One Year Of Oil Inventory Tracking: Much Of The Same

Approximately one year ago, I began publishing a series of articles on this site tracking oil inventories in an effort to aid understanding of why prices began to decline around that time. At the time, the media was consistently stating that there was an oversupply of oil in the United States but the actual numbers said differently, leading me to explain that the true story of the decline in oil prices was much more complicated than the simplistic narrative presented by the media. Around the beginning of December, the official numbers did begin to show an oversupply of oil, a situation which continues to this day. However, as I have explained before, there are reasons to believe that the official numbers may not actually reflect reality. The market trades based on the official figures however, so we are forced to rely on them when making investment decisions.

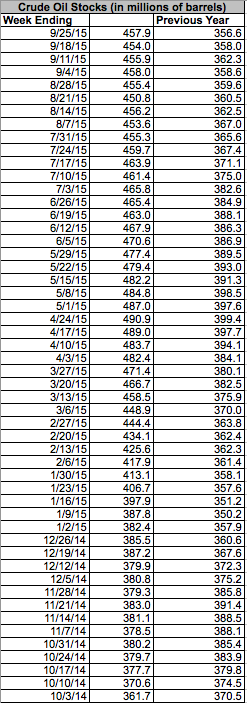

At the end of the week ended September 25, the EIA reports that the nation’s commercial inventories of crude oil contained a total of 457.9 million barrels. This is an increase of 3.9 million barrels from the 454.0 million that these same inventories contained at the end of the week ended September 18, 2015. As has been the case since December, this level is considerably higher than at the same time of last year. At the end of the week ended September 26, 2014, the nation’s commercial inventories of crude oil contained a total of 356.6 million barrels. Both the week-over-week and year-over-year growth in inventories lends support to the presence of a glut that has been blamed for pressuring oil prices downward.

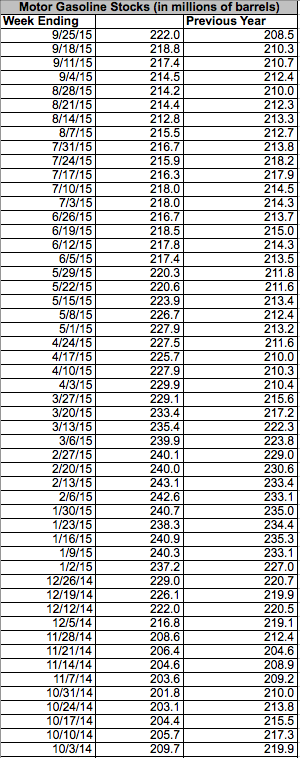

Crude oil inventories were not the only thing that increased in size last week. Motor gasoline inventories also showed growth. At the end of the week ended September 25, 2015, the EIA reports that the nation’s inventories of motor gasoline contained a total of 222.0 million barrels of gasoline. This compares to 218.8 million barrels contained in these same inventories at the end of the week ended September 18, 2015. As was the case with crude oil inventories, the amount of gasoline contained in the nation’s inventories is considerably higher than at the same time last year. At the end of the week ended September 26, 2014, these same inventories contained a total of 208.5 million barrels of gasoline.

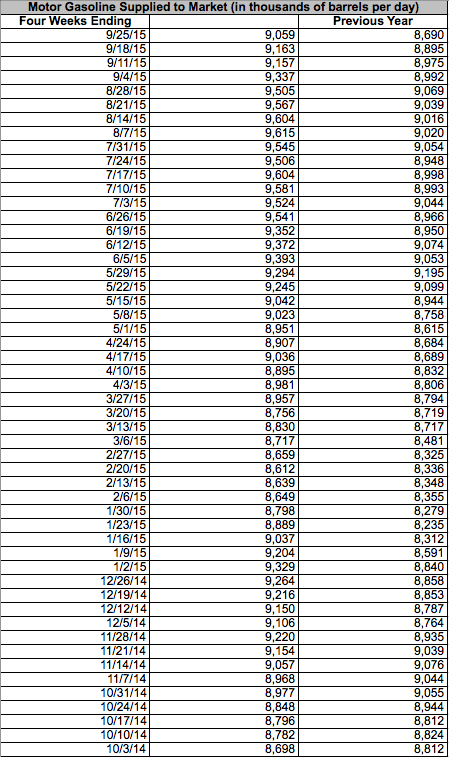

Interestingly, this increase in gasoline inventories comes despite the fact that the nation’s refineries supplied less gasoline to the market than they did during the previous week. This could be a sign that the decline in gasoline prices has not spurred the public to drive more, in direct contrast to the claims of many analysts and economists. During the four-week period ended September 25, 2015, the nation’s refineries supplied an average of 9.059 million barrels of gasoline per day to the market. This compares to an average of 9.163 million barrels per day supplied by these same refineries during the four-week period ended September 18, 2015. It is considerably more than what was supplied during the corresponding period of last year, however. During the four-week period ended September 26, 2014, the nation’s oil refineries supplied an average of 8.69 million barrels of gasoline per day to the market.

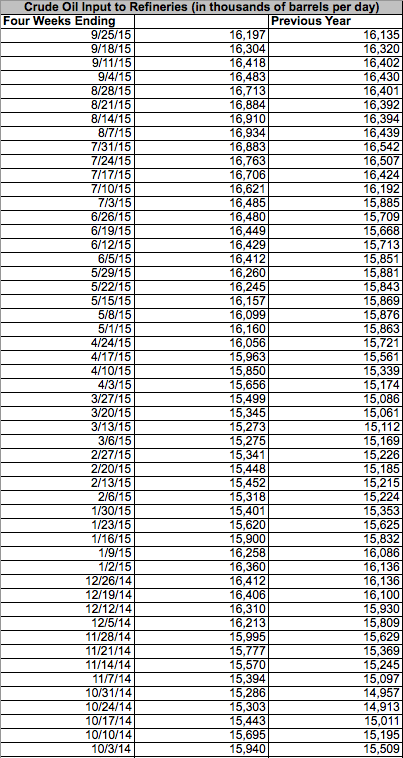

One reason for the decline in refinery production is that the utilization of the nation’s oil refineries declined in aggregate in the most recent week. During the four-week period ended September 25, 2015, the nation’s oil refineries processed an average of 16.197 million barrels of oil per day. This compares to the average of 16.304 million barrels per day processed during the four-week period ended September 18, 2015. As has consistently been the case since this series of articles began however, refinery utilization was at a higher level than last year. At the end of the week ended September 26, 2014, the nation’s oil refineries processed an average of 16.135 million barrels of crude oil per day.

For the most part, the latest oil inventory report was much the same as those that we have been seeing for the past several months, although the rising gasoline inventories over the past few weeks may be a sign of economic weakness.

Disclosure: I have various positions in oil-related stocks. I have several clients with positions in oil-related stocks.