Peak Optimism? S&P Futures Hit After Too Much "Stimulus Optimism" Sends 10Y Yields Surging

There was a curious twist in the traditional "stimulus is good" market narrative this morning.

In early overnight trading, futures initially ticked higher on Wednesday as investors pressed bets for a fiscal stimulus deal after Nancy Pelosi said she is hopeful for a stimulus this week, even though negotiations blew past her own self-imposed Tuesday deadline for agreeing on a pre-election deal. Her enthusiasm was echoed by White House Chief of Staff Mark Meadows who said everyone is "working really hard" to get a package agreed by the weekend, adding that there are still outstanding issues, while Mitch McConnell warned the Trump administration not to agree to anything like Pelosi's proposal ahead of the election (McConnell plans to seek a vote on the Republican scaled-down package in the Senate today). In any event, this initial "optimism" was enough to get futures to ramp sharply higher in early overnight trading...

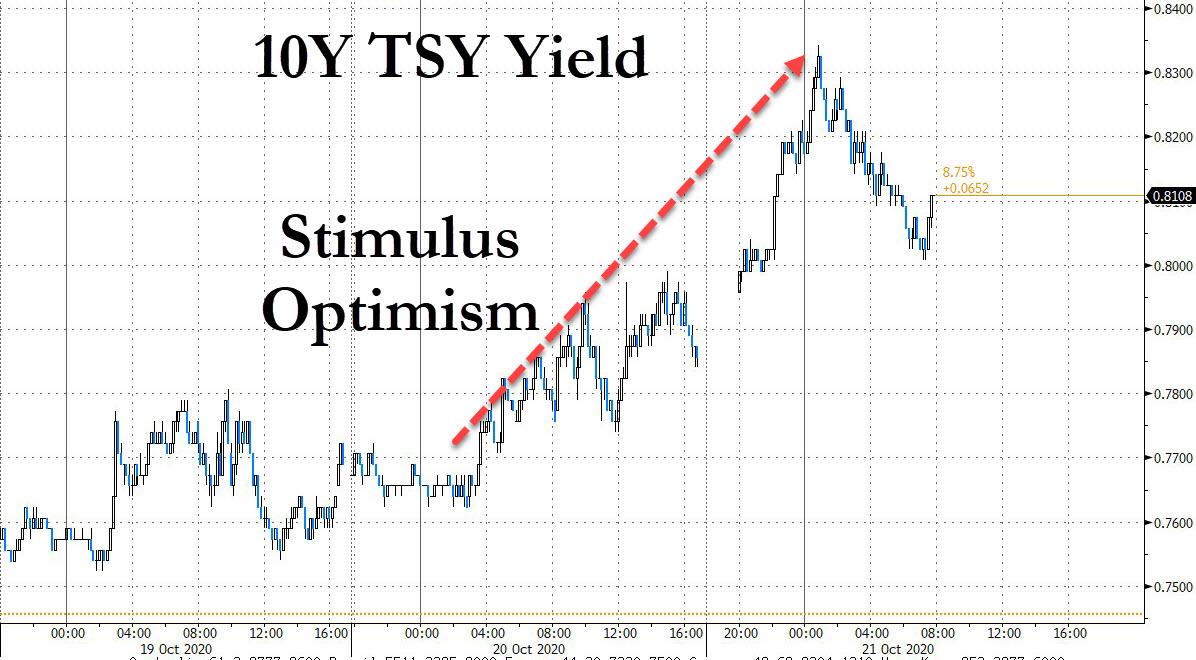

... before reversing sharply after 10Y yield spiked above 0.8% for the first time since early June on too much reflationary stimulus deal optimism!

As a result of the overnight yield spike, we saw the 10Y yield rise to 4-month highs...

... while the 5s30s curve blew out to 4 year high.

In other words, we may have finally hit the natural ceiling to where more fiscal stimulus starts hitting risk assets instead of helping them.

"The rise in yields suggests that the market thinks a stimulus deal will be forthcoming and that the Democrats are set to take both the presidency and the Senate at the Nov. 3 election," said John Hardy, chief foreign-exchange strategist at Saxo Bank.

Elsewhere, Netflix kicked off earnings from the Big Tech club and was down 5.2% premarket after it missed expectations for subscriber growth as streaming competition increased, and live sports returned to television. Tesla fluctuated before financial results later Wednesday, and social media company Snap soared surged 24.4% after the messaging app owner beat user growth and revenue forecasts, as more people signed up to chat with friends and family during the COVID-19 pandemic. Shares of other social media companies Facebook and Twitter Inc rose 2.6% and 5.7%, while image sharing company Pinterest Inc gained 6.7%.

European stocks slumped for a third day, with the Stoxx 600 Index falling 0.7%, dragged lower by U.K. stocks after the European Union’s chief Brexit negotiator said an agreement was within reach. The construction sector led losses as Assa Abloy AB and Vinci SA declined after third-quarter updates, while telecoms was the only subgroup to gain as Ericsson rallied on better-than-estimated profit. Gold miners Fresnillo and Centamin dropped after cutting their production guidance. Telecom equipment maker Ericsson was a bright spot, climbing after a profit beat.

Earlier in the session, Asia-Pac equities were mixed for most of the session. The ASX 200 (+0.1%) was caged in a tight range with no real standout performers or interesting sector action. Nikkei 225 (+0.3%) was buoyed by its industrial sector, however, Softbank shares erased all gains after sources suggested Huawei and Chinese firms are said to be seeking curbs on Nvidia's acquisition of Softbank’s ARM. KOSPI (+0.5%) swung between gains and losses and traded with no clear direction for most of the session. Hang Seng (+0.8%) initially extended on its opening gains before waning off best levels, with upside led by some of the large-cap names including Alibaba, HSBC, and CNOOC.

In FX, the dollar weakened against all of its Group-of-10 peers; the pound led gains, followed by the New Zealand dollar, while the yen headed for its best day versus the dollar since August. The pound jumped after European Union chief Brexit negotiator Michel Barnier said a deal is within reach. Copper rose close to a two-year high on supply disruptions in Chile. The euro rallied the fourth day to touch a 1-month high of 1.1870 per dollar. Australian and New Zealand dollars posted relief rallies as the greenback eased and a wave of dollar sales also benefited the yen.

Meanwhile, the yuan’s ongoing surge has taken it to the highest in more than two years, and further gains are likely. The onshore yuan rose as much as 0.55% to 6.6400 a dollar on Wednesday. The advance takes the currency’s rally from a low in May to 7.7%. The gains are due to China’s economic rebound from the virus pandemic, a wide interest-rate premium over the rest of the world, the prospects of a victory by Joe Biden over Donald Trump in the U.S. presidential election, and a weak dollar. "There is still room for the yuan to strengthen further,” said Tommy Xie, an economist at Oversea Chinese Banking Corp. in Singapore. "It’s possible for the yuan to strengthen past 6.60 quite soon, and by end of this year it may even go lower to around 6.55." The yuan’s gains have investors watching to see whether Chinese policy makers will take steps to impede the advance, such as by setting weaker-than-expected daily fixings, relaxing capital controls, or having state-backed banks sell the yuan.

In rates, treasuries are off cheapest levels of the session, reached during the Asia session amid signs of progress toward a fiscal agreement, and which in turn hammered risk assets. Ten- and 30-year yields rose 5bp-6bp to highest levels since June, with the long facing sustained pressure into $22b 20-year bond reopening at 1pm. Yields remain higher by less than 2bp across the curve with 10- year around 0.805% after touching 0.834%; curve spreads are also in retreat after 5s30s touched 128.5bp, within 2bp of its YTD high. The initial selloff was sparked by House Speaker Pelosi’s comments that she remains hopeful of a pre-election stimulus deal. German, Italian bonds also fell, while hedging costs in the major currencies over two weeks shift higher as the tenor now captures the U.S. presidential election’s immediate aftermath

In commodities, oil dropped toward $41 a barrel in New York after an industry report pointed to a surprise increase in American crude stockpiles. Gold continued to rise above $1900 as the dollar fell, although rising real rates constrained gold upside.

As we progress through earnings season, of the 66 S&P 500 firms that have reported third-quarter results, 86.4% have topped expectations for earnings, according to IBES data. Tesla, Verizon., Biogen, Chipotle, Baker Hughes, and Abbott Laboratories among the companies reporting. The Federal Reserve publishes the Beige Book at 2:00 p.m. Five regional Fed presidents and Fed Vice Chair for Supervision Randal Quarles speak at various events.

Market Snapshot

- S&P 500 futures down 0.1% to 3,429.50

- MXAP up 0.6% to 176.59

- MXAPJ up 0.3% to 585.94

- Nikkei up 0.3% to 23,639.46

- STOXX Europe 600 down 1% to 361.95

- Topix up 0.7% to 1,637.60

- Hang Seng Index up 0.8% to 24,754.42

- Shanghai Composite down 0.09% to 3,325.03

- Sensex down 0.6% to 40,287.60

- Australia S&P/ASX 200 up 0.1% to 6,191.80

- Kospi up 0.5% to 2,370.86

- Brent Futures down 1.4% to $42.54/bbl

- Gold spot up 0.6% to $1,919.09

- U.S. Dollar Index down 0.3% to 92.78

- German 10Y yield rose 2.2 bps to -0.584%

- Euro up 0.3% to $1.1853

- Brent Futures down 1.4% to $42.54/bbl

- Italian 10Y yield rose 0.7 bps to 0.525%

- Spanish 10Y yield rose 0.3 bps to 0.186%

Top Overnight News from Bloomberg

- European Union chief Brexit negotiator Michel Barnier used a speech to lawmakers to emphasize the importance of the U.K.’s sovereignty, a key British demand to return to trade talks

- U.K. inflation accelerated from the weakest in five years, to 0.5% last month, driven by transport and restaurants following the end of a government subsidy to encourage eating out

- The ECB’s ultra-cheap lending and unprecedented levels of asset purchases have created a multi-trillion-euro cash glut and a scarcity of top-rated bonds. It’s now cheaper to hedge against an increase in six-month borrowing costs rather than three months, and correlations between long-dated debt and money-market gauges have broken down

- Traders are testing China’s tolerance for a strong yuan, which keeps rallying no matter what officials do to rein in appreciation. The currency climbed nearly 0.5% to its strongest since July 2018 on Wednesday, even after the People’s Bank of China set its daily reference rate weaker than analysts had expected. Traders have pushed the yuan stronger than the so-called fixing for six days, a sign of confidence that it will continue to rally

- European Central Bank President Christine Lagarde said the unexpectedly early pickup in coronavirus infections is a “clear risk” to the economic outlook, in a sign that policy makers are gearing up for more monetary stimulus

- Despite a second call between the Brexit chief negotiators Tuesday ending in a stalemate, EU officials expect formal discussions to resume in coming days before then entering the intense period of legal drafting known as the “tunnel.” They still expect a deal to be struck in mid-November

- Europe’s coronavirus outbreak continued to spread. Germany, Greece, and the Netherlands hit daily case records, and Spain is weighing a curfew in Madrid. The head of Roche Holding AG warned that widespread shots this year are unlikely

- Oil dropped toward $41 a barrel in New York after an industry report pointed to a surprise increase in American crude stockpiles, countering optimism over a potential U.S. stimulus agreement

- Copper surged to its highest price in more than two years in London, helped by a rally in the yuan and concerns over risks of widening supply disruptions

Looking at global markets, in Asia, equities were mixed for most of the session before trading mostly higher following a lukewarm handover from Wall Street, which saw the major US indices end the day nearer to session lows, but with modest gains as yesterday’s State-side stimulus talks were seemingly constructive but with a deal yet to be reached. That being said, sources citing Senate Majority Leader McConnell suggested it will logistically be difficult to get a bill done before the elections due to the legislative hurdles that need to be overcome. Nonetheless, House Speaker Pelosi signaled progress and expressed optimism as talks with Treasury Secretary Mnuchin are poised to continue later today. US equity futures also saw mild gains at the electronic reopen, and the three major index contracts modest extended on those gains throughout the night, with ES, NQ, and YM higher by between 0.6-0.7% heading into the EU open. Back to APAC, ASX 200 (+0.1%) was caged in a tight range with no real standout performers or interesting sector action. Nikkei 225 (+0.3%) side-lined USD/JPY movement and was buoyed by its industrial sector, however, Softbank shares erased all gains after sources suggested Huawei and Chinese firms are said to be seeking curbs on Nvidia's acquisition of Softbank’s ARM. KOSPI (+0.5%) swung between gains and losses and traded with no clear direction for most of the session. Hang Seng (+0.8%) initially extended on its opening gains before waning off best levels, with upside led by some of the large-cap names including Alibaba, HSBC, and CNOOC., whilst COVID-19 related A-shares are bolstered by China ramping up efforts to expand output for the Cos. Conversely, Shanghai Comp (U/C) immediately erased the mild gains seen at the open despite another liquidity injection by the PBoC as US-Sino tensions show no signs of tempering down. Finally, JGB futures remained contained despite the bear steepening seen in USTs, whilst the BoJ Rinban operation showed offerings for 1-3ys, 3-5yrs, and 5-10yrs unchanged.

Top Asian News

- Political Crisis in Pakistan Deepens After Police, Army Dispute

- Cathay Pacific Joins Global Jobs Cull, Retires Dragon Brand

- China Evergrande Group Seeks HK$11.4b Loan for Refinancing

European equities (Eurostoxx 50 -0.8%) have sold off throughout the session despite a mildly firmer cash open. In terms of drivers of the move, European futures overnight appeared to be following some of the gains seen in US futures as markets continue to assess the likelihood of an eventual stimulus bill; however, sentiment deteriorated in quick order as European cash markets opened with little in the way of fresh macro newsflow accompanying the move. Losses across European equities are relatively broad-based with some mild underperformance in the FTSE 100 (-1.3%) as the index contends with a firmer GBP. The construction & materials sector is the region’s laggard amid losses in Vinci (-1.8%) post-earnings, in which the Co. announced a decline in revenues and cautioned that earnings are expected to fall significantly. Also, of note for the sector, Assa Abloy (-2.5%) have endured losses after Q3 results were poorly received by the market. Health care names are also faring poorly this morning with AstraZeneca (-1.6%) shares unable to benefit from source reports suggesting that the Co.’s COVID-19 vaccine trial could resume as early as this week. Additionally, for the sector, Novozymes (-3.5%) are lower on the session following Q3 earnings. To the upside, telecom names are bucking the trend with modest gains in the wake of earnings from Ericsson (+7.3%) after Q3 earnings exceeded expectations and the Co. expressed confidence in its 2020 targets. Other large-cap earnings today have included Nestle (-0.3%) who exceeded expectations for 9M organic revenue growth and Iberdrola (-0.7%) who announced that its North American arm is to acquire PNM for around EUR 3.66bln alongside posting 9M results. Looking ahead, today sees a slew of large-cap US earnings including the likes of Verizon, Abbott, Tesla & Biogen.

Top European News

- EU’s Barnier Backs U.K. Sovereignty in Bid to Resume Talks

- Lane Warns Weak Inflation Is Bad Idea in ECB Listening Session

- ECB Pandemic Policies Warp Debt Dynamics Into Distant Future

- GAM Keeps Shrinking as Clients Pull Another $2.7 Billion

In FX, sterling is leading the latest broad G10 assault against the Dollar and perhaps front-running or prematurely factoring in positive news on the eve of EU-UK trade talks amidst comments from Barnier, Sefcovic, and Michel ranging from the usual ‘we want a deal, but not at any price’ to the slightly more hopeful ‘an agreement is within reach’. Cable encountered some resistance just above 1.3000 and ahead of the 50 DMA (1.3009) initially, but breezed through at the next attempt before topping out close to near mid-month twin peaks between 1.3064-68. Meanwhile, Eur/Gbp has retreated further from Tuesday’s high just shy of 0.9150 to sub-0.9090 even though the single currency is also appreciating vs an increasingly weak Greenback as the DXY slides to 92.685 and fresh multi-week lows.

- NZD/AUD/JPY/EUR/CHF/CAD – All up against the Buck, as the Kiwi claws back RBNZ Orr induced losses and reclaims 0.6600 status in the run up to NZ CPI data for Q3 on Thursday and in spite of the recurrence of COVID-19 reaching 25 cases at last count, while the Aussie is hovering below 0.7100 in advance of a speech from RBA’s Debelle tonight and October PMIs tomorrow. Elsewhere, the Yen has rallied beyond the 21 DMA at 105.50 where 1.3 bn option expiries reside and bigger expiry interest between 105.10-00 (1.9 bn) to post a marginal new m-t-d best circa 104.89 and the Euro has absorbed offers around 1.1850 that kept the headline pair capped overnight before breaching a Fib at 1.1861 on the way to 1.1870 and almost matching September 18/21 peaks. The Franc is pivoting 0.9050 and Loonie straddling 1.3100 awaiting Canadian CPI and retail sales for some independent/additional impetus.

- SCANDI/EM - Somewhat strangely given a significantly less pessimistic 2020 GDP forecast from Sweden’s Debt Ofiice (-3.5% compared to the prior -6.5% expected contraction) and soft oil prices, the Norwegian Krona is outperforming its Swedish neighbor in Euro cross and Dollar terms as Eur/Nok trades at the lower end of a 10.9960-9000 band in contrast to Eur/Sek nudging the top of 10.3750-3200 parameters. However, it’s one-way traffic for the Yuan as Usd/Cnh and Usd/Cny continue their descent to fresh 2 year-plus highs, albeit in keeping with other EM currencies that are taking advantage of the Greenback’s more pronounced pull-back.

In commodities, The crude complex has once again been relatively devoid of specific fundamental updates and as such price action has largely followed broader equity performance this morning; directionally, benchmarks are continuing the downside post yesterday's private inventories report. The report displayed a surprise, but relatively modest, build of 0.59mln compared to expectations for a draw of 1mln; attention turns to today’s EIA report for confirmation of this build but similarly to yesterday's expectation are for a 1.02mln draw. Note, the build last night did take some desks by surprise given the BSEE were still reporting that some of the offshore Gulf production was shut-in following Hurricane Delta for the survey period. Inventories aside, WTI and Brent have largely been at the whim of downside in the equity space (see above) posting losses of circa USD 0.60/bbl at present; albeit, the benchmarks are off lows by around USD 0.30/bbl. Moving to metals, spot gold hasn’t been able to derive much in the way of further upside post-APAC hours as the DXY continues to drop further below the 93.00 mark. Currently, the precious metal is firmer by ~USD 10/oz. Separately, this morning saw a number of mining updates including Fresnillo cutting their FY20 gold production expectation to 745-775k/oz from the prior forecast of 785-815k/oz but did maintain their guidance around silver. While Antofagasta reiterated their view of copper production for 2020 coming in at the lower end of their original guidance for the year.

US Event Calendar

- 7am: MBA Mortgage Applications, prior -0.7%

- 2pm: U.S. Federal Reserve Releases Beige Book

DB's Jim Reid concludes the overnight wrap

After today I’m taking a three-day holiday to spend some bad quality time with the children over half term. Tomorrow we’re going to a huge adventure park (Longleat for those who know it) where my wife and I are debating whether to go the whole hog and drive through the monkey enclosure. We’ve got a family car that I’ve no interest in replacing until essential bits start falling off of it. However, looking at the video of the experience there’s a good chance that the monkeys will accelerate that day. So we are debating the trade-off between seeing the kids faces when monkeys jump on the car to the risk of having permanent damage. All advice welcome.

Speaker Pelosi and Treasury Secretary Mnuchin debated matters of slightly higher importance last night as they walked back on last night’s deadline for an agreement on stimulus ahead of the election. Overnight Pelosi has said that she’s hopeful for a stimulus agreement this week, which would be “bigger, better and retroactive”. This is pushing the S&P 500 futures (+0.66%) higher.

Senate Majority leader McConnell has said that he would put any bill agreed to by the White House and Democrats up for a vote in the Senate, however it is unclear if Republican Senators would be on board. Notably, Senators Romney and Shelby, the latter of whom is the chair of the Senate Appropriations Committee, have already said that they would not support a large bill. McConnell reportedly told colleagues that trying to finalize a stimulus agreement ahead of the election could delay the Supreme court vote for Judge Amy Coney Barrett which are set to take place next week. So a lot of politics to get through over the next few days. It’s tough to see what’s genuine progress and what’s just political maneuverings.

Earlier US equities advanced in anticipation of potential stimulus as the “oh yes they will, oh no they won’t” saga continued. As a result of a more positive interpretation, there was a further bear-steepening in US treasuries, as the 2s10s curve reached a 4-month high of 64.1bps (from the August 4 local lows of 39.6bps), while 10yr yields were up +1.7bps at 0.786%. This morning 10y yields are up a further +3.7bps to 0.823% and the 2s10s curve is up a further +3.2bps to 67.3bps. The recent steepening moves have come as investors increasingly price in a potential stimulus package, either by the election or afterward in Q1 under a possible Blue Wave election scenario, the chances of which have risen notably in the last 3 weeks.

For equities, the S&P 500 was up +0.47% by the close, with bank stocks (+1.32%) helping lead the way, while the NASDAQ saw a smaller +0.33% increase. UBS (+5.28%) earnings helped bank stocks on both sides of the Atlantic with European banks rising +1.54% as well. In other earnings news, Netflix fell -5.7% in after-market trading as the streaming service added just 2.2 million new subscribers in the quarter compared to the 3.32 million analysts had projected. They are also expecting to bring in fewer subscribers in the upcoming quarter than estimated (6.0m vs 6.54m). Chipmaker Texas Instruments (+1.44% after-market) beat analysts’ estimates, citing strong rebounding demand from automakers and consumer electronics.

Another major story from yesterday was that the US Department of Justice, along with 11 state Attorneys General, filed an antitrust lawsuit against Google, saying that it was “to stop Google from unlawfully maintaining monopolies through anticompetitive and exclusionary practices in the search and search advertising markets and to remedy the competitive harms.” Google’s legal office responded by calling the government’s case “deeply flawed” and at least on the day, investors seemed to agree as the company’s stock rose +1.39% and appeared more sensitive to the fiscal stimulus news. It remains to be seen what specific remedies the government would seek against Google, though any ultimate decision would be set by the federal court judge overseeing.

Asian markets have tracked Wall Street’s move this morning with the Nikkei (+0.40%), Hang Seng (+0.73%), Kospi (+0.26%), and Asx (+0.16%) all up while the Shanghai Comp (-0.35%) is down. In Fx, the onshore Chinese yuan is up +0.33% to 6.6549, the strongest level since July 2018 but this is more on the back of a broader USD move lower this morning. The US dollar index is down -0.17% overnight marking four consecutive day of declines.

In other overnight news, Bloomberg reports that China’s technology companies including Huawei have expressed strong concerns to local regulators about Nvidia’s proposed acquisition of Arm Ltd. The report added that Chinese companies' major concern is that Nvidia may force the British firm to cut off Chinese clients as it could become a pawn in the US-China tech supremacy race. Elsewhere, the ECB President Lagarde said that the current virus wave has come a bit earlier as against expectations of a resurgence in “November or December, with the cold” and “from that point of view that has surprised. It’s not a good omen.”

In terms of the coronavirus, yesterday saw the UK report another 21,365 cases as Prime Minister Johnson announced that Greater Manchester would go into tier 3 - the strictest restriction level. Elsewhere in Europe, the Spanish health minister said that they would look at imposing a curfew in Madrid, while in Italy, which had been performing relatively better than the UK or France in recent weeks, a further 10,871 cases were reported. Italian Prime Minister Conte joined the refrain of his fellow European leaders calling for localized restrictions rather than national lockdowns, with the Lombardy region expected to order a curfew starting on Thursday. In the US, cases continue to see the biggest rise in the Midwest and Southern regions as the country saw over 60k new cases over the last day and looks to be seeing a “third” wave as the weather turns. Hospitalizations have started ticking higher as well, in particular, Texas is at 8-week highs with particular strain coming to more rural regions with lower capacity. Overall, coronavirus hospitalization in the US stood at 39,230 yesterday, the highest in two months.

On therapeutics, there was bad news as the US FDA inspectors found quality-control problems at an Eli Lilly plant used to help produce its Covid-19 antibody therapy. Elsewhere, Cathay Pacific Airways said that it will cut about 5,300 jobs based in Hong Kong and close its Cathay Dragon unit as part of a sweeping restructuring.

On Brexit, the UK government suffered a defeat in the House of Lords on its controversial Internal Market Bill, which would seek to override parts of the already-reached Brexit Withdrawal Agreement with the EU. Though the bill passed and will move on to further debate, members voted by 395-169 in favor of an amendment to the second reading motion which said that the House regretted that part of the bill “contains provisions which, if enacted, would undermine the rule of law and damage the reputation of the United Kingdom.” Notably, 39 Conservative peers voted in favor of that amendment, including former leader Michael Howard. Otherwise, the negotiations between the UK and the EU remained in a stalemate, with the EU’s Michel Barnier tweeting that he spoke again to the UK’s David Frost yesterday, and said “My message: we should be making the most out of the little time left.” The U.K. are currently being cold to the prospect that the EU is moving far enough to restart negotiations although The Telegraph newspaper reported that Barnier was considering a trip to London tomorrow (which wouldn’t happen without some encouragement) so all eyes will be on whether we see a resumption in talks over the coming days. It’s another political dance.

Elsewhere in markets yesterday, the STOXX 600 lost -0.35%, though this masked strong regional divergences, with the DAX (-0.92%) underperforming as Italy’s FTSE MIB (+0.56%) and Spain’s IBEX 35 (+0.98%) made solid gains. Europe saw a similar selloff in rates to the US, with 10yr yields on bunds (+2.2bps), OATs (+1.4bps), and BTPs (+0.8bps) all rising. Finally, on the data front, US housing starts in September rose to an annualized rate of 1.415m (vs. 1.465m expected), while building permits rose to an annualized 1.553m (vs. 1.520m expected), their highest rate since 2007.

To the day ahead now, and earnings releases include Tesla, Verizon Communications, Abbott Laboratories, Thermo Fisher Scientific, and NextEra Energy. Central Bank speakers include ECB President Lagarde, Vice President de Guindos, and chief economist Lane, along with the Fed’s Mester, Kashkari, Kaplan, and Bullard and BoE Deputy Governor Ramsden. The Fed will also be releasing their Beige Book and both the UK and Canada will release their September CPI readings.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more