Oil Prices Plunge After Surprise Crude, Gasoline Build

Oil prices have plunged overnight (back near 7-month lows) as global growth fears accelerate (despite a bigger than expected crude draw from API) as traders wait to see if official DOE data confirms the API print.

“The bearish and deteriorating global macro situation seems to have the upper hand, pushing oil lower and lower,” said Bjarne Schieldrop, Oslo-based chief commodities analyst at SEB AB.

API

-

Crude -3.43mm (-2.8mm exp)

-

Cushing -1.6mm

-

Gasoline -1.1mm (-1.2mm exp)

-

Distillates +1.2mm (+200k exp)

DOE

-

Crude +2.39mm (-2.8mm exp) - biggest build since May

-

Cushing -1.504mm

-

Gasoline +4.44mm (-1.2mm exp) - biggest build since Jan

-

Distillates +1.529mm (+200k exp)

After 7 straight weeks of draws, DOE reports crude inventory built by 2.39mm barrels last week (and Gasoline stocks also jumped)

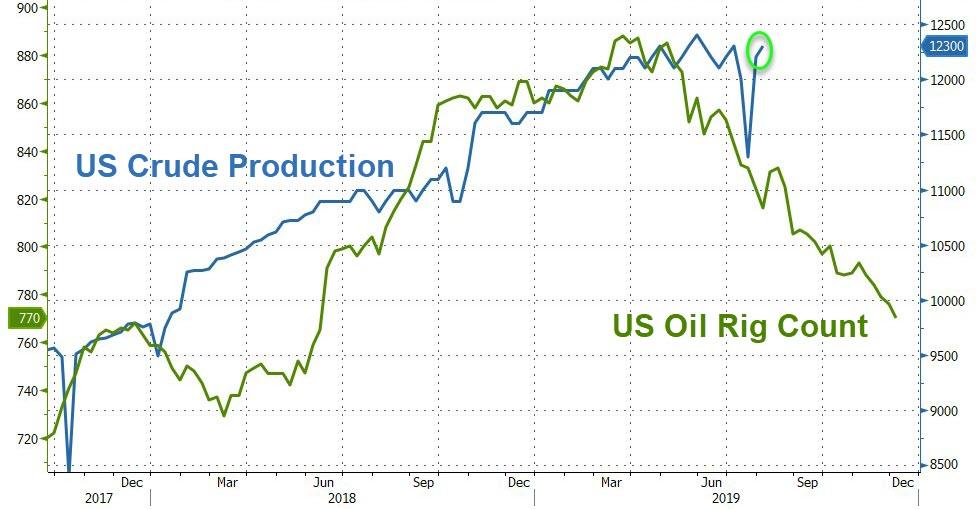

US Crude production continued to rebound last week from storm-driven shut-ins

WTI tumbled to a $51 handle this morning (back near 7-month lows) ahead of the DOE data, but was rebounding at the print before its plunged on the surprise builds...

Brent Crude futures entered a bear market, but WTI is underperforming most recently..

“Brent-WTI differentials have decreased quite a bit for quite a while,” says Bart Melek, head of global commodity strategy at TD Securities.

Narrowers spreads “lead to less incentive to push product out”

Finally, Bloomberg Intelligence Senior Energy Analyst Vince Piazza notes:

Trade tensions have escalated and a deal will be delayed, as we anticipated, while China likely attempts to wait out the Trump administration. We see darker clouds pressuring sentiment for the oil-and-gas complex as well, discounting near-term data on balances.

We were never worried about capacity, but demand remains our biggest concern, even if central banks come to the economic rescue with monetary accommodation. We need hydrocarbon exports to balance out local market, but slower global growth will inflate inventories here given resilient domestic production.

Disclosure: Copyright ©2009-2019 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more