No Bubble Here, Just BTFD, Kolanovic Reassures JPM Clients

With bank after bank after bank piling on with warnings that the market is due for a substantial setback to ease some of the retail euphoria (without realizing that said euphoria will merely shift to squeezing the most shorted stocks), Wall Street was in desperate need of some cheering up. Today, one of Wall Street's biggest permabulls, did just that when JPM's Marko Kolanovic urged investors to ignore warnings about a bubble - despite clear evidence of a bubble everywhere one looks - and to just buy the dip on any fallout from the feud between retail investors and hedge funds.

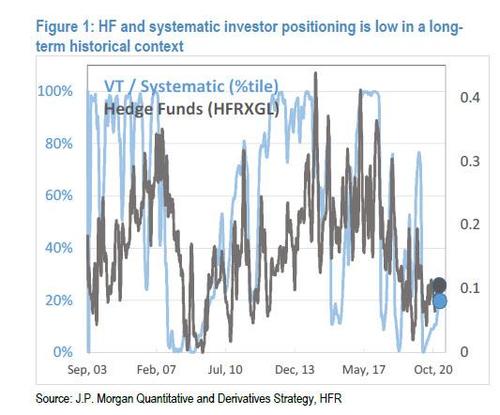

Conceding that we have "seen a number of strategists calling for a market correction or indicating equities are in a bubble" coupled with recent "turmoil related to trading activity in small highly shorted stocks" the JPM quant disagrees and said that professional investors are far from bullish, as the firm’s model tracking computer-driven strategies to stock-picking funds shows their equity positioning sat in the 30th percentile of a 15-year range (which, of course, is for a reason namely the fact that the VIX remains remarkably sticky and vol control strategies simply can not lever up to historical levels, but we don't expect Kolanovic to dwell too much on what's really going on if there is an agenda to be promoted).

According to the Croat, there are 3 main reasons for the firm's (perpetually) rosy outlook:

- equity positioning is low in a long-term historical context, and we expect it to increase;

- we expect the COVID-19 pandemic to rapidly subside at the back of vaccines and population immunity (already started to happen);

- we expect monetary and fiscal support to remain in place, driving consumption, global trade and demand for goods, and supporting higher inflation. In that light, any market pullback, such as one driven by repositioning by a segment of the long-short community (and related to stocks of insignificant size), is a buying opportunity, in our view.

"In that light", Kolanovic notes, "any market pullback, such as one driven by repositioning by a segment of the long-short community (and related to stocks of insignificant size), is a buying opportunity, in our view."

The JPM strategist then gives some more detail behind his three core views, starting with his view how funds apparently are not that bullish, despite today's mauling of the most popular hedge fund positions which are being dumped en masse ahead of upcoming anticipated liquidations to meet margin calls:

Positioning across risky asset classes, and in particular in equities and commodities, in a long-term historical context is low. Our analysis shows that equity positioning is in the 30th percentile relative to the past 15 years, both for systematic and discretionary managers. The reason for this is simple: market expectations of volatility and tail risk are still very high (e.g., as indicated by VIX, variance convexity, etc.), and historically that has been the main impediment for institutional buying of equities. Figure 1, below, shows the equity beta of global hedge funds as well as our model for equity exposure (percentile) of systematic investors – they are largely following (inverse) volatility, and currently there are no signs of exuberance in institutional equity positioning. Here, we also want to discuss the question that we often get: “how come data from prime broker xyz shows that exposure is high?” The reason is often combination of these factors: prime data tend to have a short history of 1-3 years (and in the context of the global pandemic and trade war/manufacturing recession of past 3 years, indeed net positioning is above average). However, 2021 should be a transformative year of COVID recovery, and looking at a 1-3 year history is not sufficient.

Ironically, in a day when stocks are tumbling and the VIX is soaring above 30, Kolanovic once again goes against the grain and expect the VIX to magically drop just because:

We expect the VIX to decline into the mid-to-high teens and positioning, accordingly, to increase from the ~30th to ~60th historical percentile. In fact, realized volatility has already declined significantly (S&P 500 realized volatility ~10 vs VIX ~25 is a near-record spread). Given the low levels of inflation over the past decade, global trade war, and recent pandemic, the exposure of investors to equities and inflation protecting assets such as commodities is also very low (as compared to pre-GFC era).

Of course, if the VIX does not decline but keeps rising, expect much more pain. Sadly, there was zero discussion of this eventuality in Marko's note.

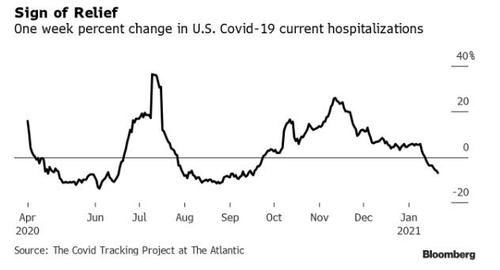

Moving on, the JPM strategist then focuses on the pandemic and clearly ignoring the warnings from the Harris-Fauci administration that mutant covid strains will take over the world, writes that he expects the global COVID pandemic "to decline rapidly in the coming weeks." Echoing what we said here last Friday, he then notes that "the pace of decline in new cases over the last 2 weeks is the highest on record both in the US and globally."

"What is driving this" Kolanovic asks rhetorically, and answers:

We believe it is the impact of a large number of cases over the past few months and the beginning of large-scale vaccination programs. For instance, in the US, the current vaccination pace is >1M per day, and new vaccines (J&J) are expected to be announced shortly. Given the estimation of natural immunity (cumulative cases), current pace of vaccination, as well as other considerations (e.g. the impact of warmer weather, variation in susceptibility here), we expect the pandemic to effectively end in Q2. In addition to the individual impact of the above drivers, there is also a positive feedback loop between them, which we think will lead to a rapid decline in hospitalizations and enable a fast reopening of economies this spring.

Kolanovic then correctly notes that the implications "for growth expectations, outperformance of equities over bonds, outperformance of value and cyclical assets over growth and defensive assets, and a new commodity bull market" are significant if he is right. The only question is whether the Harris-Fauci administration will allow him to be right, or will it keep lockdowns extended for the foreseeable future in hopes of getting even more stimulus from Congress/Powell. A big if.

Finally, Marko focuses on the source of the bubble itself - pardon, there is no bubble - the market move, Central Banks. He writes that they should "remain accommodative given the elevated unemployment levels and over a decade of low inflation running below their targets." He's right: central banks are trapped and they can never again tighten or else they will unleash the mother of all stock market crashes. It's also why the Fed recently revised its entire inflationary framework, effectively giving itself a greenlight to keep injecting $120BN per month in perpetuity even if home prices are surging by 10% annually.... as they are now.

Additionally, Marko writes that "fiscal support for individuals and businesses hurt by the pandemic will also likely continue and be a significant driver." Here he is right too, and much of said stimulus will end up in the most shorted stocks as we have now observed.

As a result, he summarizes that "the monetary and fiscal backdrop of 2021, along with the strong recovery from COVID-19 and relatively low positioning in risky assets, should be positive for stocks and commodities and negative for bonds." But wait, won't a spike in rates crush risk assets as Morgan Stanley has been warning for months? Apparently not, because by some magical shortcut, capital flows from bonds will mysteriously end up in stocks instead of money markets/offshore banks:

We believe Inflation will be an investment theme, reinforcing bonds to equities flows, and a continuation of the rally in value stocks and commodities, and steepening of the yield curve.

His conclusion: "short-term turmoil, such as the one this week, are opportunities to rotate from bonds to equities."

So all is great right? Nope, because even Kolanovic must realize how idiotic he would sound if he did not at least admit that there are "some" bubbles in a market that has become a slow motion trainwreck freakshow controlled by a bunch of teenagers.

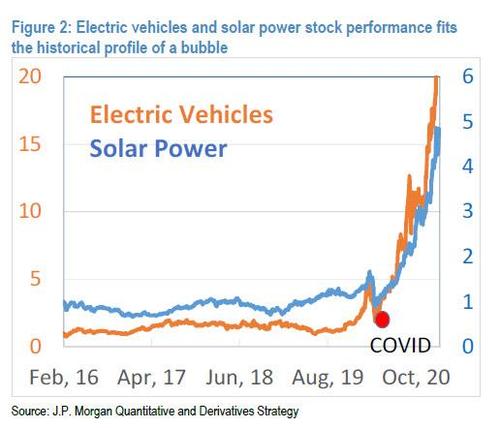

Sure enough, he then admits that while his view is positive, "we do acknowledge that some market segments are most likely in a bubble. This is a result of excessive speculation (including but not limited to retail investing) as well as perceived benefits for these segments from the COVID-19 pandemic and related political trends. Let’s first define some parameters of what could be considered a bubble."

It gets better: "we see some market segments that fit the bill of a speculative bubble: for instance Electric Vehicle stocks, which increased ~10 fold, or Solar Energy stocks, which increased ~5 fold in a year." And the hilarious punchline: "This price action occurred inexplicably at the onset of the COVID-19 pandemic."

Oh, "inexplicably"? It had nothing to do with... say... the $2.2 trillion CARES act? Or the Fed nationalizing the corporate bond market and injecting trillions into the market via repos and QE? Oh ok, then head JPM quant. Because we were confused.

What Marko is not confused about is how to trade this non-bubble: just go long everything, but short the bubble "market segments":

To hedge this risk, one can short the market segments that fit the profile of a bubble and go long value and cyclical stocks that are expected to benefit from the COVID recovery and reopening.

And so, after this distressing discussion of "bubbly market segments" Kolanovic reverts to his favorite "all is well" position - which may work with the bank's clients, but what we really wonder is what JPM's prop traders are doing here - he writes that "if one takes historical examples of the Nikkei in 1989, Nasdaq in 2000 or commodities in 2008, and several other bubbles in broad asset classes that appear to be quite similar – assets tend to quadruple (~300% return) in a period of ~3 years" - and yet, despite zero profit growth in the past 4 years, the Croat says that "if one looks at the performance of the S&P 500 over the last ~3 years, it is up a bit over 30%, and it would not fit the profile of a broad asset bubble." Actually the fact that stonks aren't down 40% - keeping "up" with earnings - and are instead up 30% is all one needs to know.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more