October 2018 Leading Index Review: Generally A Slowing Rate Of Growth

This post is a review of the Philadelphia Fed's Leading Index and all major leading indicators - and their trends are generally slowing.

Analyst Opinion of the Leading Indicator Forecasts

Most of the leading indicators are based on factors which are known to have significant backward revisions - and one cannot take any of their trends to the bank. The only indicators with minimal backward revision are ECRI, RecessionAlert's WLEI, and the Chemical Activity Barometer. Unfortunately, the Chemical Activity Barometer is targeted to the industrial sector of the economy - and at best seems to be a coincident indicator, not a leading indicator. Note that both ECRI and RecessionAlert are forecasting marginally negative growth over the next six months.

The leading indicators are to a large extent monetary based. Econintersect does not use any portion of the leading indicators in its economic index. Most leading indices in this post look ahead six months - and are all subject to backward revision.

At this point, Econintersect continues to see NO particular dynamic at this time which will deliver noticeably better growth in the foreseeable future - and the majority of the indicators are forecasting slowing rate of growth.

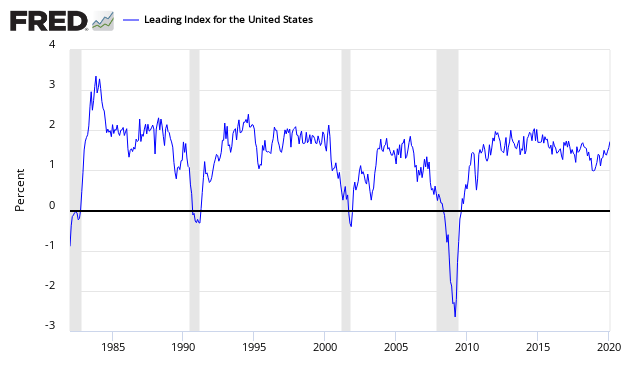

Philly Fed Leading Index

The Philly Fed Leading Index for the United States is continuously recalculated. Note that this index is not accurate in real time as it is subject to backward revision, Per the Philly Fed:

The Federal Reserve Bank of Philadelphia has released the leading indexes for the 50 states for October 2018. The indexes are a six-month forecast of the state coincident indexes (also released by the Bank). Forty-nine state coincident indexes are projected to grow over the next six months, and one is expected to decrease. For comparison purposes, the Philadelphia Fed has also developed a similar leading index for its U.S. coincident index, which is projected to grow 1.4 percent over the next six months.

Index Values Over the Last 12 Months

This index has been noisy, and is about mid-range of the values seen since the end of the Great Recession.

Chemical Activity Barometer (CAB)

The CAB is an exception to the other leading indices as it leads the economy by two to fourteen months, with an average lead of eight months. The CAB is a composite index which comprises indicators drawn from a range of chemicals and sectors. Its relatively new index has been remarkably accurate when the data has been back-fitted, however - its real time performance is unknown - you can read more here. A value above zero is suggesting the economy is expanding. Note that the authors of this index want to be measured against industrial production. Econintersect's analysis of this index is [here].

ECRI WLI Index

ECRI's Weekly Leading Index - the methodology used in created this index is not released but is widely believed to be monetary based. Econintersect's review of this index is [here].

The Conference Board's Leading Economic Indicator (LEI)

The LEI has historically begins contracting well before a recession.

RecessionAlert's Weekly Leading Economic Index

RecessionALERT.com has constructed a Weekly Leading Economic Index (WLEI) for the U.S Economy that draws from over 50 time-series from the following broad categories - Corporate Bond Market Composite, Treasury Bond Market Composite, Stock Market Composite, Labor Market Composite, and Credit Market Composite. From the authors of the index:

Being a weekly growth index, it provides data with at most a 1-week lag, which is far more timely than the lag found on monthly economic indicators. Additionally, it is published on Thursday afternoons, a full 18 hours before the widely known ECRI Weekly Leading Index.

As with all weekly indices though, the data is far more volatile than monthly or quarterly indicators and the WLEI components are therefore subject to more false positives (calling recession when one does not occur.). The WLEI is heavily weighed toward financial market data, but the obvious advantage of this is that data revisions are minor and isolated to the Labor Market Composite and small portions of the Credit Market Composite.

Econintersect Economic Index

Unlike the other leading indices, Econintersect Leading Index (LEI) only forecasts one month in advance.

The EEI is a non-monetary based economic index which counts "things" that have shown to be indicative of direction of the Main Street economy at least 30 days in the future. Note that the Econintersect Economic Index is not constructed to mimic GDP (although there are correlations, but the turning points may be different), and tries to model the economic rate of change seen by business and Main Street. The vast majority of this index uses data not subject to backward revision.

Econintersect Economic Index (EEI) with a 3 Month Moving Average (red line)

Leading Indicators Conclusion: most are forecasting modest to average growth seen since the Great Recession - and none indicating a recession over the next six months.

- Chemical Activity Barometer (CAB) growth rate is near average for times of economic expansion and its rate of growth and its rate of growth is slowing.

- ECRI's WLI is forecasting a marginal contraction in the business cycle six months from today.

- The Conference Board (LEI) 6-month rolling average suggesting continuation of the current rate of growth over the next 6 months.

- The Philly Fed's Leading Index continued backward revisions make this index worthless - however its growth trend currently is projecting a marginally improving rate of growth over last month's forecast.

- RecessionAlert's Weekly Leading Economic Index is forecasting a slowing rate of growth.

- Econintersect's Economic Index is projecting nearly the same rate of growth.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more