Next Week’s Economic Indicators - Friday, Jan. 4

This week saw a mix of manufacturing and labor data with results spanning from huge beats to horrible misses. While most manufacturing data saw sizeable misses, on the bright side, labor data had strong beats in the second half of the week. Dallas Fed Manufacturing Activity started the week on a sour note. As the last US release of 2018, it came in well below expectations and even further below the previous period at a meager –5.1. Markets took Tuesday off to celebrate New Years Day, and on Wednesday we came back to a better, but still weaker, manufacturing reading with the Markit Manufacturing purchase managers index seeing a drop of only 0.1. Thursday saw the ISM release of their manufacturing data which saw broad—but predictable given recent regional Fed indices—declines that far exceeded most forecasts. Despite weak manufacturing sector data in the first half of the week, some positive labor data helped to end the week on a high note. On Thursday ADP released their employment change data for December with a huge surprise to the upside showing 271K additional jobs created. The BLS’s Nonfarm Payrolls report (which typically moves in tandem with the ADP numbers) saw a nice surprise to the upside on Friday as well further reinforcing evidence of a strong labor market.

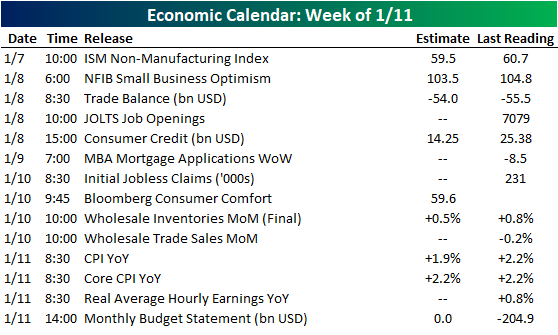

Despite being the first full week coming back from the holidays, next week will be a bit quieter. Whereas this week saw 19 releases, next week will only have 14; none of which will likely be major market movers like the manufacturing or NFP data we just saw. The only release on Monday will be the ISM Non-Manufacturing Index which, like its manufacturing counterpart, is expected to decline although it is also expected to remain at very strong levels. On Tuesday we get a variety of indicators including small business optimism, trade balance data, JOLTS job openings, and consumer credit. Mortgage applications will be the only release scheduled for Wednesday. Thursday will see weekly claims and consumer comfort data alongside wholesale inventories and sales for December. We cap off next week with CPI and the monthly budget statement which will surely be impacted by the government shutdown.

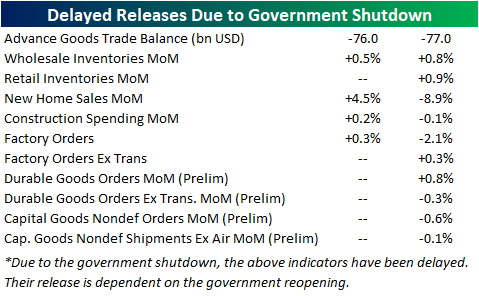

While on the topic of the shutdown, there are a number of indicators that were scheduled to release in the time since the shutdown began but have been postponed due to the closure of the agencies in charge of the data. Below is a list of these indicators. Their release is contingent on the government reopening.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more