One-Handed

Beware the one-handed economist. As we learned from FOMC Powell yesterday, the FOMC can be patient on one hand and nervous on the other with inflation data central to their pause in tightening along with financial conditions. The rally up in equities this week balances against the US CPI this morning. The role of oil bouncing with equities and the role of better US/China trade talks supports renewed global growth views and adds to the one-handed risks for today. Against this, we have the US government shutdown, the weakness in retail sales and autos in China and Europe and the ongoing uncertainty from emerging markets. One has to respect the calendar in the week ahead and remember its Friday to get the full picture for why a one-handed market seems particularly scary today – with China growth data, US 4Q earnings a one-two punch risk. All that puts the stories from overnight into perspective with weaker Japan household spending, lower EcoWatchers survey, smaller C/A surplus, weaker Italian industrial production, weaker UK industrial production all pointing to trouble in 4Q that sets the momentum for 1Q and beyond. The risk barometer to watch isn’t the CNY – its expensive here – nor is it the EUR at 1.15 as the ECB looks as confused as the FOMC. Rather, the safe-haven story to respect should it start to move today or next week is JPY with 107.50 the pivot to watch for a return to flash crash 105 barriers.

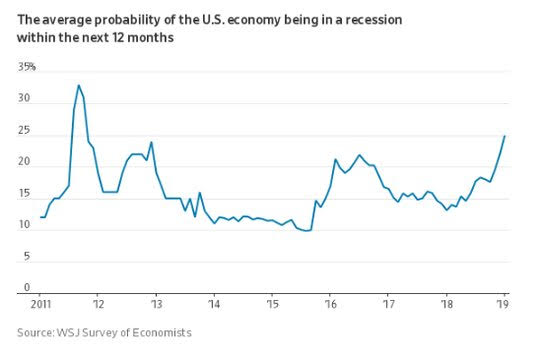

Question for the Day: Are economists too bearish on recession risks for 2020? The WSJ reports today that a survey of economists showed 25% see a recession in the near term, the most since Oct 2011, and up from 13% in 2018 survey, with over half seeing the start of the downturn in 2020 with about a quarter pushing it to 2021. The key trigger for a US slowdown comes from China, Europe, and Japan.

The focus for trading markets will be in the policy responses outside of the US to the soft-patch bleeding into a recession in the rest of the world. The markets are telling us today that the ECB isn’t dovish enough, that the Japanese need something more and that China is still in trouble despite the big push for fiscal stimulus. The data from China in the week ahead is likely to be crucial to keeping markets sanguine compared to economists.

What Happened?

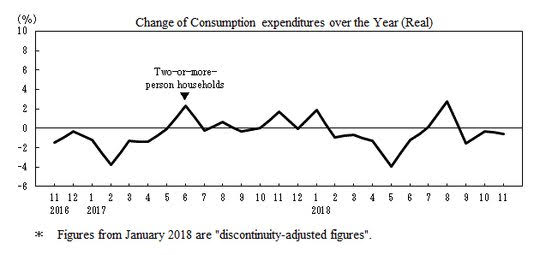

- Japan November household spending -0.6% y/y after -0.3% y/y – weaker than -0.1% y/y expected– 3rd straight decline. Average incomes rose 1.8% y/y in real terms to Y455,644. Food fell 2.2%, fuel/water fell 10%, medical -5.2% y/y, culture/recreation -2.3% y/y, furniture -1.8% y/y, while housing +18.6%, education +7.5% y/y.

- Japan November current account surplus Y757.8bn after Y1.309trn – near expectations of Y570bn– still off 43% due to oil imports. The goods trade remained in deficit at Y559.1bn vs. a Y199.1bn surplus in 2017. Exports were up 1.9% y/y to Y6.918trn while imports were up 13.5% yy to Y7.477trn. The primary income account rose 8.2% to Y1.438trn.

- Japan December EcoWatchers survey 48 from 51 – weaker than 49 expected. The outlook survey fell to 48.5 from 52.2.

- Australia November retail sales 0.4% m/m after 0.3% m/m – more than 0.3% m/m expected. The rise was led by household goods rose 1.2% m/m, clothing and footwear rose 1.5% m/m with Black Friday sales noted by the ABS as key while other retailing -0.1% m/m with cafes/restaurants also -0.1% m/m. Trend for turnover is 0.2% m/m/m, 3.6% y/y.

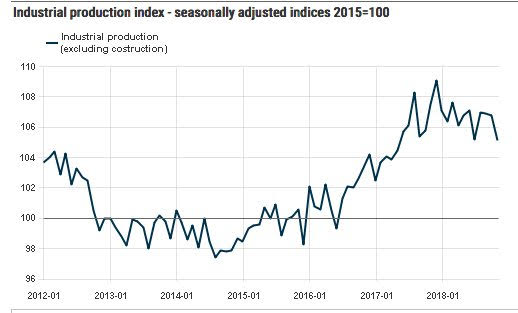

- Italy November industrial production -1.6% m/m, -2.6% y/y after 0.1% m/m, 1% y/y – weaker than -0.3% m/m, 0.2% y/y expected. For the 3M to November production fell 0.1%. Electricity/Gas fell 3.4% y/y, Manufacturing -2.4% y/y, while mining -9.7% y/y.

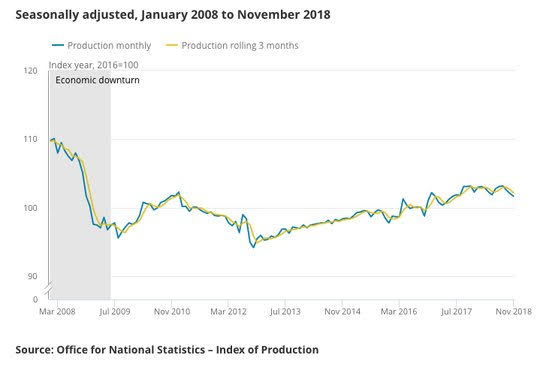

- UK November industrial production -0.4% m/m, -1.5% y/y after -0.5% m/m, -0.9% y/y – weaker than +0.2% m/m, -0.7% y/y expected. The manufacturing output -0.3% after -0.6% - also weaker than 0.3% m/m expected. Electricity and gas -1.1% while mining fell 1.3% m/m. For the 3M to November, production fell 0.8% with 10 of 13 sub-sectors weaker – transport was the worst off 1.1% with cars -2.4% q/q.

- UK November construction output rose 0.6% m/m, 3% y/y after 4.1% y/y – better than 2.5% y/y expected. The 3M average now 2.1% with new work driving up 3.4% while repair fell 0.4% q/q. Construction hit record highs exceeding GBP14bn for the first time since record-keeping started in 2010.

- UK November GDP 0.2% m/m, 1.4% y/y after 0.1% m/m, 1.6% y/y – better than 0.1% m/m, 1.3% y/y expected. This puts the 3M average at 0.3% q/q after 0.4% q/q – in line with expectations. Services and construction led growth while production was a drag. Services was up 0.3% q/q, while all four parts of the industrial sector contracted with total -0.4% q/q after -0.5% in October.

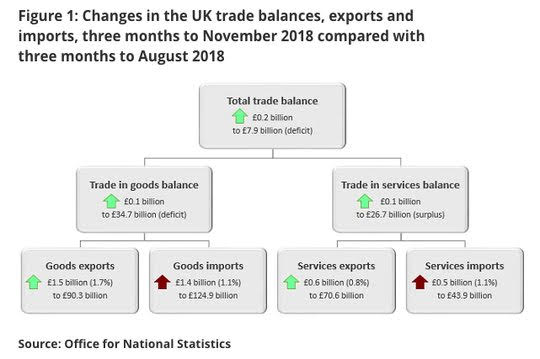

- UK Nov trade deficit narrows to GBP2.904bn after GBP3.037bn – still bigger than GBP2.2bn expected. The total trade deficit widened after inflation by GBP0.3bn to GBP6.5bn for the 3M to November. Oil and aircraft led the nominal improvement while for the year the deficit widened GBP4.1bn mostly dues to narrowing services surplus. The goods trade deficit widened to GBP0.8bn with EU and narrowed GBP0.9bn to non-EU over the 3M.

Market Recap:

Equities: The US S&P 500 futures are off 0.15% after a 0.45% gain. The Stoxx Europe 600 is up 0.1% despite auto and retail fears. The MSCI Asia Pacific index rose 0.6%.

- Japan Nikkei up 0.97% to 20,359.70

- Korea Kospi up 0.60% to 2,075.57

- Hong Kong Hang Seng up 0.55% to 26,667.27

- China Shanghai Composite up 0.74% to 2,553.83

- Australia ASX off 0.33% to 5,834.80

- India NSE50 off 0.25% to 10,794.95

- UK FTSE so far up 0.2% to 6,955

- German DAX so far off 0.2% to 10,902

- French CAC40 so far off 0.2% to 4,794

- Italian FTSE so far off 0.2% to 19,259

Fixed Income: Bid day - Weaker data in EU, and less clarity on central bank policy moves leave bonds watching equities, risk mood for direction – German 10-year Bunds off 1bps to 0.19%, French OATs flat at 0.67% and UK Gilts up 2bps to 1.29% - where data led – while in periphery Italy off 6bps to 2.84% - good auctions, Spain off 1bps to 1.44%, Portugal off 2bps to 1.70% and Greece off 2bps to 4.28%.

- Italy sold E3bn of 3Y 2.3% Oct 2021 BTP at 1.07% with 1.49 cover, E2.25bn of 7Y 2.5% Nov 2025 BTP at 2.35% with 1.64 cover and E0.75bn of 30Y 3.45% Mar 2048 BTP at 3.68% with 1.35 cover.

- US Bonds claw back gains waiting for CPI– 2Y off 2bps to 2.54%, 5Y off 2bps to 2.54%, 10Y off 1bps to 2.72% and 30Y off 1bps to 3.04%.

- Japan JGBs see curve steeper with BOJ/JPY driving– 2Y flat at -0.15%, 5Y flat at -0.15%, 10Y off 1bps to 0.02%, 30Y up 1bps to 0.70%.

- Australian bonds rally despite US/China trade/better retail sales– 3Y off 1bps to 1.81%, 10Y flat at 2.32%.

- China bonds see modest profit-taking – watching CNY/PBOC– 2Y up 1bps to 2.66%, 5Y up 1bps to 2.91%, 10Y up 1bps to 3.14%.

Foreign Exchange: The US dollar index is off 0.2% to 94.94 reversing gains on Powell with Asia leading on CNY. However, USD is more bid in EM than offered - In Asia – KRW flat at 1117, INR off 0.1% to 70.495 with oil, but in EMEA RUB off 0.15% to 66.936, ZAR up 0.3% to 13.813, TRY off 0.5% to 5.4390.

- EUR: 1.1525 up 0.25%.Range 1.1496-1.1541 with 1.1635 the next key and crosses driving

- JPY: 108.30 off 0.1%.Range 108.23-108.47 even with bid equities, USD lower – EUR/JPY 124.85 up 0.2%.

- GBP: 1.2810 up 0.55%.Range 1.2710-1.2851 with EUR/GBP .8995 off 0.25% - data better helping, Brexit still boring but key. 1.26-1.29 watch.

- AUD: .7225 up 0.6%.Range .7182-.7235 with .73 before .7050 now in play with China trade and CNY moves. NZD .6835 up 0.7%.

- CAD: 1.3195 off 0.3%. Range 1.3183-1.3245 with oil, crosses driving 1.3250 now resistance for 1.3080 test.

- CHF: .9830 off 0.15%.Range .9814-.9843 with EUR/CHF 1.1335 up 0.2% - with 1.1250 back as base and 1.14 resistance in play.

- CNY: 6.7420 off 0.65%.Range 6.7370-6.7900 with 6.71-73 base than 6.6450 with trade deal hopes and PBOC pushing.

Commodities: Oil up, Gold up, Copper up 0.25% to $2.6940.

- Oil: $52.89 up 0.55%. Range $52.14-$53.31 with Brent up 0.3% to $61.88 after $62.49 highs. Focus is on oil bid holding with support on global growth hopes with US/China trade, USD weakness and equities key. $52.50 now pivot for $55 again in WTI while $62 in Brent remains similar pivot with $64 target.

- Gold: $1292.40 up 0.4%. Range $1287-$1295.70 with $1300 and $1305 still key resistance and $1285 base holding – USD/equities drive. Silver up 0.6% to $15.74 with $15.90 key. Platnium up 0.25% to $828.10 and Palladium up 0.7% to $1282.20.

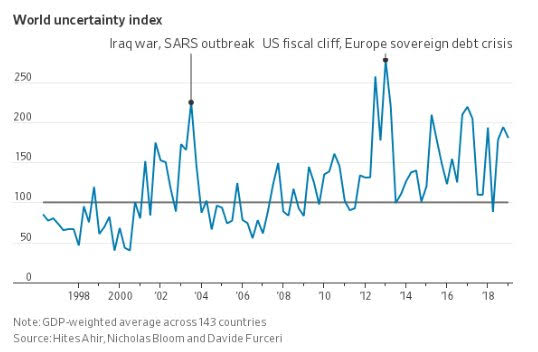

Conclusions: Is it time to buy protection? The markets look a bit wobbly again today – like they have all week into the US open. But this time we have some important economic data and a much higher S&P500. The world uncertainty index is still very high and its about this foreign risk that many maybe pushing aside today given the hopes around China/US trade. The World Uncertainty Index is worth considering as a tool for understanding when its time to get some protection as volatility and fear drive markets which the hits confidence and eventually hurts the real economy.

Economic Calendar:

- 0830 am US Dec CPI (m/m) 0.2%p 0.2%e (y/y) 2.2%p 1.9%e / core 2.2%p 2.2%e

- 1200 pm US WASDE report

- 0200 pm US Dec budget statement

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.