No Doves

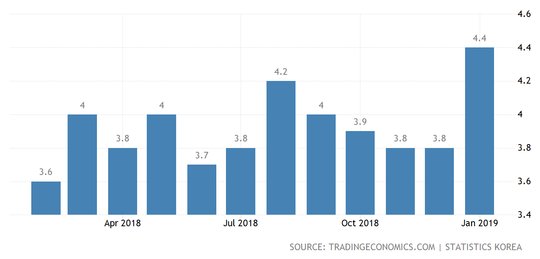

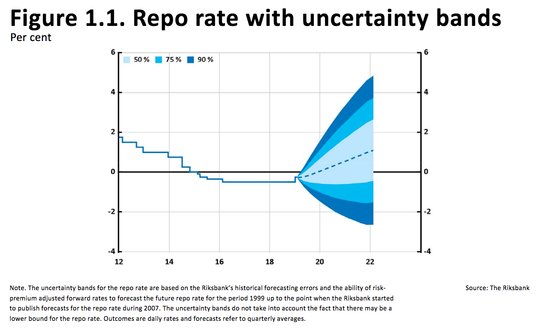

If you prove you aren’t a hawk, that doesn’t make you a dove. This is the logical biconditional problem for central bankers. Today was about the RBNZ and Riksbank not being dovish and so assumed to be hawkish. NZD and SEK rally accordingly. FX extends its role from flow gauge to confidence barometer. There is a difference between keeping accommodative policy steady rather than doing more extraordinary actions to bolster markets and economies. We live in a world where expectations have become part of the policy process with forward guidance seen as a useful tool even when present uncertainty makes such calls suspect. Rates can indeed go up and down, tracking the risks for inflation, growth, and unemployment. Overnight, the hope from a US/China trade deal continued as did the hope for the US avoiding another government shutdown. These offset some of the uglier economic stories – like Korea joblessness reaching back to 2000 levels, like Japan PPI dropping back to Jan 2017 lows, like UK PPI and CPI showing more deflationary impulses and like the Eurozone industrial production being even worse than expected. The urge to do something about clearly weaker global growth inputs wasn’t sufficient to sway the RBNZ and Riksbank today and that is what matters. Central bankers are indifferent to market moods and expectations. They are biconditional with their views and only as good as their tools. Then there is the role of politics as the power of monetary policy finds its limits under the fiscal constraints of government. The biggest overnight story maybe in Spain where the PM seems likely to announce a snap election as the 2019 budget proposal gets rejected by parliament. GBP remains mired with May’s Brexit deal or a long delay, gleefully ignoring CPI at 2-year lows. The Belgian national strike reminds many investors that Europe faces more difficult issues as pay demands rise even as growth stutters. The NZD spike today is the barometer to watch as it is in stark contrast to the moves for AUD last week after the RBA sounded distinctly dovish rather than neutral. The role of FX in reflecting bigger issues is very much in play today with the NZD trying to return to the January highs. Whether this happens or not maybe more a reflection on the rest of the world and its mood for running risks for a return to normalization, where the FOMC Powell put becomes a collar and where the S&P500 isn’t set for 2800 but 2600.

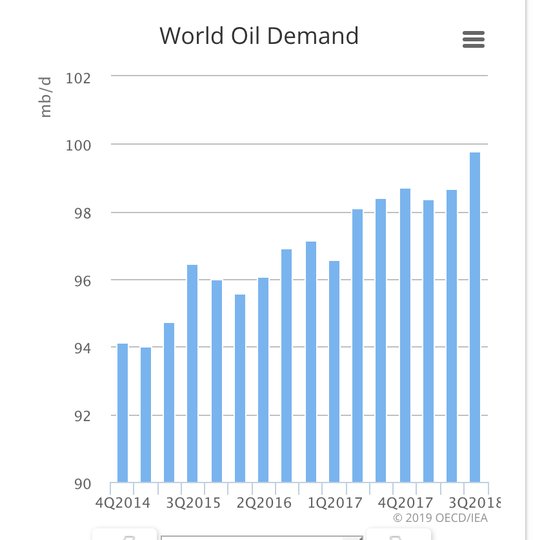

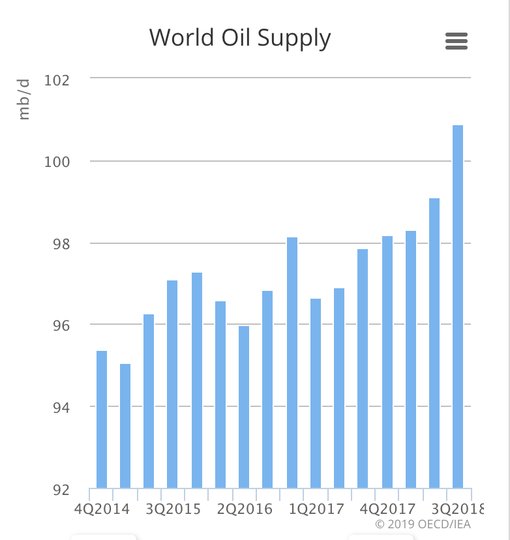

Question for the Day: Is there both a supply and demand problem in oil? The IEA report today follows the OPEC yesterday. The global oil market will struggle this year to absorb fast-growing crude supply from outside OPEC, even with the group’s production cuts and US sanctions on Venezuela and Iran. The IEA left its demand growth forecast for 2019 unchanged from its last report in January at 1.4 million barrels per day. “It is supported by lower prices and the start-up of petrochemical projects in China and the US. Slowing economic growth will, however, limit any upside,” the agency said. The IEA raised its estimate of growth in crude supply from outside the Organization of the Petroleum Exporting Countries to 1.8mn bpd in 2019, from 1.6mn bpd previously, while OPEC crude was cut to 30.7mn bpd down from 31.6m bpd.

Oil is bid up today less because of the OPEC or IEA reports and more because of the API weekly US inventory data that reportedly showed a decline of 998,000 barrels. The market was expecting a 2.5mb build – something that the US EIA report today will either confirm or reverse. The API gasoline stockpiles rose 0.746mb while distillates fell 2.5mb.

The differentiator for markets isn’t just about supply and demand equilibrium being found but the quality of the oil delivered. The impact of the US sanctions and the cost to refining from such matters. This is how the IEA sees it: ‘So far, there are no signs that other producers, e.g. Saudi Arabia, are intending to push more barrels into the market to offset shortfalls. Oil prices have not increased alarmingly because the market is still working off the surpluses built up in the second half of 2018, when global supply is estimated to have exceeded demand by 1.3 mb/d. In quantity terms, in 2019 the US alone will grow its crude oil production by more than Venezuela's current output. In quality terms, it is more complicated. Quality matters.’

What Happened?

- RBA Heath: Views on domestic economy shifted on weaker retail sales and consumption, which drove growth forecast cuts. Heath also said the bank was confident that the corner had been turned on wages and that growth would pick up over time. Such growth would help offset any drag on wealth from falling home prices.

- Australia February Westpac consumer confidence jumps 4.3% to 103.8 – better than 99.2 expected – rebounding from 4.7% drop in January. The survey's measure of economic conditions for the next 12 months climbed sharply (+7.0 points) to 103.0 (vs -7.8 percent in January), and the measure for the next five years advanced by 3.8 points to 100.2 (vs -5.9 percent). In contrast, the time to buy a major household item index edged up only 0.3 to 118.6. Meantime, both family finances subindices improved in February: vs a year ago by 5.6 points to 89.4 and next 12 months by 5.5 points to 107.8.

- RBNZ leaves cash rate unchanged at 1.75% - as expected – but remains neutral. The RBNZ sees rates unchanged until later 2020, with Governor Orr seeing risks for rates going “up or down.” The statement noted their forecasts on growth: Despite the weaker global impetus, we expect low-interest rates and government spending to support a pick-up in New Zealand’s GDP growth over 2019. Low-interest rates and continued employment growth should support household spending and business investment. Government spending on infrastructure and housing also supports domestic demand.

- Korea January unemployment jumps to 4.4% from 3.8% - weaker than 3.9% expected – the highest in 9-years. The number of jobless rose 159,000 to 1.225mn while the workforce rose 58,000 to 26.922mn. The labor force participation rate jumped to 63.5% from 63.0%.“There was some base effect from January last year when the one-month job increase rate temporarily soared,” said an official of the statistics office.

- Japan January PPI up -0.6% m/m, 0.6% y/y after 1.5% y/y – less than 1.1% y/y expected – lowest since Jan 2017. The weakness was mostly due to energy (gasoline and coal off -5.0% y/y vs 4.5% in December); chemicals (-1.7% vs 1.4%); non-ferrous metals (-7.4% vs -4.1%) and iron & steel inflation (3.4% vs 4.4%). In contrast, prices for textiles rose by 2.2% vs 1.6%.

- Sweden Riksbank keeps rates on hold at -0.25% - as expected – notes mixed signals. The central bank noted: “Growth abroad has slowed down, but economic activity will continue to be good over the next few years, with low unemployment and rising wage growth in many countries. There is still substantial uncertainty about the strength of the international economy. Although indicators point to sentiment in the household and corporate sectors having dampened in Sweden, the picture of strong economic activity remains. Developments on the labor market have been slightly stronger than expected and unemployment is at its lowest level in a decade. Both inflation and inflation expectations have become established at around 2 percent.”

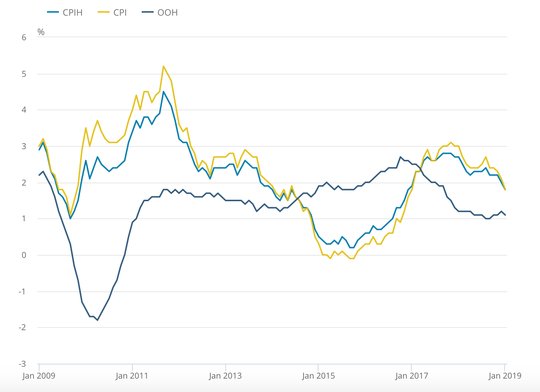

- UK January CPI fell 0.8% m/m, +1.8% y/y after 0.2% m/m, 2.1% y/y – lower than the -0.7% m/m, 1.9% y/y expected. The core CPI -0.8% m/m +1.9% y/y – holding steady. The RPI fell back to 2.5% from 2.7% y/y. The CPIH fell to 1.8% from 2.0% y/y. Housing costs lifted CPI while gas and electricity subtracted.

- UK January PPI output 0% m/m, +2.1% y/y after -0.3% m/m, 2.4% y/y – as expected. The core output PPI rose 0.4% m/m, 2.4% y/y same as December. The input PPI -0.1% m/m, up 2.9% y/y after -1.6% m/m, 3.2% y/y – more than the 3.9% y/y expected.

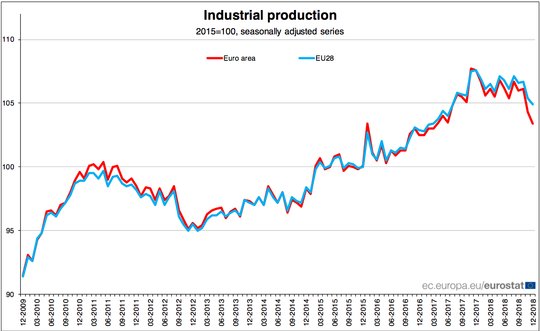

- Eurozone December industrial production -0.9% m/m, -4.2% y/y afer-1.7% m/m, -3% y/y – worse than the -0.4% m/m, -3.2% y/y expected. Capital goods fell 1.5% m/m, consumer goods -1.5% m/m and energy fell 0.4% m/m while intermediate goods were 0% and durable consumer goods up 0.7% m/m. The biggest monthly drops were in Ireland -13.4%, Malta -5.2% and the Netherlands -3.2%.

Market Recap:

Equities: The S&P500 futures are up 0.2% after a 1.29% gain. The Stoxx Europe 600 is up 0.4% while the MSCI Asia Pacific rose 1% again.

- Japan Nikkei up 1.34% to 21,144.48

- Korea Kospi up 0.50% to 2,201.48

- Hong Kong Hang Seng up 1.16% to 28,497.59

- China Shanghai Composite up 1.84% to 2.721.07

- Australia ASX off 0.14% to 6,140.20

- India NSE50 off 0.35% to 10,793.65

- UK FTSE so far up 0.6% to 7,175

- German DAX so far up 0.1% to 11,136

- French CAC40 so far up 0.25% to 5,068

- Italian FTSE so far up 0.65% to 19,934

Fixed Income: Risk on sentiment and less dovish central banks driving but with weaker data – fixed income is on holiday – German 10-year Bunds are flat at 0.13%, French OATs are off 1bps to 0.55%, UK Gilts flat at 1.19% while periphery rallies – Italy off 4bps to 2.80%, Spain off 1bps to 1.24%, Portugal off 5bps to 1.61% and Greece off 3bps to 5.91%. Sales in Germany and Italy go off without a hitch – though German 30Y 2.5% Bunds sold just E1.448bn at 0.72% with 0.97 cover before Bundesbank.

- US Bonds mixed with curve flatter despite risk-on – 2Y up 1bps to 2.51%, 5Y up 1bps to 2.50%, 10Y flat at 2.69%, 30Y flat at 3.02%.

- Japan JGBs see curve steeper post BOJ – 2Y off 1bps to -0.16%, 5Y flat at -0.15%, 10Y up 1bps to -0.01%, 30Y up 2bps to 0.62%.

- Australian bonds sold off in sympathy with RBNZ – 3Y up 3bps to 1.70%, 10Y up 4bps to 2.16% - note NZD 10Y up 8bps to 2.21%.

- China bond rally despite trade hopes – waiting for data – expecting more from PBOC – 2Y off 1bps to 2.63%, 5Y off 1bps to 2.86%, 10Y flat at 3.09%.

Foreign Exchange: The US dollar index up 0.05% to 96.76 – In EM, USD mixed - RUB up 0.2% to 65.725, ZAR off 0.8% to 13.872, INR off 0.4% to 70.795. KRW off 0.15% to 1122.10.

- EUR: 1.1320 flat. Range 1.1311-1.1342 with focus on 1.1250 against 1.1380 with rates and politics in play.

- JPY: 110.65 up 0.2%. Range 110.42-110.77 with EUR/JPY 125.25 up 0.1% - all about equities and focus on risk mood.

- GBP: 1.2910 up 0.15%. Range 1.2874-1.2959 with EUR/GBP off 0.25% to .8760– focus is on politics more than CPI or BOE with 1.28-1.30 holding.

- AUD:.7115 up 0.3%. Range 0.7092-.7136 with NZD the main driver as RBNZ sounds less dovish and NZD up 1.2% to .6815 watching .6880 and .6920 for breakouts.

- CAD:1.3240 flat. Range 1.3196-1.3241 with 1.3050 back in play – oil up and focus on BOC vs. FOMC rate bias.

- CHF: 1.0055 off 0.15%. Range 1.0044-1.0072 with EUR/CHF 1.1375 off 0.2% - caught with 1.1420 capping.

- CNY: 6.7620 off 0.2%. Range 6.75-6.7725 - Capital Inflows? The People's Bank of China (PBOC) set the yuan reference rate at 6.7675 vs the previous day's fix of 6.7765.

Commodities: Oil up, Gold flat, Copper up 0.4% to $2.7745

- Oil: $53.79 up 1.3%. Range $53.32-$53.89. Brent up 1.6% to $63.42 with API an EIA stats key today along with IEA/OPEC monthly – focus is on $54 resistance

- Gold: $1314.50 flat. Range $1312.80-$1317.60 withholding pattern continuing as USD and rates remain in range - $1305-$1325 keys. Silver off 0.15% to $15.67. Platinum up 0.25% to $7971.60. Palladium up 0.65% to $1384.30.

Economic Calendar:

- 0715 am Atlanta Fed Bostic speech

- 0830 am US Jan CPI (m/m) -0.1%p 0.1%e (y/y) 1.9%p 1.5%e /core 2.2%p 2.1%e

- 0850 am Cleveland Fed Mester speech

- 1030 am US weekly EIA oil inventories 1.263mb -0.5mb

- 0200 pm US Dec budget statement -$205bn p -$12bn e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.