October 2020 Coincident Indices Generally Improve But Most Remain In Contraction Year-Over-Year

The year-over-year rate of growth of the majority of coincident indices improved relative to last month - but mostly remain in contraction. It should be obvious the economy entered a recession in March 2020 but likely exited in May or June. A recession ends when the economy starts improving.

Analyst Opinion of the Current Status of the Coincident Indicators

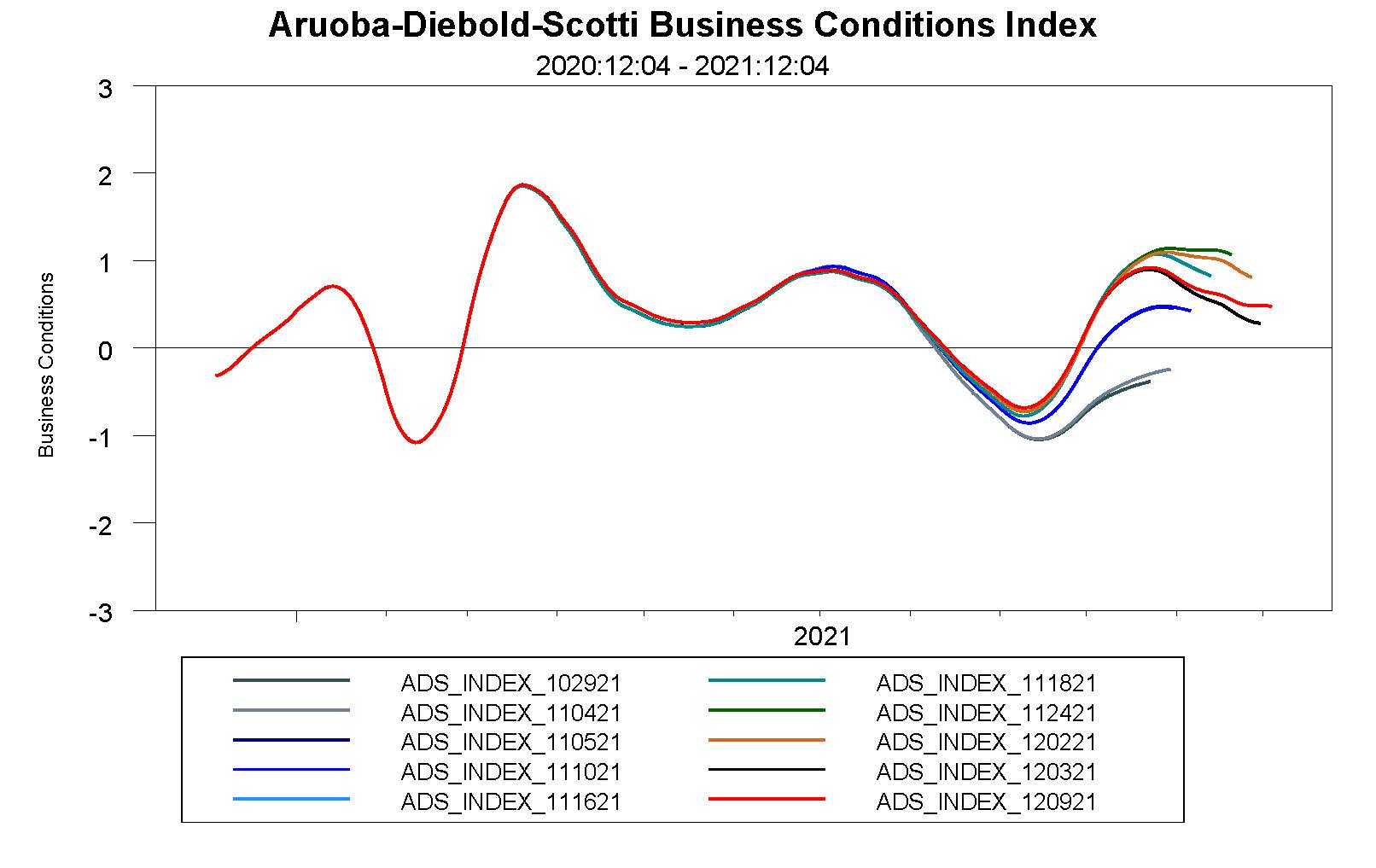

The reality is that most of the economic indicators have moderate to significant backward revision - and this month they are generally showing improved growth. Out of this group of coincident indicators discussed in this post, only ECRI, The New York Fed's Weekly Economic Indicator, and the Aruoba-Diebold-Scotti business conditions index have no backward revision - and are designed to track the economy in real-time.

Economic indicators that coincide with economic movements are coincident indicators. Coincident indicators by definition do not provide a forward economic view. However, trends are valid until they are no longer valid, making the trend lines on the coincident indicators a forward forecasting tool.

Note that the indices discussed in this post are the last release of that index,

Generally, the coincident indices are showing modest growth but are in contraction year-over-year. Econintersect's analysis of the coincident indices is that:

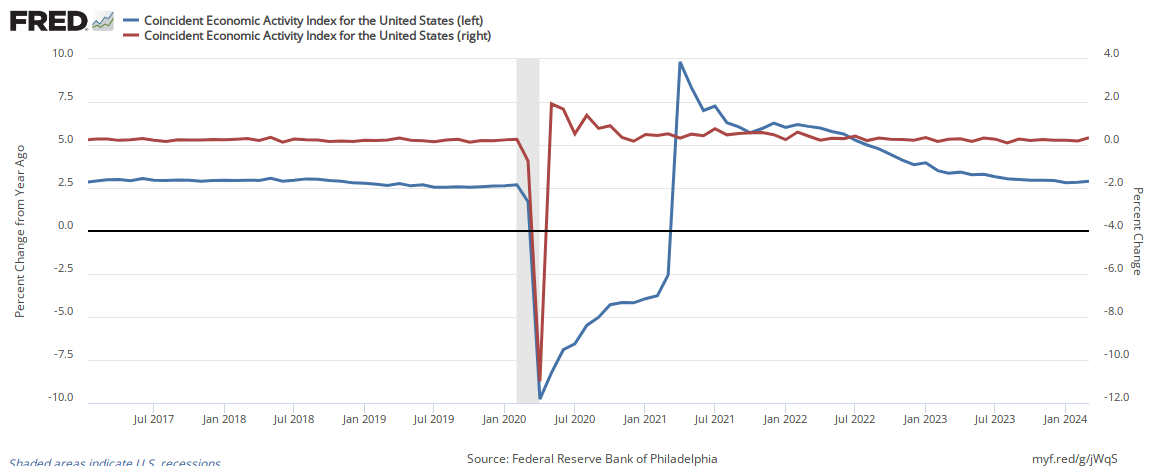

- The Philly Fed US Coincident index year-over-year rate of growth improved at a slower rate than last month but remains in contraction.

- The Aruoba-Diebold-Scotti business conditions show improving conditions - but the index is now barely in expansion and showing the growth rate is slowing.

- The New York Fed's Weekly Economic Indicator shows modest growth in November

- The rate of growth of the Conference Board Coincident Index improved but remains in contraction.

- ECRI's Coincident Index's rate of growth shows improvement but remains in contraction.

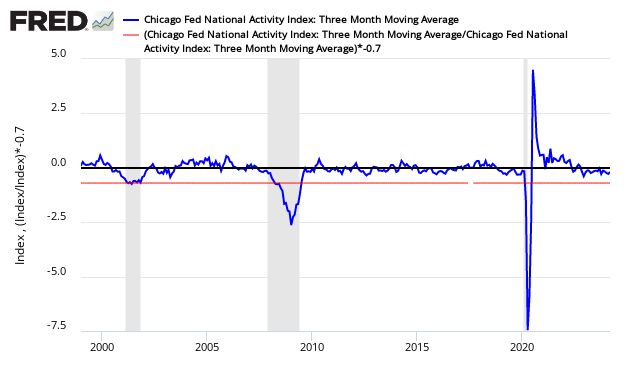

- The CFNAI rate of growth slowed but remains in expansion.

Excerpt from Philly Fed Report for the United States Coincident Index

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for October 2020. Over the past three months, the indexes increased in 48 states and decreased in two states, for a three-month diffusion index of 92. Additionally, in the past month, the indexes increased in 42 states and decreased in eight states, for a one-month diffusion index of 68. For comparison purposes, the Philadelphia Fed has also developed a similar coincident index for the entire United States. The Philadelphia Fed's U.S. index increased 2.4 percent over the past three months and 0.8 percent in October

[click graph below to enlarge]

In the graph below, the blue line shows the year-over-year growth rate of the US Coincident Index, while the red line shows the month-over-month change.

Aruoba-Diebold-Scotti Business Conditions Index

Per the Philly Fed:

The Aruoba-Diebold-Scotti business conditions index is designed to track real business conditions at high observation frequency. Its underlying (seasonally adjusted) economic indicators (weekly initial jobless claims; monthly payroll employment, monthly industrial production, monthly real personal income less transfer payments, monthly real manufacturing and trade sales; and quarterly real GDP) blend high-frequency and low-frequency data. The ADS index on this web page is updated in real time as new or revised data on the index's underlying components are released. Hence at the time of any ADS update, the index is based on all information on all indicators available at that time.

The average value of the ADS index is zero. Progressively bigger positive values indicate progressively better-than-average conditions, whereas progressively more negative values indicate progressively worse-than-average conditions. The ADS index may be used to compare business conditions at different times. A value of -3.0, for example, would indicate business conditions noticeably worse than at any time in either the 1990-91 or the 2001 recession, during which the ADS index never dropped below -2.0.

New York Fed's Weekly Economic Index (WEI)

From the New York Fed:

The WEI is an index of real economic activity using timely and relevant high-frequency data. It represents the common component of ten different daily and weekly series covering consumer behavior, the labor market, and production. The WEI is scaled to the four-quarter GDP growth rate; for example, if the WEI reads -2 percent and the current level of the WEI persists for an entire quarter, we would expect, on average, GDP that quarter to be 2 percent lower than a year previously.

The Weekly Economic Index (WEI) provides a signal of the state of the U.S. economy based on data available at a daily or weekly frequency. It represents the common component of ten different daily and weekly series covering consumer behavior, the labor market, and production.

Conference Board's Coincident Index (red line):

ECRI's USCI (U.S. Coincident Index):

Chicago Fed National Activity Index (CFNAI)

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more