November 2018 Producer Price Final Demand Year-Over-Year Inflation Moderates Again

The Producer Price Index year-over-year inflation moderated from 2.9 % to 2.5 %.

Analyst Opinion of Producer Prices

The Producer Price Index declined year-over-year. Energy prices was the major factor in this decline - and but was partially offset by services inflation lead by transport and warehousing. Here is what the BLS said in part:

Final demand services: The index for final demand services moved up 0.3 percent in November, the third straight rise. The broad-based November advance was led by a 0.3-percent increase in the index for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and retailers.) Prices for final demand transportation and warehousing services climbed 1.2 percent, and the index for final demand services less trade, transportation, and warehousing inched up 0.1 percent.

Product detail: Most of the November advance in prices for final demand services can be traced to margins for fuels and lubricants retailing, which jumped 25.9 percent. The indexes for health, beauty, and optical goods retailing; cellular phone and other wireless telecommunications services; airline passenger services; food wholesaling; and truck transportation of freight also moved higher. Conversely, prices for guestroom rental fell 3.5 percent. The indexes for machinery and equipment wholesaling and for portfolio management also declined.

Final demand goods: The index for final demand goods moved down 0.4 percent in November, the largest decrease since falling 0.5 percent in May 2017. The November decline was the result of a 5.0-percent drop in the index for final demand energy. In contrast, prices for final demand goods less foods and energy climbed 0.3 percent, and the index for final demand foods advanced 1.3 percent.

Product detail: Leading the November decrease in the index for final demand goods, gasoline prices dropped 14.0 percent. The indexes for liquefied petroleum gas, electric power, fresh fruits and melons, jet fuel, and primary basic organic chemicals also moved down. Conversely, the index for pharmaceutical preparations rose 1.5 percent. Prices for fresh and dry vegetables and for residential natural gas also increased.

The PPI represents inflation pressure (or lack thereof) that migrates into consumer price.

The market had been expecting (from Econoday):

| month over month change | Consensus Range | Consensus | Actual |

| PPI-Final Demand (PPI-FD) | -0.1 % to +0.2 % | +0.0 % | +0.1 % |

| PPI-FD less food & energy (core PPI) | +0.0 % to +0.3 % | +0.1 % | +0.3 % |

| PPI-FD less food, energy & trade services | +0.1 % to 0.3 % | +0.2 % | +0.3 % |

The producer price inflation breakdown:

| category | month-over-month change | year-over-year change |

| final demand goods | -0.4 % | |

| final demand services | +0.3 % | |

| total final demand | +0.1 % | +2.5 % |

| processed goods for intermediate demand | -0.7 % | +4.3 % |

| unprocessed goods for intermediate demand | -5.3 % | -0.7 % |

| services for intermediate demand | +0.2 % | +3.1 % |

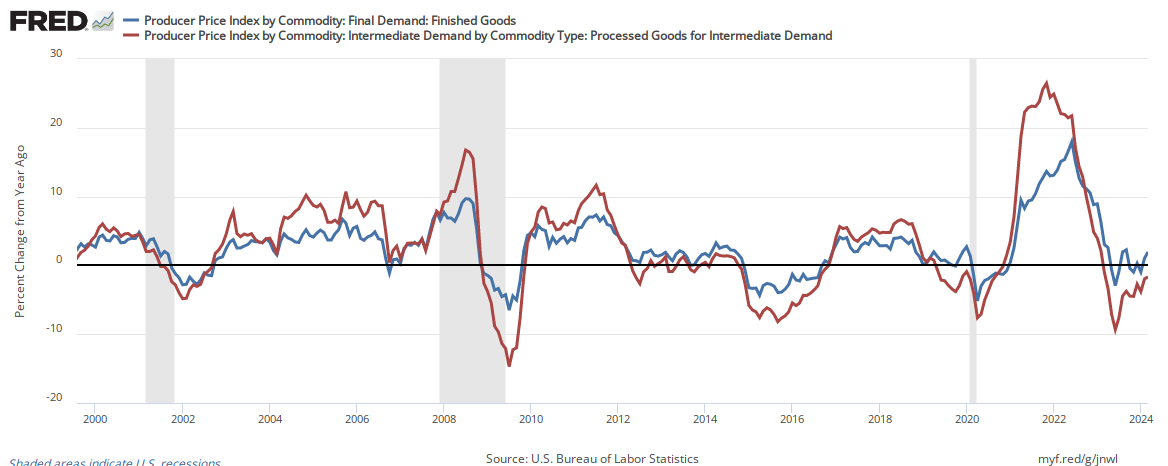

In the following graph, one can see the relationship between the year-over-year change in intermediate goods index and finished goods index. When the crude goods growth falls under finish goods - it usually drags finished goods lower.

Percent Change Year-over-Year - Comparing PPI Finished Goods (blue line) to PPI Intermediate Goods (red line)

Econintersect has shown how pricing change moves from the PPI to the Consumer Price Index (CPI).

Comparing Year-over-Year Change Between the PPI Finished Goods Index (blue line) and the CPI-U (red line)

The price moderation of the PPI began in September 2011 when the year-over-year inflation was 7.0%. Currently, inflation is on an increasing trend line.

Caveats on the Use of Producer Price Index

Econintersect has performed several tests on this series and finds it fairly representative of price changes (inflation). However, the headline rate is an average - and for an individual good or commodity, this series provides many sub-indices for a specific application.

A very good primer on the Producer Price Index nuances can be found here.

Because of the nuances in determining the month-over-month index values, the year-over-year or annual change in the PPI index is preferred for comparisons.

There is moderate correlation between crude goods and finished goods. Higher crude material prices push the finished goods prices up.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more