Oil Inventories Should Continue To Fall

It’s interesting to watch the dramatic turnaround in our holding CHK. Post-Wildhorse deal the stock collapsed as oil prices fell and Wall St assumed prices would be low forever. Oil has rebounded higher and no the deal is being thought of a smart one and the stock has reacted accordingly (up over 50% YTD). Additionally, our DTO short has performed spectacularly (86% gain) and will continue to do so.

“Davidson” submits:

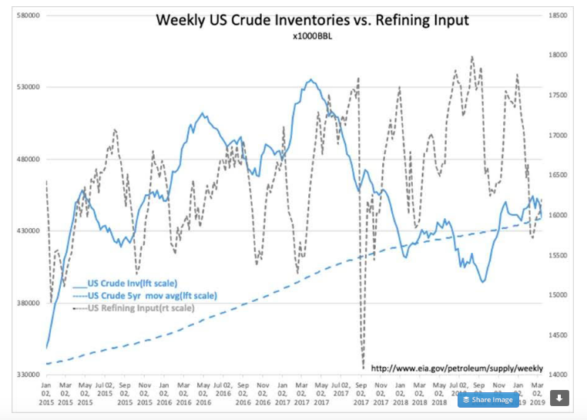

Refining has picked up-US Crude Inv falls 9,589mil BBL to 439,483mil BBL which is basically inline with its 5yr Mov Avg at 438,920mil BBL-next report likely to show continued draw with additional refining coming on line which is typical this time of year.

Expect a continued decline in US Crude Inv below the 5yr Mov Avg to push $WTI higher with the historical market psychology response all things being equal.

(Click on image to enlarge)

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more