No Guts, No Glory: Two Beaten-Down ETFs To Buy Now

Everyone says they're a contrarian until their favorite sector comes crashing down, and then they're afraid to dip their toes in the water. Isn't it funny how that works? I'm as guilty as anybody when it comes to the "afraid to trade" syndrome, but I'm seeing two contrarian opportunities that are just too enticing to pass up.

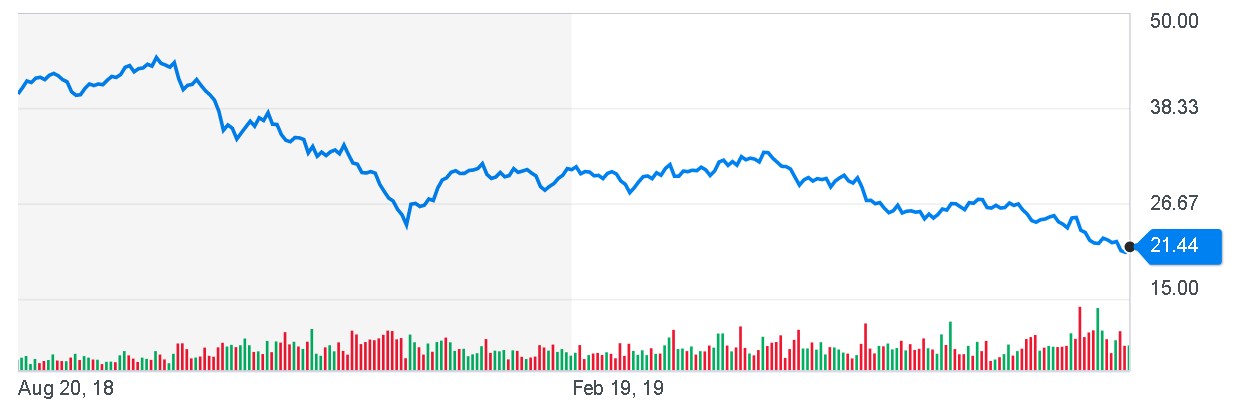

The first one on my radar is oil and gas, which I'll represent through the SPDR S&P Oil & Gas Exploration & Production ETF (XOP):

Courtesy: Yahoo Finance

The price of WTI crude oil has been holding steady between $50 and $60 per barrel for a long time, but XOP has slid to multi-year lows. Slowing economic growth and the prolonging of the Sino-U.S. trade dispute - and the impact of these factors on global oil demand - have been priced into XOP more than oil itself, and irrationally so, in my humble opinion. If you want pure exposure to oil services and no gas on your grill, feel free to focus on the VanEck Vectors Oil Services ETF (OIH) as an alternative to XOP.

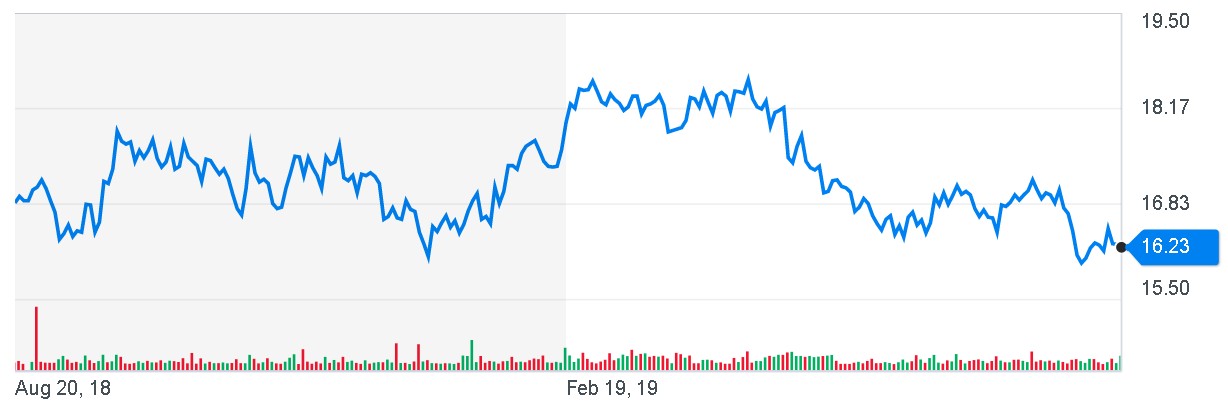

The other sector that's overcorrected to the downside is copper, a commodity that the world can't function without but which is also hard-hit by the global economic slowdown and the trade war. The experts tend to agree with me on the aggravating factors at least, with geologist Brent Cook asserting that "The current stagnant-to-declining copper price is accurately reflecting a slowing global economy" and Banyan Hill Research analyst observing that "Copper was in a steady two-year bull market right up until the trade war escalated."

If you're of the same mind as I am regarding the undue price pressure on the red metal, feel free to do your due diligence on the United States Copper Index Fund, LP (CPER):

Courtesy: Yahoo Finance

Alternatives to CPER include iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) or, for more volume but less copper focus, good old Freeport-McMoRan Inc. (FCX).

Or, you can just sit on the sidelines like 99% of retail investors always do. Personally, that's not how I choose to roll; as DeepValueETFAccumulator.com's Micah McDonald likes to say, "Folks, you've gotta buy this stuff when it's on sale."

Disclosure: David Moadel is not a licensed or registered investment advisor, and has no position in any securities listed herein.