One Of My Favorite Option Trade Strategies

Strategy #1

Directional Swings

Trades That Last a Few Weeks

Buying Options

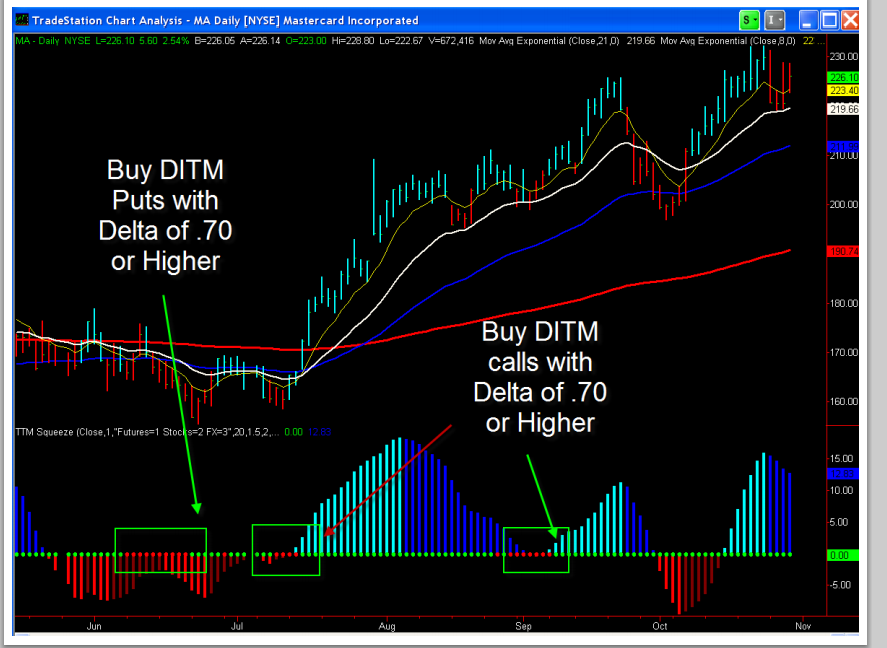

• Main thing is to have a setup on the underlying stock.

• Squeeze on the daily chart works really well.

• Think of it this way – you are just using the option as a CHEAPER WAY to buy the stock.

• $16 for an option is a lot cheaper than $160 for the stock.

• 1 option = 100 shares of stock. $16 option = $1600 out of pocket cost.

• Key is buying IN THE MONEY strike prices

• Squeeze fires off long on MA at $170

• July options at this point only have 1 week left.

• TWO OPTIONS:

• Buy DITM July Options – like $155

• And if trade is still valid at expiration sell these options and then buy the Aug 155s.

• Or just start off with the Aug 155s.

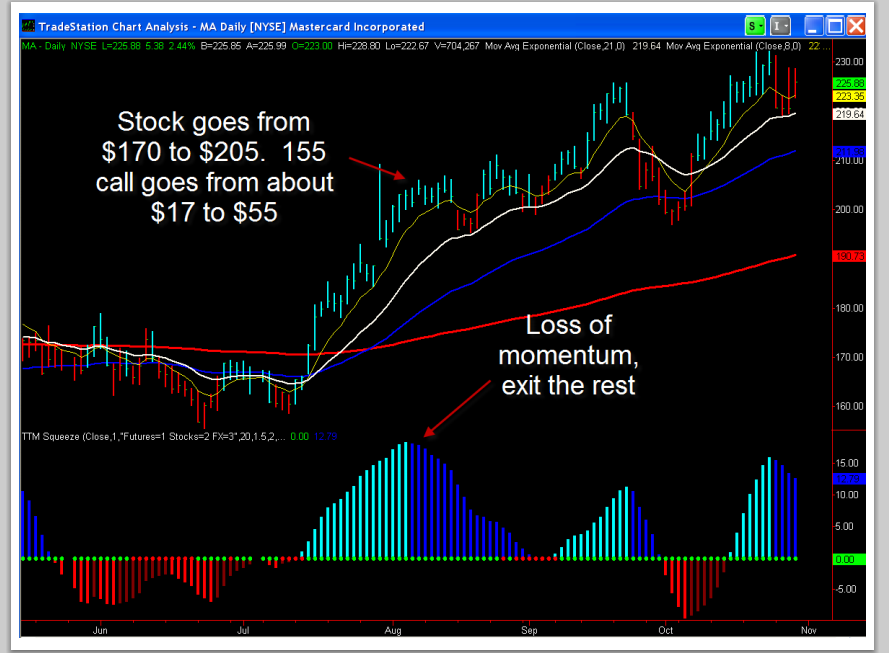

Exit strategy same as stock – I’m looking to scale out.

• Stop on option is 50% of the value.

• $16 option, then $8 stop.

• First target is 50%, for 1/3. So $24.

• Second target is 100% for 1/3, $32.

• Last hold on for squeeze loss of momentum, TTM Trend change etc.

• 1 option at $17 = $1700 cost

• 1 option at $55 = $5500 in proceeds

• Proceeds $3800 per contract.

For more, Visit John for a free webinar here.

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as calls, give the buyer a right to buy a particular stock at that option's strike price.BK training conduct classes for options strategies in Mumbai.we are well known coaching center to provide option strategies courses in Mumbai.

bktraining.in/basics-of-options-trading-20hrs/