New Stocks Make Most Attractive/Dangerous Lists For August

Our Most Attractive and Most Dangerous stocks for August were made available to the public at midnight on Monday. July saw some strong performances from our picks. Most Attractive Large Cap stock PetSmart(PETM) gained 14%, and last month’s feature Neustar (NSR) was up 6%.

Our Most Dangerous Stocks (-5.9%) fell by more than the S&P 500 (-2.2%) and outperformed as a short portfolio. Most Dangerous Small Cap stock Real Page (RP) fell by 29%. In total, 12 out of the 40 Most Dangerous stocks last month fell by over 10%.

These successes underscore the benefit of our diligence. Being a true value investor is an increasingly difficult, if not impossible, task (see “Secrets to Annual Reports”). By scrupulously analyzing every word in annual reports, our research protects investors’ portfolios and allows our clients to execute value-investing strategies with more confidence and integrity.

10 new stocks make our Most Attractive list and 7 new stocks fall onto the Most Dangerous list this month.

Our Most Attractive stocks have high and rising return on invested capital (ROIC) and low price to economic book value ratios. Most Dangerous stocks have misleading earnings and long growth appreciation periods implied in their market valuations.

Most Attractive Stock Feature For July: NetApp (NTAP: ~$39/share)

NetApp (NTAP) is one of the additions to our Most Attractive stocks for August. Investors have soured on this stock over the past year as revenue growth has slowed. In its focus on the top line, the market seems to have missed the excellent cash flows and cheap valuation of this data storage provider.

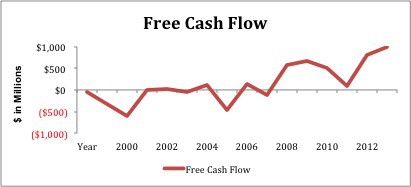

NTAP has done something really impressive over the past couple years. It has increased after-tax profit (NOPAT) while significantly reducing its invested capital. Figure 1 has the details.

Last year, NTAP earned an ROIC of 43%, the highest of any data storage company we cover. NTAP’s significantly improved gross margin—up from 59% to 62%–allowed it to grow NOPAT significantly even though revenue was flat for the year.

Since NTAP increased profits while decreasing invested capital in 2014, it also earned its highest free cash flow in the history of our model, which dates back to 1998. Figure 1 has the details.

Figure 1: Record Free Cash Flow

Sources: New Constructs, LLC and company filings.

NTAP generated nearly $1 billion in free cash flow, which allowed it to pay down over half of its debt and repurchase over 10% of its shares, which leaves existing shareholders with much greater equity.

Even after using all that cash, NTAP still has $4.7 billion in excess cash against only $1.2 billion in debt. NTAP’s cash position gives it the flexibility to invest in new growth opportunities or continue to buyback its undervalued stock.

Despite its improving profitability, the market seems to be focused on NTAP’s lack of revenue growth. At its current valuation of ~$39/share, NTAP has a price to economic book value (PEBV) ratio of just 1.1. This ratio implies that the market expects NTAP to grow NOPAT by no more than 10% from its current level for the remainder of its corporate life.

Those expectations seem too low. NTAP has grown NOPAT by 27% compounded annually over the past five years, and while I don’t expect that rapid profit growth to continue long-term, it also seems unlikely that profits will suddenly stagnate forever.

In a market as expensive as this one, it’s rare to find a company with a high and growing ROIC that trades as cheaply as NTAP.

Most Dangerous Stock Feature For July: ACI Worldwid (ACIW: $19/share)

ACI Worldwide (ACIW) is one of the additions to the Most Dangerous list this month. Acquisition driven earnings growth disguises the lack of true profitability of this business.

In six out of the past seven years, ACIW has earned negative economic earnings, which means its ROIC has been lower than its weighted average cost of capital (WACC).

Large acquisitions in 2012 and 2013 have increased reported earnings significantly (and sent the stock up over 100%), but economic earnings tell a different story. ACIW’s $600 million acquisition of S1 Corporation in 2012 helped it to achieve significant revenue and earnings growth, but ROIC actually fell from 11% to 7%. ACIW’s acquisitions may have been “earnings accretive”, but in reality they destroyed value for shareholders.

These acquisitions also have taken a toll on ACIW’s balance sheet. In 2011, the company had a positive net cash position, but now it has very little excess cash and over $800 million in debt (39% of market cap). It will be much more difficult for ACIW to fund any further growth opportunities, especially value-destroying acquisitions.

Unfortunately, ACIW needs to grow profits rapidly if it is going to maintain its lofty valuation. In order to justify its current valuation of ~$19/share, ACIW must grow NOPAT by 16% compounded annually for 14 years. Before ACIW’s big acquisitions in 2012 and 2013, it had only grown NOPAT by 8% compounded annually for the prior 8 years. It seems unlikely that ACIW will be able to double its long-term rate of profit growth going forward.

While NTAP offers investors positive and increasing economic earnings, ACIW only offers growth in accounting earnings. Investors who focus only on accounting earnings cannot assess the true profitability of these businesses.

Disclosure: NewConstructs staff receive no compensation to write about any specific stock, sector, or theme.