Not Excited

Color me not excited. News flows are not matching up with market volatility as we see bonds higher, stocks mixed, FX stuck and commodities confused but holding more bid than offered. This is risk-parity heaven where passive beats active, where machines make mockery of discretionary human thought. We can blame ourselves for the color choice and the programming. The US/China trade talk optimism is cited for calming bearish nerves in EM and elsewhere today. US President Trump said we’re going to make “a very good” deal with China in an interview, while an official noted that tariffs will be a sticking point to deal but technology transfer maybe close to being resolved in talks. The balancing act of good news on US/China is balanced against EM and DM headlines that leave few investors excited. Point is that US/China may end their battle in April or June but the effects on the rest of the world continue. The emerging market pain trade in 2019 remains in play for ARS, TRY and BRL. The economic headlines overnight show New Zealand business mood weaker, Korea better but still below average, and European economic sentiment weaker still, and ability for central bankers to fix it all remains in doubt. Here are the headlines that stand out in EM and DM

- ECB and tiered rates in play. The Draghi speech yesterday mulled the effects of negative rates and with deposit hikes infeasible, tiering ala BOJ and Riksbank being studied. Praet speech adds to this speculation. One factor for tiered deposit rate policy is to alleviate the penalty of excess reserves. This allows for more rate cuts if needed.

- Waiting for Brexit clarity as the political stakes for UK PM May are all-in with her promise to resign should her deal pass Parliament. Of course, no deal passed with DUP opposition driving except the one to delay until April 12 – all of which makes it more difficult to see good outcomes with no deal odds rising. As an aside, Betfair odds put Rees-Mogg and Cox in the lead to replace May.

- The Turkish Central Bank (CBRT) raised the TRY swap sale limit to 30%from 20% for swap transactions that haven’t matured. TRY weakens to 5.6, forwards drop with implied rates O/N dropping from 1300% to 50%.

- Three more Vale dams in Brazil on high alert for disruption– adding to BRL pain trade as the Bolsonaro honeymoon ends. A constitutional change limits the budgets of local and federal to “free” spending of 10%. FinMin Guedes doesn’t seem happy, and the pension reform is rescheduled again.

- Thai poll agency says the pro-military party won the general election, but the stalemate in lower House likely. THB trade near 32. Under new rules, the 250 member Senate appointed by the junta will vote with the 500 members of the lower house to vote for prime minister. This means 376 lower house member needed to ensure PM without junta support.

The lack of clarity in UK and EU policy and Brexit matters to global growth as it stalls investment plans and drives down the views for a faster recovery. The focus for today is on the GDP revision in 4Q and what it means for 1Q outlooks. For those that want more on seasonal noise read the SF Fed blog on this point. The US trade deficit was less painful in January and that will help even out the 4Q to 1Q story. The role of the USD in this game of risk between global fear and US divergence is still where the excitement for traders lives. This puts the EM/USD relationship on the front lines and the TRY move today as the stand out counterpoint to anyone brave enough to not be excited.

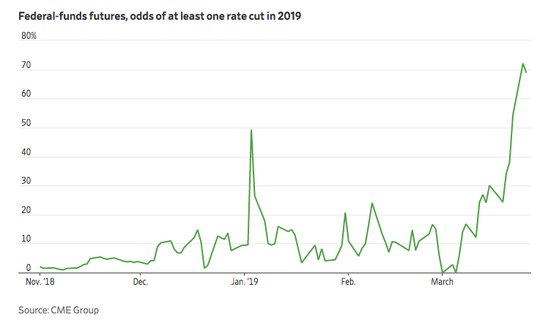

Question for the Day: Is the Fed really going to cut rates in 2019? The pricing of the market is about to clash with the Fed Speakers. We saw some of this with Dallas Fed Kaplan already – who noted its too soon to consider cutting rates. Expect more to follow. The question maybe more about signals – is a -6.5bps inversion in 3M to 10Y yields sufficient to trigger action or do you need GDP below 1.5% to force the Powell put? Or is it about the inflation expectations being anchored? The 5Y inflation swap maybe the tie-breaker as that was the key to the December to January flip from normalization to patience.

Federal-funds futures showed Wednesday the market pricing in a 26% chance of the Fed holding interest rates steady this year, compared with a 40% chance of one rate cut and a 25% chance of two rate cuts, according to CME Group.

What Happened?

- New Zealand March ANZ business confidence drops to -38 from -30.8 – weaker than -35 expected. Activity outlook drops to 6.3 from 10.5 – lowest since August 2018, investment drops to 0.9 from 2.3, unemployment rate rises to 30.3 from 25.1 while inflation expectations steady at 2.05 from 2.06%. The ANZ report noted: "Most activity indicators eased slightly in March, consistent with our expectation that the economy is quietly losing steam."

- Korea March business confidence jumps to 73 from 69 – better than the 71 expected. The April outlook is flat at 76. The service sector rose to 73 from 70 and its outlook rose 1 to 76 for April. The export focus business sector rose 1 on the month while the domestic fell 1.The combined consumer and business surveys – ESI fell 0.9 to 94.2 in March. Another poll from the Korea Federation of SME showed outlook for April weakening with its SBHI down 0.9 to 85.7.

- Spanish March flash HICP 1.4% m/m, 1.3% y/y after 0.2% m/m, 1.1% y/y – less than the 1.6% m/m, 1.5% y/y expected. The National CPI 0.4% m/m, 1.3% y/y after 1.1% - more than the 1.2% expected.

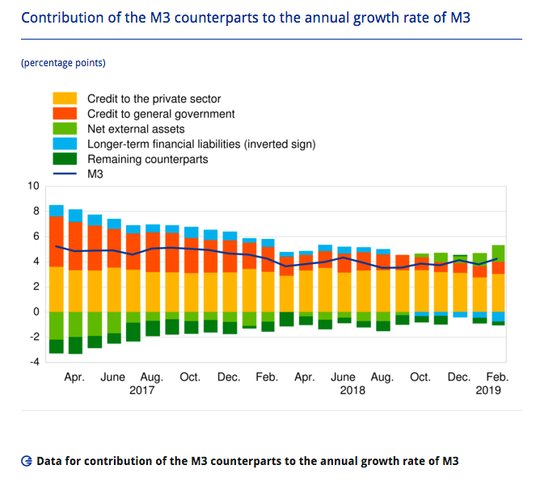

- ECB February M3 4.3% y/y after 3.8% y/y – more than the 3.9% y/y expected. The private loan growth rises to 3.3% y/y from 3.2% y/y – as expected.

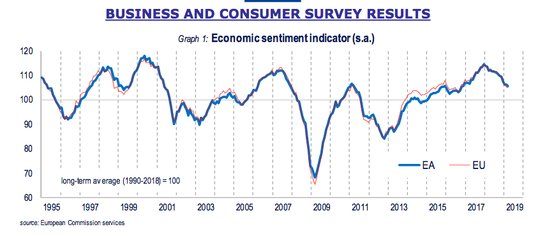

- Eurozone March economic sentiment drops to 105.5 from 106.2 – weaker than 105.9 expected. The business confidence drops 0.53 from 0.69 – also weaker than 0.66 expected. By component, consumer confidence up -7.2 after -7.4, industrial down -1.7 from -0.4, services down to 11.3 from 12.1, retail trade up 0.2 from -1.3, construction up to 7.5 from 6.6. Also notable financial services up to 19.8 from 10.6.

Market Recap:

Equities: The US S&P 500 futures are off 0.05% after losing 0.46% yesterday. The Stoxx Europe 600 is up 0.15% with ECB easing talk and US/China trade hopes key. The MSCI Asia Pacific fell 0.8% with focus on bank earnings.

- Japan Nikkei off 1.61% to 21,033.76

- Korea Kospi off 0.82% to 2,128.10

- Hong Kong Hang Seng up 0.16% to 28,775.21

- China Shanghai Composite off 0.92% to 2,994.94

- Australia ASX up 0.63% to 6,256.50

- India NSE50 up 1.09% to 11,570

- UK FTSE so far up 0.45% to 7,227

- German DAX so far up 0.25% to 11,450

- French CAC40 so far up 0.1% to 5,305

- Italian FTSE so far off 0.5% to 21,081

Fixed Income: Talk of ECB cutting rates and weaker ESI driving EU bonds on top of the catch up to US from yesterday. German 10-year yields off 7bps to -0.08%, French OATs off 6 to 0.31%, UK Gilts up 1bps to 1.0% with Brexit unclarity. Periphery suffers with Italy weak auction/growth doubt – Italy up 6bps to 2.50%, Spain up 3bps to 1.09%, Portugal up 3bps to 1.28% and Greece flat at 3.78%.

- Italy sold E7.50bn of bonds on upper end of issues expectations but with weaker demand – sold E3.25bn of 5Y 1.75% July 2024 BTP at 99.9 with 1.31 cover – down from 1.46 previously; sold E2.25bn of 10Y 3% Aug 2029 BTP at 10329 with 1.4 cover from 1.31 and sold E0.5bn of 6Y 1.61% Jan 2025 CCTeu at 98.47 with 1.67 cover from 1.62 previously.

- US Bonds are mixed with focus on Fed and data– 2Y up 2bps to 2.23%, 5Y up 3bps to 2.19%, 10Y up 1bps to 2.38%, 30Y flat at 2.82%.

- Japan JGBs are bid with BOJ/weaker equities driving– 2Y off 1bps to -0.18%, 5Y off 2bps to -0.19%, 10Y off 3bps to -0.09%, 30Y off 4bps to 0.50%. MOF sold Y2.1trn of 2Y 0.1% bonds at -0.175% with 5.28 cover – previously -0.167% with 6.08 cover.

- Australian bonds sees curve flatten further– 3Y up 2bps to 1.42%, 10Y off 5bps to 1.73% with NZD 10Y off 1bps to 1.78%.

- China PBOC skips open market operations for 7thday– leaves liquidity unchanged. China bonds chop into trade talks/Li speech – 2Y flat at 2.64%, 5Y off 2bps to 2.95%, 10Y flat at 3.10%.

Foreign Exchange: The US dollar index off 0.15% to 96.77. In emerging markets, the USD is mixed – ASIA: INR off 0.15% to 69.09, KRW up 0.15% to 1136.80; EMEA: ZAR off 0.2% to 14.616 – tested 14.65, RUB flat at 64.85 and TRY off 4.5% to 5.568.

- EUR: 1.1230 off 0.1%. Range 1.1228-1.1261 with focus on 1.12-1.1280 now and ECB policy vs. Fed. 1.1180 pivotal support.

- JPY: 110.30 off 0.2%. Range 110.02-110.53 with EUR/JPY 124 off 0.35%. Focus is on equities and

- GBP: 1.3105 off 0.55%. Range 1.320801.3101 with EUR/GBP .8565 up 0.45% as Brexit issues nag and 1.30 risks rise.

- AUD: .7085 flat. Range .7074-.7106 with NZD .6805 up 0.1%. Rally back on US/China trade fizzles a bit in Europe with EUR and .7050 pivot in play. NZD watching .6820 pivot.

- CAD: 1.3435 up 0.2%. Range 1.3401-1.3440 with oil and rates in play again 1.3450 pivot for 1.36 risk.

- CHF: .9955 up 0.1%. Range .9938-.9965 with EUR/CHF 1.1190 flat – back to watching risk with .9880 and 1.1250 keys.

- CNY: 6.7290 flat. Range 6.7200-6.7400 with some stops triggered over 50 day at 6.7320 opens 6.80 test risk but reverses on trade talk chatter. PBOC fixed 6.7263 from 6.7141 – weakest setting since Feb 20th.

Commodities: Oil lower, gold flat, Copper up 0.6% to $2.8945

- Oil: $58.88 off 0.9%. Range $58.62-$59.43 with EIA supply and Asia equity weakness countering trade talk hopes - $58-$60 holding in WTI – Brent off 0.85% to $67.24 with $68 still pivot.

- Gold: $1310.70 flat. Range $1310-$1317.60 with USD holding pattern, focus is on risk mood/rates with $1305 back as key. Silver $15.19 off 0.7% with $15.50 cap. Platinum $854.30 off 0.25% and Palladium $1386.10 off 2.5% - bubble pop continues.

Economic Calendar:

- 0715 am Fed Quarles speech

- 0800 am German Mar flash HICP (m/m) 0.5%p 0.6%e (y/y) 1.7%p 1.6%e / national 1.5%p 1.5%e

- 0830 am US 4Q final GDP 3.4%p 2.4%e / PCE core 1.6%p 1.7%e

- 0830 am US weekly jobless claims 221k p 220k e

- 0900 am SARB rate decision – no change from 6.75% expected

- 0930 am ECB Guindos speech

- 0930 am Fed Clarida speech

- 1000 am US Feb pending home sales (m/m) 4.6%p 0.3%e (y/y) -2.3%p -1.8%e

- 1130 am Atlanta Fed Bostic speech

- 0100 pm US 7Y note sale

- 0115 pm NY Fed Williams speech

- 0300 pm Mexico central bank rate decision no change from 8.25% expected.

- 0620 pm St. Louis Fed Bullard speech

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.