NZDUSD: Many Reasons To Rise And Few To Fall

Over the past month, the NZD has been the weakest currency against the US dollar due to its strong fall on March 23rd. Now NZDUSD has recovered to 0.720. Identifying the factors that contributed to its sharp decline in March will help to understand whether the pair will continue to rise or not.

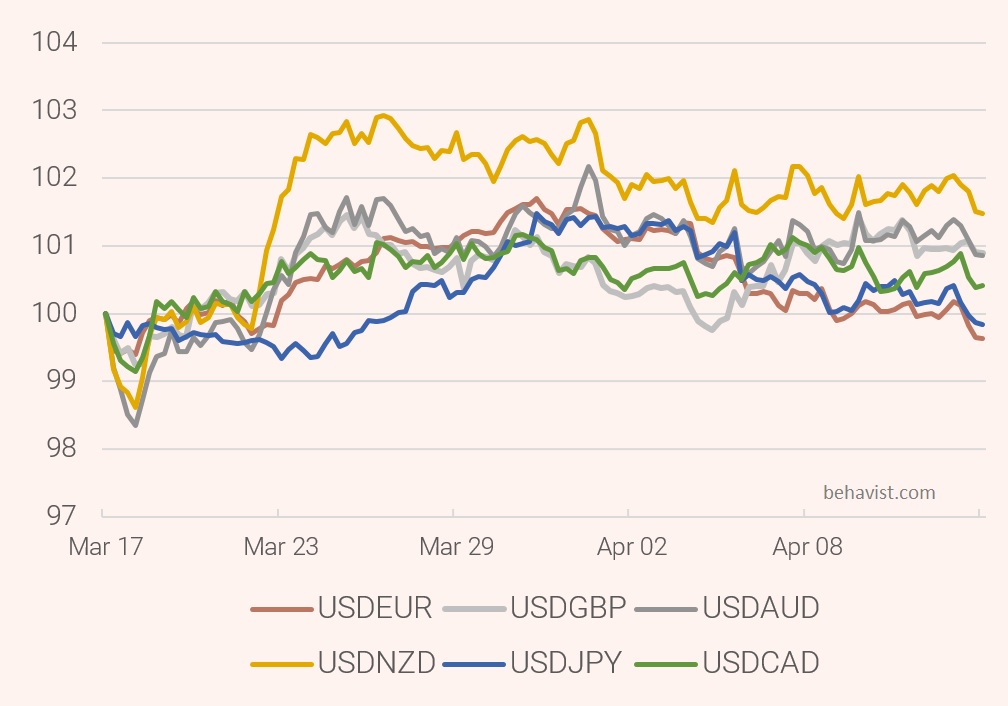

Monthly change in the USD against other currencies

The chart shows currency indices. The currency index measures currency pair increase as a percentage.

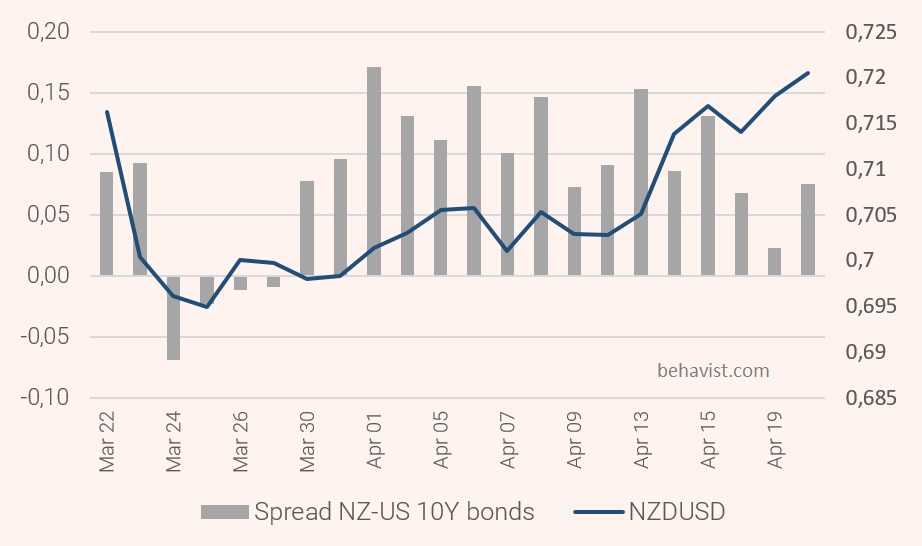

In our opinion, the main reason for the NZD collapse was the yield spread reduction between NZ and US 10Y bonds to negative values.

10Y US and New Zealand bonds yield spread and NZDUSD

The spike in bond demand was provoked by releasing a government housing package that removes tax incentives for speculators. The Government has agreed to remove the ability for property investors to offset their interest expenses against their rental income when they are calculating their tax.

Although this measure supports people who buy their first house, it provokes risks for economic recovery. Probably investors expected a fall in the stock market against this background and bought bonds reducing their risks. But the New Zealand stock market has been resilient.

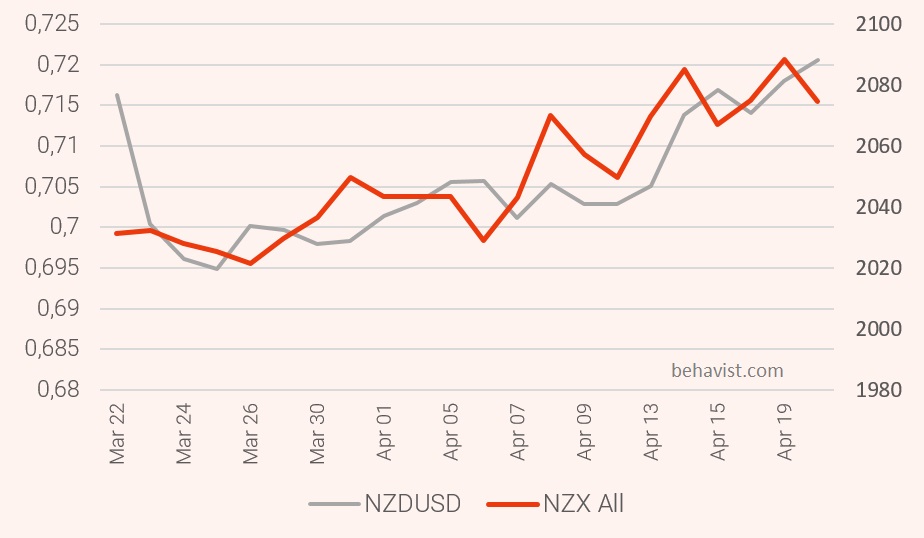

New Zealand stock index NZX All and NZDUSD

New Zealand's NZX All Index has risen 2.1% since March 23rd. The index growth is driven by two global factors.

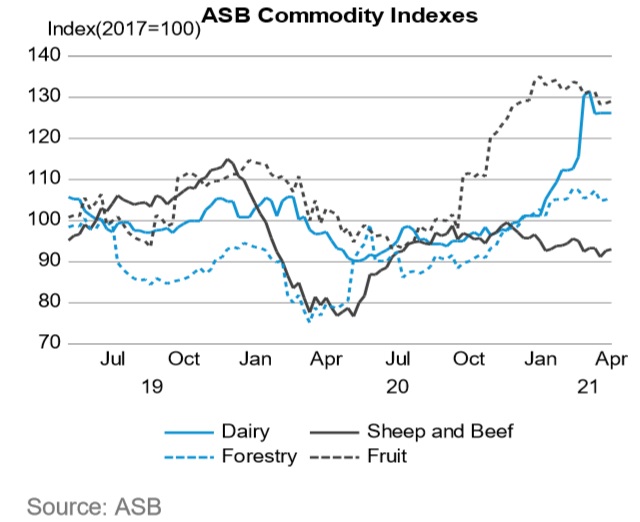

1) Commodity price growth supports expectations of growth in the revenue of New Zealand companies, especially in the dairy market, which accounts for more than 30% of the country's exports. Thus, the rise in dairy products prices work in two directions:

- increases the trade balance by providing fundamental support to the New Zealand dollar;

- provokes an influx of international capital into the New Zealand stock market, which also supports the NZD.

2) The rapid recovery of the Chinese economy increases the demand for New Zealand exports. Many NZX All companies are export-oriented to China. Growing exports likewise shape expectations for the future revenue of New Zealand companies, forcing their stocks to rally.

Based on this, the continued growth of commodities and the recovery of the Chinese economy will provoke an international capital inflow to New Zealand. It will fundamentally support the NZD.

The CPI data was released this week. Inflation in Q1 increased by 0.8%. Annual inflation for the year to March 2021 was 1.5%. Given the decline in the NZIER Business Confidence Index last week, mainly due to the deteriorating situation in the retail sector, the small inflation surge was due to disruption in global supply chains and higher prices for imported products. But RBNZ's comments previously noted that it would not affect monetary policy. Thus, a slight rise in inflation will not have a significant impact on the New Zealand dollar. NZD in the short term will be influenced by external factors:

• rise in prices for commodities;

• recovery pace of the Chinese economy.

We expect the NZDUSD will rise to 0.725-0.730, provided the US dollar remains weak, and the yield spread between the 10-year US and New Zealand bonds remains positive. A possible US dollar strengthening may weaken the pair, but the factors of the New Zealand dollar will support it.

Disclaimer: This material contains general commentary only and is not intended to constitute or be relied upon as personal financial advice. To the extent that this material contains any general ...

more