No More Snow

The US got hit with snow this weekend and markets got hit with more US/China trade hopes. Both are a nuisance for the bigger picture as we all know that there are just 17 days until Spring and maybe even less before Trump/Xi meet and sign something. Trading risk on the basis of a trade deal or acting like the present deluge of wet slush will not matter to traffic is foolhardy. Snow like trade hides a larger issue of policy. The most interesting comments last night came from BOJ Kuroda as he was pressed on the negative effects of negative-interest rates, QE and yield curve targeting. Better to pay attention to low volatility and the search for yield as drivers ahead. Note that JPY trades at 4 ½ year lows for option volatility and Greek bonds are back to 2006 highs. The friction in this comes from the USD, which continues to rally despite the wishes of the US President. There are some other headlines to consider for the risk-on continuation today:

1) China plans to cut its VAT rate by 3% according to Bloomberg. This would be a $90bn relief to manufacturers and maybe announced after the annual National People’s Congress. Many expect a more proactive fiscal program with budget deficit rising to 2.8% of GDP from 2.6% in 2018 and special bond quota set at CNY2.15trn from CNY1.35trn in 2018. In contrast, the spending on the military was up 8.1% in 2018 but only 1.3% of GDP. The 2019 plans will be watched closely for a similar increase – potentially to 2% of GDP.

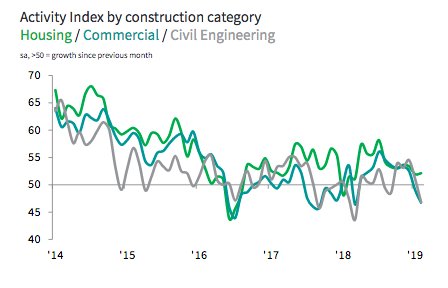

2) Irish Border deal still key for UK May’s Brexit. The DUP wants “treaty-level change” before it supports her plan. The UK communities secretary noted negotiations are at a critical stage and that the backstop plan seeks legally binding changes. Notable that UK construction PMI fell for the first time in 11 months today.

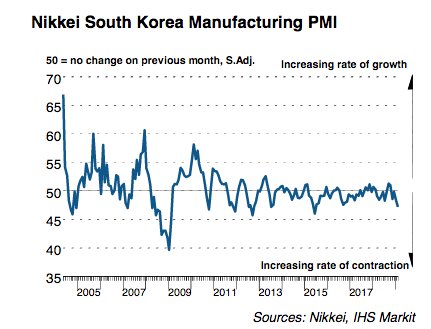

3) Korea Manufacturing PMI sinks to June 2015 lows. This follows a rough US/North Korea summit but more likely reflects the hit of the 25bps rate hike from the BOK in November adding to international woes over trade.

For the day, the market is bid for equities regardless of FX or rates. This puts the EUR/USD move as the most interesting one to watch given its back towards the lower end of its ranges and the ECB meeting later this week.

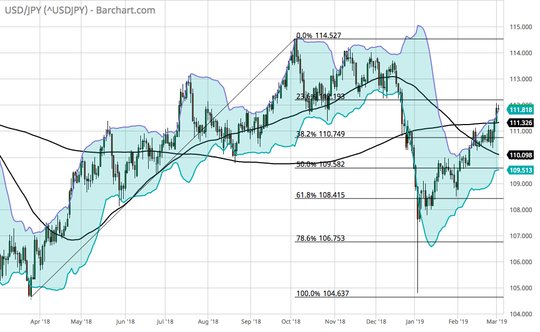

Question for the Day: If the world is so uncertain why is volatility so cheap? Tight real ranges in bonds and FX and bid equities make options cheap everywhere. FX is a case study - JPY 3M volatility trades at 4 ½ lows. The USD/JPY is at 10-week highs near 112. This contrasts with USD/CNY, which traded back to 6.6880 today near the 8-week lows of 6.67 but reversed with EUR in Europe. The USD index is up 0.1% on the day at 96.60 and holding its ranges despite the weekend Trump speech hitting Powell and the stronger USD. Markets are sanguine and the JPY is the one currency that captures the correlation of risk-on in equities and USD bid today. Volatility in the JPY is not going to matter unless we see 105 or 115 break.

What Happened?

- BOJ Kuroda: Will debate exit from QE/ZIRP at right time. Kuroda said in testimony to the upper house budget committee, the BOJ did not have a specific exit strategy now because it would take “significant time” in achieving its 2% inflation target. The exit would involve hiking rates and on shrinking the balance sheet. “To ensure markets remain stable, it’s important to come up with a strategy and guidance at an appropriate timing on how to proceed with an exit,” Kuroda said. When asked about the issues of his policy, Kuroda noted: “There’s a concern low-rate environment and competition will prolong downward pressure on financial institutions’ profits. As a result, I’m aware of risks that financial intermediation could stagnate and financial system could become unstable,” he said. “I don’t think such risks are large at the moment given that financial institutions are equipped with ample capital base. But I need to pay enough attention to future developments.”

- Australia 4Q business inventories -0.2% after -0.1% revised – worse than 0.4% rise expected. 3Q revised from +0.1%. The 4Q corporate profits rose just 0.8% q/q after revised 1.2% (preliminary 1.9% in 3Q) – also weaker than the 3% q/q expected.

- Australian January dwelling approvals up 2.5% m/m, -28.6% y/y after -8.1% m/m – better than 0% m/m expected. The seasonally adjusted estimate of the value of total building approved rose 1.3% in January. The value of residential building fell 2.0%, while the value of non-residential building rose 6.4%. In trend terms, dwellings were -3.2% m/m, -27% y/y – with private homes -0.4% m/m but apartments -8.1% m/m.

- Korea February manufacturing PMI 47.2 from 48.3 – weaker than 48.1 expected – lowest since June 2015. Demand weakness notable with both domestic and foreign orders lower. New export orders are at 5 ½ year lows. Employment plans fell for the 4th month running. Notable was that business confidence improved from January but remains subdued.

- UK February Construction PMI 49.5 from 50.6 – weaker than 50.3 expected – the first fall in 11-months. The drop was led by commercial building and civil engineering while residential work growth was up modestly.

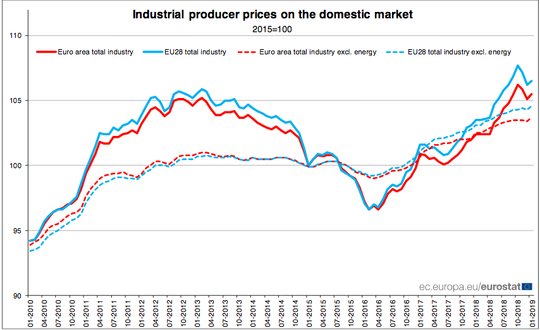

- Eurozone January PPI up 0.4% m/m, 3% y/y after -0.8% m/m, 3% y/y – more than the 0.3% m/m, 2.9% y/y expected. By category, durable goods up 0.5% m/m, energy up 0.4%, intermediate goods up 0.3% and consumer goods stable. The ex-energy PPI was up 0.3% m/m.

Market Recap:

Equities: The US S&P500 futures are up 0.25% after a 0.69% gain. The Stoxx Europe 600 is up 0.35% with focus on US/China trade. The MSCI Asia Pacific rose 0.8% with China leading.

- Japan Nikkei up 1.02% to 21,822.04

- Korea Kospi off 0.22% to 2,190.66

- Hong Kong Hang Seng up 0.51% to 28,959.59

- China Shanghai Composite up 1.12% to 3,027.58

- Australia ASX up 0.46% to 6,302.50

- India NSE50 up 0.66% to 10,863.50

- UK FTSE so far up 0.6% to 7,150

- German DAX so far up 0.15% to 11,619

- French CAC40 so far up 0.55% to 5,295

- Italian FTSE so far up 0.1% to 20,707

Fixed Income: Focus is on Greek bonds after Moody’s on Friday lifted Greece’s issuer ratings to B1 from B3, citing the success of the reform program. Greek 10Y yields are back to 2006 lows at 3.65% flat on the day after trading to 3.60 near the open. The rest of the periphery mixed – Italy up 4bps to 2.77%, Spain flat 1.21%, Portugal up 1bps to 1.50%. Core EU bond are bid with data and ECB focus – German 10Y Bund yields are off 2bps to 0.17%, France OATs off 1bps to 0.58%, UK Gilts up 1bps to 1.31%.

- US Bonds are slightly bid – waiting for more data/FOMC speeches– 2Y flat at 2.55%, 5Y off 1bps to 2.55%, 10Y off 1bps to 2.75% and 30Y off 1bps to 3.11%.

- Japan JGBs are lower post BOJ Kuroda, ahead of supply– 2Y flat at -0.14%, 5Y up 1bps to -0.14%, 10Y up 1bps to 0%, 30Y up 2bps to 0.64%.

- Australian bonds are lower with focus on US/China deal– 3Y up 2bps to 1.69%, 10Y up 3bps to 2.18% while NZ 10Y up 2bps to 2.23%.

- China bond lower into budget plan– 2Y up 1bps to 2.76%, 5Y up 1bps to 3.06%, 10Y up 2bps to 3.21%.

Foreign Exchange: The US dollar index is up 0.1% to 96.62 recovering from Asia 96.34 lows. In emerging markets, the USD is mostly weaker– EMEA: ZAR off 0.1% to 14.235, RUB up 0.2% to 65.777, TRY off 0.15% to 5.38; ASIA: INR up 0.2% to 70.863, KRW up 0.1% to 1126.

- EUR: 1.1335 off 0.25%.Range 1.1334-1.1383 with focus on ECB this week vs. FOMC speeches and US data. 1.1250-1.1450 still key.

- JPY: 111.85 off 0.1%.Range 111.75-112.01 with EUR/JPY 126.80 off 0.3%. The 112 resistance still mostly holding with equities key.

- GBP: 1.3200 flat. Range 1.3198-1.3254 with EUR/GBP off 0.2% to .8585. All about Brexit still and weaker data mostly ignored.

- AUD: .7080 flat.Range .7075-.7108 with NZD .6805 up 0.1%. Focus is on metals and China with GDP and RBA key this week, .7050 base holding.

- CAD: 1.3320 up 0.2%.Range 1.3275-1.3322 with oil not enough, rates in play with BOC focus this week 1.3250 base building for 1.34

- CHF: 1.0015 up 0.25%.Range .9978-1.0020 with EUR/CHF 1.1345 off 0.1%. Mixed day with EUR driving and 1.00 pivot intact – watching 1.0080 as key.

- CNY: 6.7040 flat. Range 6.6840-6.7060. Early gains fizzled flips in Europe with EUR move. PBOC fixed 6.7049 from 6.6957.

Commodities: Oil up, Gold off, Copper off 0.45% to $2.9535

- Oil: $56.11 up 0.55%.Range $55.81-$56.42 – WTI tracks equities and US/China deal hope with $55-$58 holding. Brent up 0.8% to $65.58 with $64.50-$67.50 key.

- Gold: $1288.60 off 0.8%. Range $1287.30-$1298.10 with USD bid and equities up – safe-havens losing glitter - $1268 next key. Silver $15.18 off 0.5%. Platinum $848.40 off 1.7% and Palladium off 0.1% to $1504.50.

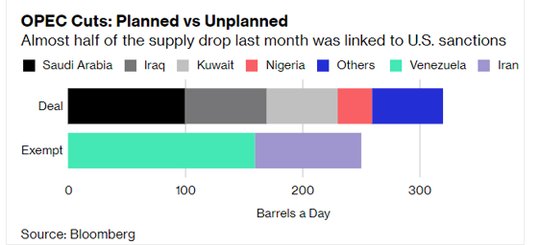

Conclusions: Is oil the key for trading risk now? If you want to find volatility it remains in commodities with the reversal in gold and the rally in oil notable. The role of OPEC production cuts is important to the equation for oil returning to “normal” supply and demand but the role of the cartel with US production likely continuing to rise remains in doubt over the longer term. Throw in energy alternatives and technology and the view that oil dominates USD and US rates and US equities – all that seems likely to fade away. In the present, the role of US policy vs. OPEC is the read for the day as sanctions on Iran and Venezuela appear more important than the cartels actual cuts.

Economic Calendar:

- 0730 am Boston Fed Rosengren speech

- 1000 am US Dec construction spending (m/m) 0.8%p 0.2%e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.