Oil Algos Unsure As Crude Inventories Pop, Production Drops

WTI held on to losses overnight (bouncing of $61) after a big surprise crude build (reported by API) trumped geopolitical risk premia from drone attack in Saudi Arabia.

“We’ve become used now to the ongoing supply worries,” IEA Head of Oil Industry and Markets Neil Atkinson said in a Bloomberg Television interview. The latest attacks in the Gulf appear not to have caused any “sustained damage” and the market “remains focused on the underlying fundamentals.”

Additionally, the International Energy Agency said that global oil demand will grow more slowly than previously thought following an economic lull in Asia while warning that supplies stand to tighten due to U.S. sanctions on Iran.

“Even so, slower demand growth is likely to be short-lived, as we believe that the pace will pick up during the rest of the year.”

Disappointing fuel consumption in China, Japan and Brazil meant 2019 started with a “tough quarter,” the agency said, lowering its global demand estimate for the first time since October. As a result, world oil inventories surprisingly swelled during the first three months of the year.

API

-

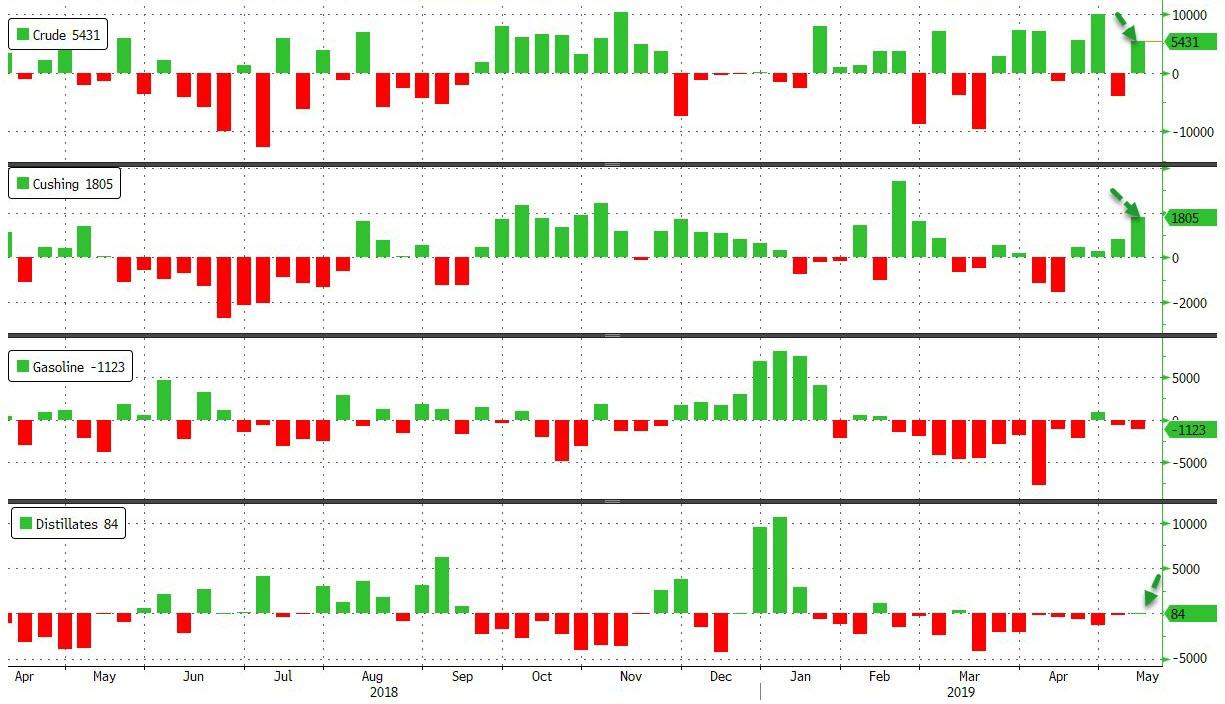

Crude +8.6mm (-1.3mm exp)

-

Cushing +2.1mm (+1.3mm exp)

-

Gasoline +567k (-300k exp)

-

Distillates +2.2mm (-1.0mm exp)

DOE

-

Crude +5.431mm (-1.3mm exp)

-

Cushing (+1.3mm exp)

-

Gasoline -1.12mm (-300k exp)

-

Distillates +84k (-1.0mm exp)

After builds across the entire energy complex overnight from API, EIA was still expected to see a draw (following last week's surprise draw) but crude stockpiles built last week along with Cushing inventories. Gasoline resumed its draws but distillates surprised with a small 84k build...

US Crude production pushed to a new record high the week before but rolled over in the last week, perhaps ready to trend lower with the falling rig count...

Bloomberg Intelligence's Energy Analyst Vince Piazza sums it all up nicely:

Throw the textbook out the window. In previous cycles, attacks on capacity would have pushed crude benchmarks higher, but we’ve adjusted to the reality of unplanned supply outages as the new normal. Lack of lift in prices implies demand remains the concern, affirming our view. Supply isn't an issue in the near term, as Saudi Arabia will account for the Iranian barrels coming off line and U.S. volume remains resilient.

Benchmarks seem elevated and a downturn in demand growth from trade tensions and a maturing economic cycle presses our more cautious stance.

WTI was hovering around $61.30 ahead of the DOE data (having found support at $61.00) overnight but kneejerked higher, surprisingly, on the crude build...

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more