'Phase 1' Trade Deal Pushes S&P 500 To New Record Highs

For the S&P 500 (Index: SPX), the biggest story of the second week of December 2019 came with the confirmation the U.S. and China had struck a 'Phase 1' trade deal, which pushed the index to close the week once again at record highs. As of Friday, 13 December 2019, the highest closing value ever recorded for the S&P 500 reached 3,168.80, where though news of the deal broke on Thursday and boosted stock prices near that height, there was just enough momentum to carry the S&P just slightly higher to end the week.

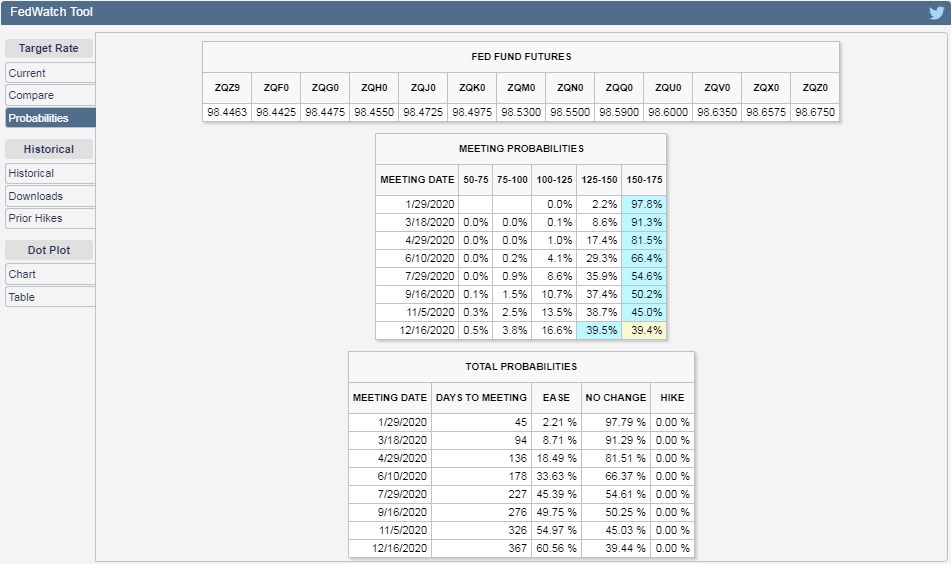

With that trade deal now falling back in the rearview mirror, the second biggest news item of the week offered a glimpse of what might come to dominate the attention of investors in the weeks ahead, because the Federal Reserve met and did nothing, while also establishing the expectation they won't be adjusting interest rates in 2020. The CME Group's FedWatch Tool has captured much of that change in future expectations, where it now gives better than even odds that the earliest the Fed might next cut the Federal Funds Rate would be in the fourth quarter of 2020, though the odds of a rate cut in 2020-Q3 are still close to the 50% mark.

Going by the dividend futures-based model we use to create the alternate futures chart above, a shift in the forward-looking focus of investors from 2020-Q3 to 2020-Q4 would be accompanied by a decline in the S&P 500, in which we would see stock prices drop potentially well below the redzone forecast range, which assumes they remain focused on 2020-Q3 in setting current day stock prices. Should they shift their focus toward the nearer term quarter of 2020-Q1 however, there would be little impact to stock prices because the expectations for the changes in the year over year rates of dividend growth are similar between 2020-Q1 and 2020-Q3.

The random onset of new information would be responsible for driving such a shift in focus, where the following headlines we extracted from last week's news flow provide the context for why we believe investors have largely been focusing on 2020-Q3 in recent weeks.

Monday, 9 December 2019

- Oil slips as weak China exports highlight trade war impact

- Bigger trouble developing in China:

- Trade negotiations status update:

- Wall St. falls as Apple, health shares drag, tariff deadline looms

Tuesday, 10 December 2019

- Oil rises but U.S.-China trade war weighs on demand outlook

- Bigger trouble developing in China:

- U.S.-Mexico-Canada Trade Deal

- Powell's 'half-full' U.S. glass sturdy but still at risk for spills as Fed meets

- Wall Street dips as tariff deadline approaches

Wednesday, 11 December 2019

- Oil drops on surprise U.S. crude build but tariff deadline eyed

- More backfire economics in China in tariff war:

- Powell signals Fed open to adjusting regulations to keep money markets stable

- Wall Street posts modest gain as Fed signals rates to hold for some time

Thursday, 12 December 2019

- Oil rises 1% on optimism for a U.S.-China trade deal

- Trade negotiations entering their endgames:

- Bigger trouble developing in the Eurozone and China:

- Fed minions meet, do nothing:

- Wall Street hits records on news of U.S.-China trade deal

Friday, 13 December 2019

- Oil nears three-month high as trade hopes, UK election boost sentiment

- U.S.-China strike 'Phase 1' trade deal:

- Bigger stimulus developing in China:

- Bigger trouble developing in the Eurozone:

- ECB's De Guindos says larger banks in the eurozone should consolidate transnationally

- Translation: There are very big banks in several countries of the Eurozone that are at risk of going under, which the ECB anticipates will need to bought out by big banks in other countries.

- ECB's De Guindos says larger banks in the eurozone should consolidate transnationally

- Fed policymakers see U.S. economy on good footing

- Wall Street steady as U.S., China announce trade deal

Meanwhile, Barry Ritholtz itemized the positives and negatives he found in the week's economics and market-related news.

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more