 53.1e

- 1130 am US sells $50bn in 1M bills

- 0100 pm US sells $38bn 3Y notes

- 0430 pm US weekly API oil inventory 2.09mb p 1mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.