Negative Beige Book Signals Fed Will Be Dovish

Negative Beige Book

Fed’s Beige Book was released on Wednesday. It’s no surprise that the Fed has become more cautious about the economy. To be clear, the Beige Book doesn’t affect my own analysis on the economy and shouldn’t affect yours either. We follow this report to understand the Fed policy.

Fed’s analysis is usually late because the Fed is afraid to change policy too soon. However, being late isn’t ideal either. Being late isn’t an option for traders and investors because stocks often move ahead of the economy.

In this instance, stocks fell at the end of last year before the Fed acknowledged the economic slowdown.

Fed finally recognizing the slowdown helped boost stocks because it means the Fed will be more dovish. The Fed is moving in the right direction as the number of rate hikes it expects is shrinking. It’s common to hear various Fed officials claim the Fed could stop hiking rates altogether. That’s not exactly news...

Negative Beige Book - Fed funds futures market has been expecting zero rate hikes this year for a while.

The chart below shows the Fed’s use of the word tariff and anything with the word slow in it. As you can see, the usage of the word tariff has declined to only 20 times. It’s not as if tariffs aren’t still in play.

Fed probably stopped mentioning the term because new tariffs aren’t being enacted. The U.S. and China are in a 90-day negotiating window where no new tariffs can be enacted.

The bad news on the trade front is that on Wednesday the U.S. Justice Department announced it will pursue a criminal case against Huawei for trade secret theft relating to T-Mobile’s robotic device called “Tappy” which tests smartphones.

Anytime America acts against Huawei it strains its relationship with China. The chart also shows the use of the word slow in any form has increased from 43 to 65 which is the highest usage in at least the past 12 months. This supports my point that the Fed will be dovish at its next meeting on January 30th.

The 2nd chart below shows the Beige Book diffusion index. It measures the difference between the usage of the words weak and strong. As you can see, the index has fallen to the lowest level since at least November 2017. This is no surprise.

Economic growth is probably near the worst point during the 2015-2016 slowdown.

As you can see, the Fed was still optimistic in October even though the economy had already started to slow and the stock market had peaked. This optimism and hawkishness helped catalyze the 20% decline in the S&P 500.

Negative Beige Book - Oxford Economics Shutdown Estimate

Latest updates from the Atlanta Fed as of January 16th show Q4 GDP growth is still expected to be 2.8%. The change in the Import and Export price index didn’t move the needle enough affect the Nowcast.

Oxford Economics has come up with projections for how much the government shutdown will affect Q1 growth. It calculated GDP growth is impacted by $700 million per week which is 0.05%.

As you can see from the chart below, if the shutdown lasts until the end of January, growth will be hurt by 0.2%.

If it lasts through the end of Q1, growth will be hurt by 0.6%. Oxford Economics also mentioned that the longer the shutdown lasts, the larger the multiplier, so the impact could surpass 0.6%. I can’t see any way the government will allow workers to not get paid all quarter.

Government workers might decide to quit to get a job that actually pays them on time.

Keep in mind that the Q1 2019 GDP tracker isn’t accurate because there hasn’t been much economic data reported from January.

This estimated impact is half that of the anonymous source from the government. JP Morgan thinks it can be from 0.1% to 0.2% per week. During the government shutdown that lasted 16 days, GDP growth was hurt by 0.4%. Therefore, the Oxford Economics analysis could be too optimistic.

Negative Beige Book - Latest Fund Manager Positioning

The chart below shows the Bank of America Merrill Lynch fund manager survey where managers are asked about their positioning.

In the January survey, fund managers showed they added more to tech, emerging markets, commodities, and REITs. I think adding to commodities and emerging markets makes sense. Also, I think the dollar will fall and I think the Fed is done hiking rates.

Fund managers pulled back from American and Japanese stocks, bonds, and industrials. Selling industrials makes sense because the global economy is seeing a manufacturing slowdown. This was shown in the November European industrial production report and the December ISM manufacturing report.

Negative Beige Book - U.S. Dollar Is Overvalued

The American dollar is considered the most overcrowded trade by fund managers.

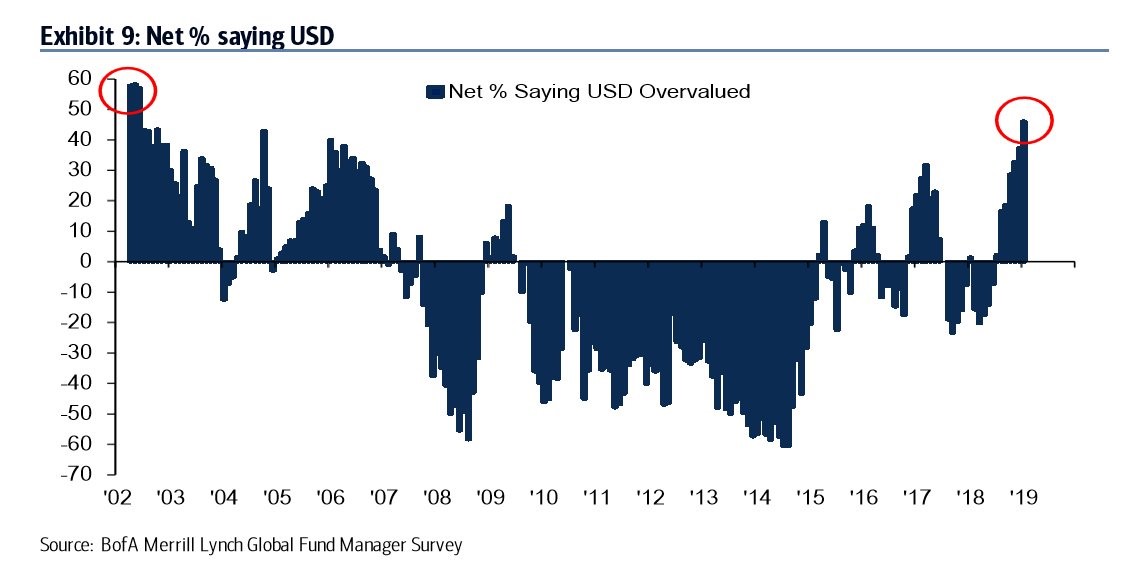

As you can see from the chart below, the net percentage of fund managers saying the dollar is overvalued is the highest since 2002. This survey has been accurate as the dollar was considered very undervalued in 2014 which was right before it went on a major bull run.

The dollar index went from about $80 to $97.

This survey was also correct in 2017 as the index peaked at $102 and fell to $90 in early 2018. A decline greater than that could occur this year because more fund managers are saying the dollar is overvalued than in 2017.

The biggest call this survey made was in 2002 when the dollar was considered overvalued by about 60% of managers. This index went from $113 in 2002 to $84 in 2008.

Negative Beige Book - Conclusion

Fed now expects growth to fall. This dovishness is bullish for stocks.

Unfortunately, the global slowdown should limit U.S. returns. I am currently bearish on the dollar and bullish on emerging markets and commodities. Merrill Lynch fund manager survey agrees with me on the dollar as the highest percentage of fund managers say the dollar is overvalued since 2002.

Back in 2002, the dollar had a major top where it fell from $113 to $84 over a 6 year period.