Palladium Vs. Platinum: One Is Setting Records, Other May Be Underpriced

While gold prices have traditionally gotten quite a lot of attention, a pair of silvery-white metals is capturing more and more attention. Some investors and analysts are starting to see platinum and palladium as almost two sides of the same coin — even though the price gap between the two is at a record high. Now it looks like platinum prices could also benefit from the soaring price of palladium.

Palladium prices soar while platinum remains subdued

In a note this week, HSBC analyst James Steel noted that although platinum has been soft, palladium has soared on “pronounced end-user buying.” In fact, palladium rallied to a new record high of $1,269.50 per ounce. In turn, palladium supported platinum prices, boosting them close to $800 per ounce.

Steel describes the palladium market as "severely backwardated, lease rates are high and end-user buying remains strong even at high prices." He believes platinum is underpriced still and that it should be more than $800 per ounce, although he warned that upside could be limited.

The price gap between the two silvery-white metals is causing some speculations that automakers could begin to substitute platinum for palladium, which is used in automotive catalytic converters. Palladium prices have gotten so high because of the extreme undersupply against the growing demand for the metal.

However, substituting platinum could change the entire picture — if automakers actually end up doing it. Steel did not mention this possibility when he said he thinks platinum prices should be over $800 an ounce.

Analysts talk up palladium

Analysts like Joni Teves of UBS have been talking up palladium for quite some time. Teves pointed out last month that investors have long been favoring palladium over platinum, adding that the supply/ demand of both precious metals backs up this position.

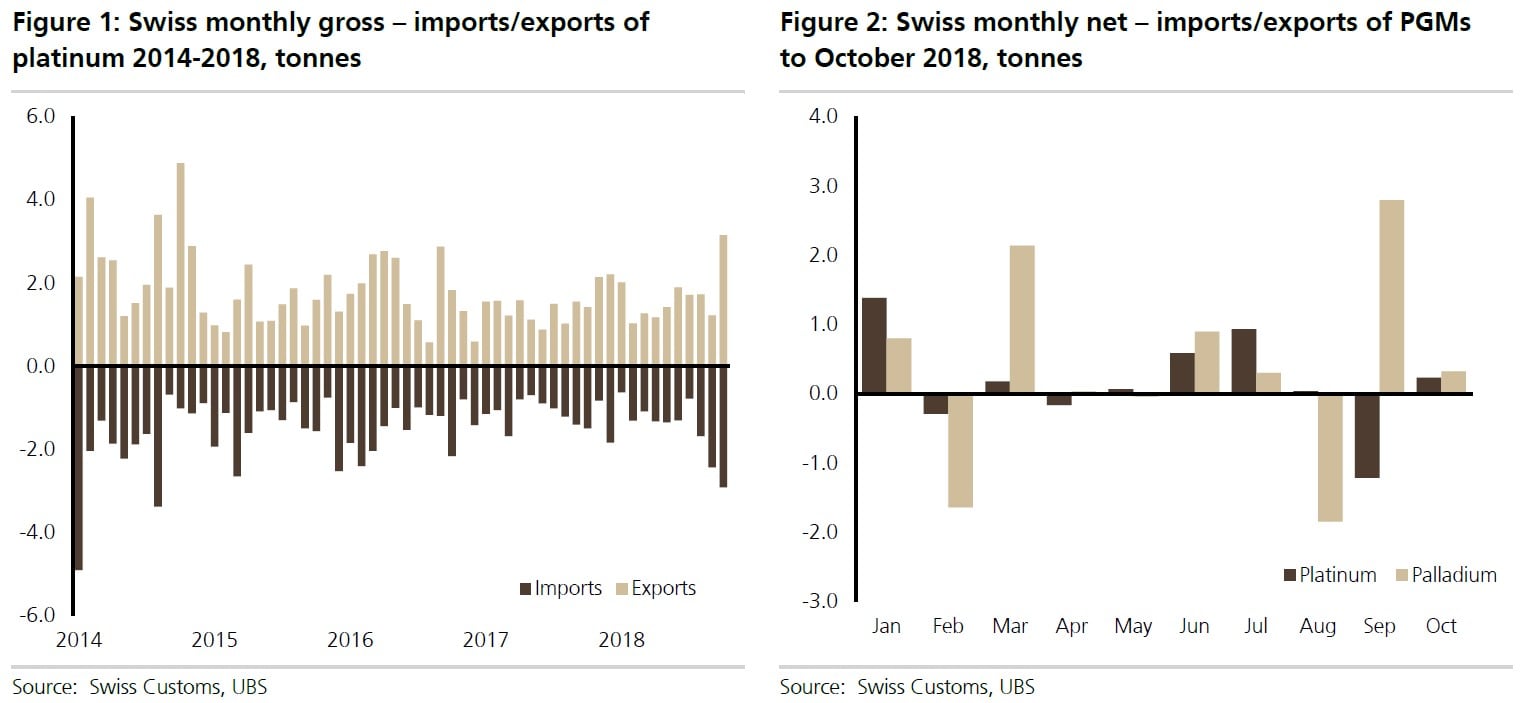

She described palladium's story as "compelling" with "healthy demand dynamics against constrained supply." On the other hand, Teves said that demand for platinum was expected to fall along with diesel's share of car sales around the globe. She also said that data out of Switzerland, which is a key trade hub for precious metals, supports the continuation of this view.

(Click on image to enlarge)

"Fundamentals should continue to support a considerable premium for palladium over platinum," she wrote. "However, we expect some moderation of the price gap from current levels, especially as platinum benefits from its strong positive correlation with gold, which suggests that it could be better placed than palladium during times of risk-off."

She added that industry conversations suggest that sentiment toward platinum is gradually becoming "more sympathetic, although only to the extent that we have probably already seen the lows, and further downside should be relatively contained from here."

It's also important to note that palladium demand is strongly linked to auto sales, so any major hiccup in the auto market could be negative for the metal.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more