New Stocks On Most Attractive And Most Dangerous Lists: June 2015

Recap from May Picks

Our Most Attractive Stocks (+2.5%) outperformed the S&P 500 (SPY) (+1.5%) last month. Most Attractive Large Cap stock Goodyear Tire & Rubber (GT) gained 16% and Most Attractive Small Cap stock Triple-S Management Corp (GTS) was up nearly 25%. Overall, 19 out of the 40 Most Attractive stocks outperformed the S&P 500 in May.

Our Most Dangerous Stocks (1.5%) rose slightly less than the S&P 500 (1.5%) last month. Most Dangerous Small Cap stock and 3/23/15 Danger Zone pick El Pollo Loco Holdings (LOCO) fell by 20% and Most Dangerous Large Cap Stock Manitowoc (MTW) fell by 2%. Overall, 20 out of the 40 Most Dangerous stocks outperformed the S&P 500 in May.

The successes of the Most Attractive and Most Dangerous stocks highlight the value of our forensic accounting. Being a true value investor is an increasingly difficult, if not impossible, task considering the amount of data contained in the ever-longer annual reports. By analyzing key details in these SEC filings, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

20 new stocks make our Most Attractive list this month and 21 new stocks fall onto the Most Dangerous list this month. June’s Most Attractive and Most Dangerous stocks were made available to members on June 3.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

Most Attractive Stock Feature for June: RPX Corporation (RPXC: ~$16/share)

RPX Corporation (RPXC), provider of patent management services, is one of the additions to our Most Attractive stocks for June. Despite RPX Corporation’s strong underlying fundamentals, the stock remains undervalued and has excellent upside.

RPX Corporation boasts a ROIC of 27%, placing it in the top quintile of all the companies we cover. Such a high ROIC is a great sign of the company’s ability to generate returns on the money being invested into the business. In addition to an excellent ROIC, RPX Corporation has grown its after-tax profit (NOPAT) by 7% compounded annually since 2011.

On a trailing-twelve month basis (TTM), RPX Corporation has grown its NOPAT by 31% while also increasing its ROIC over 2014 levels. The company increased its free cash flow to $44 million on a TTM basis, giving the company a 7.4% free cash flow yield.

Despite the growing patent litigation industry and RPX Corporation’s strong business fundamentals, the stock price is down 4% over the past year. This drop puts shares below their economic book value. At its current price of ~$16/share, RPXC has a price to economic book value ratio (PEBV) of 0.9, which means the market expects RPX Corporation’s NOPAT to permanently decline by 10%.

Those expectations seem rather pessimistic when considering RPX Corporation has grown NOPAT by 7 % compounded annually since 2011 and over 31% in the past twelve months.

If RPX Corporation can grow NOPAT by 8% compounded annually over the next six years, the stock is worth $20/share today – a 25% upside. Undervalued companies are increasingly harder to find. Investors should take a close look at RPXC.

Most Dangerous Stock Feature: Triumph Group, Inc. (TGI: ~$68/share)

Triumph Group, Inc. (TGI), an aerospace designer and manufacturer is one of the additions to our Most Dangerous stocks for June. The stock is dangerously overvalued considering the market has not yet priced in the company’s declining fundamentals.

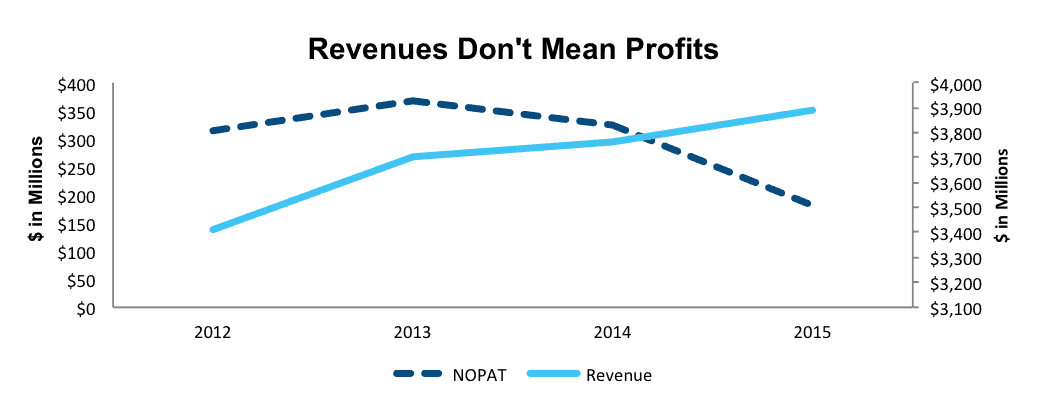

Despite increasing revenue at a 4% compounded annual rate since 2012, Triumph’s after-tax profit (NOPAT) has declined by 17% compounded annually. Narrowing pre-tax (NOPBT) margins, from 14% in 2012 to 7% in 2015, caused profits to drop precipitously even while revenues rose.

Figure 1: Rising Revenue Obscures Falling Profits

Sources: New Constructs, LLC and company filings

Not surprisingly, the company’s ROIC has fallen as well: from 8% in 2012 to a bottom-quintile 3% in 2015.

Forensic Accounting Reveals Overstated EPS

Triumph Group currently trades at a hefty price despite its deteriorating fundamentals. This disconnect between price and profits appears to be a result of too much reliance on reported earnings. After removing over $80 million in non-operating income from the income statement, largely from gains on legal settlements, we see that the true recurring cash flows of the business declined in 2015. This decline runs counter to revenue and the reported 15% increase in net income. Forensic accounting is increasingly needed to protect investors from accounting shenanigans.

Why TGI is Not a Stock to Consider Buying

Taking all the above into account, Triumph Group’s expensive valuation looks very risky. Our DCF models explain just how overvalued some stocks can be. To justify its current price of ~$68/share, Triumph Group must grow NOPAT by 7% compounded annually for the next 24 years. Considering that Triumph Group’s NOPAT has been decreasing for the past 5 years, betting on the company to reverse its declining profits and sustain new profit growth for such an extended period of time seems like a risky bet. Why take so much risk in TGI when you have an alternative like RPXC?

Disclosure: New Constructs staff receive no compensation to write about any specific stock, sector, or theme.