Never Reason From A Quantity Change

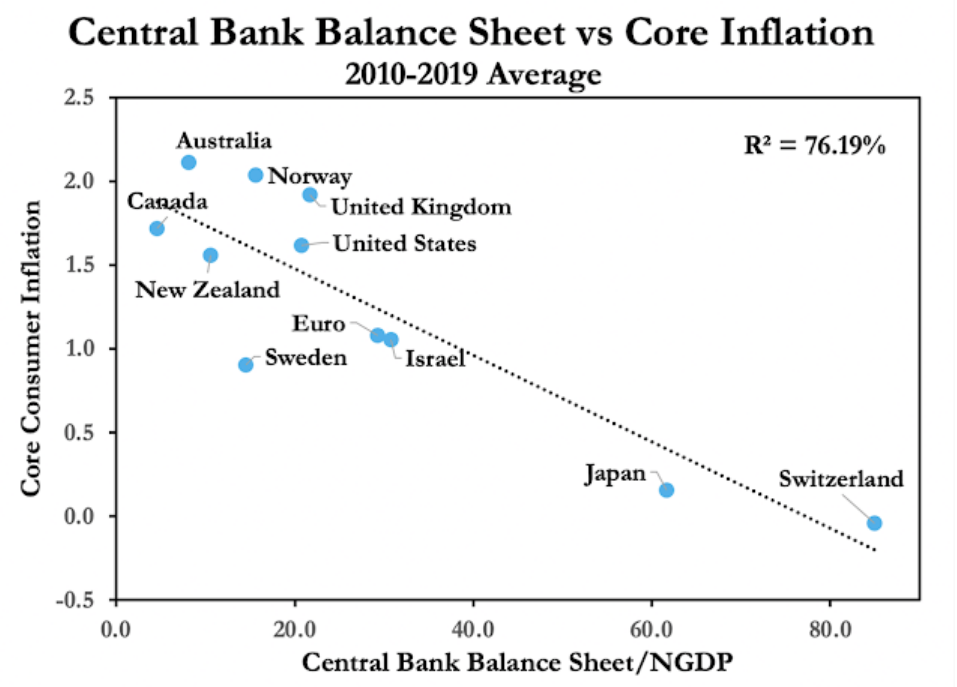

David Beckworth has a graph showing the relationship between inflation and the size of central bank balance sheets, as a share of GDP:

(You get roughly the same result with either NGDP growth or nominal interest rates on the vertical axis.)

So why is this line downward sloping? Shouldn’t printing lots of money lead to higher inflation?

Just as one should never reason from a price change, you also need to avoid reasoning from a quantity change. When expected inflation falls to extremely low levels, the opportunity cost of holding base money declines and the demand for base money rises sharply.

At this point the central bank faces a choice. They can do nothing, in which case you’ll end up with the sort of severe deflation that we saw in the early 1930s, or they can inject enough base money into the economy to keep prices roughly stable. The BOJ and the SNB decided to avoid severe deflation by accommodating the increased demand for base money.

People often ask whether QE “works”? That’s as nonsensical as asking whether lower interest rates work. It depends on whether the QE is temporary or permanent, and also whether the QE is creating excess cash balances, or merely accommodating an increased demand for base money. Similarly, it depends whether lower interest rates are caused by a tight money policy or an easy money policy.

What “works” is a level targeting regime combined with a whatever it takes commitment to increase the base (or decrease the base) enough so that market expectations of inflation equal the policy target.

Suppose I am wrong, and the graph above somehow proves that increasing the money supply doesn’t “work”. What then? Does that mean we should forget about the money supply and target interest rates? Not at all.

You could construct an alternative graph showing the relationship between inflation and nominal interest rates. That graph would have a positive correlation. And how should we interpret that positive correlation? Would it imply that lower interest rates lead to lower inflation?

If you think the graph above shows that QE doesn’t “work”, you’d be forced to conclude that reductions in interest rates also don’t “work”. But those economists who are skeptical of the efficacy of changes in the money supply are often big believers in the efficacy of changes in interest rates. Unfortunately, in the realm of macroeconomics most economists either reason from a price change or they reason from a quantity change.

The graph shown above merely reflects the fact that inflation is a proxy for the opportunity cost of holding money, and thus it’s merely telling us that demand curves slope downward. That’s not surprising!

The positive relationship between inflation and nominal interest rates reflects the Fisher effect, the fact that lenders and borrowers care about real interest rates. Because money is neutral in the long run, the nominal interest rate will tend to rise with inflation. That’s also not surprising.

Lots of things that seem strange from one perspective look perfectly normal if you avoid reasoning from a price change, or a quantity change.

PS. My favorite part of David’s post shows a graph comparing population growth rates and real interest rates. It seems clear to me that the global slowdown in population growth is one factor in the long run downward trend in real interest rates.