Need To Hedge Rate Risk?

By now it’s plainly evident that interest rates are in an uptrend. The yield on the 30-year Treasury bond has ticked up 62 basis points over the last 12 months, a 22 percent ascent. That hurt a lot of unhedged portfolios. And what of hedged assets? Well, some have fared better than others.

Now, nobody should hold on to a hedge indefinitely. Hedges tend to be costly, so they’re more effectively employed to buy time for realigning a portfolio to current market conditions. A hedge provides cover while assets are redeployed.

Institutional traders have long used forward sales and short futures to hedge long bond holdings. Certain accounts, however, can’t use margin. For these accounts, inverse bond ETFs may be a suitable substitute.

Inverse ETFs come with various gearings to suit an investor’s need and experience with leverage. The ProShares lineup, for example, includes three funds for hedging the long end of the Treasury curve.

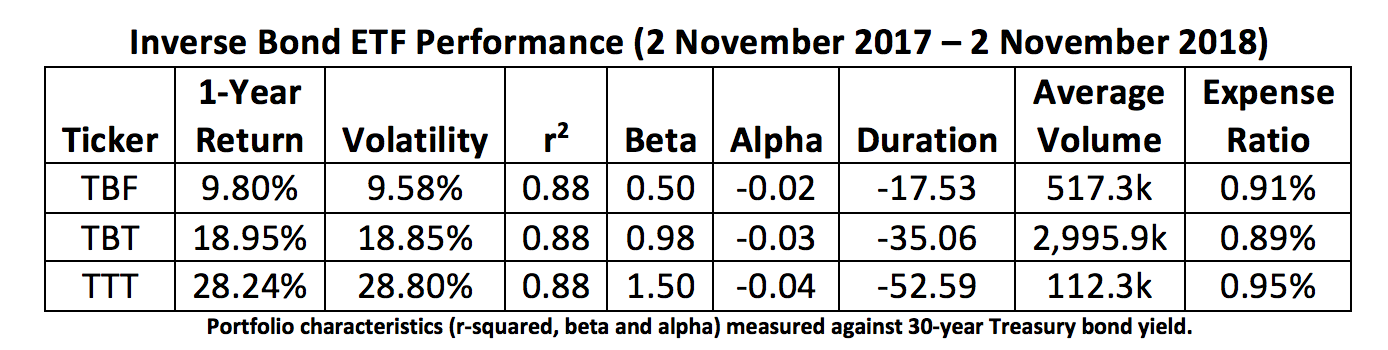

The ProShares Short 20+ Year Treasury ETF (NYSE Arca: TBF) uses futures and swaps in its attempt to match the daily returns of a short position in Treasurys with more than 20 years to maturity. The objective of the ProShares UltraShort 20+ Year Treasury ETF (NYSE Arca: TBT) is to provide twice the daily return of a short position in Treasury bonds. Yet more leverage – three times the daily short return – is sought by the ProShares UltraPro Short 20+ Treasury ETF (NYSE Arca: TTT).

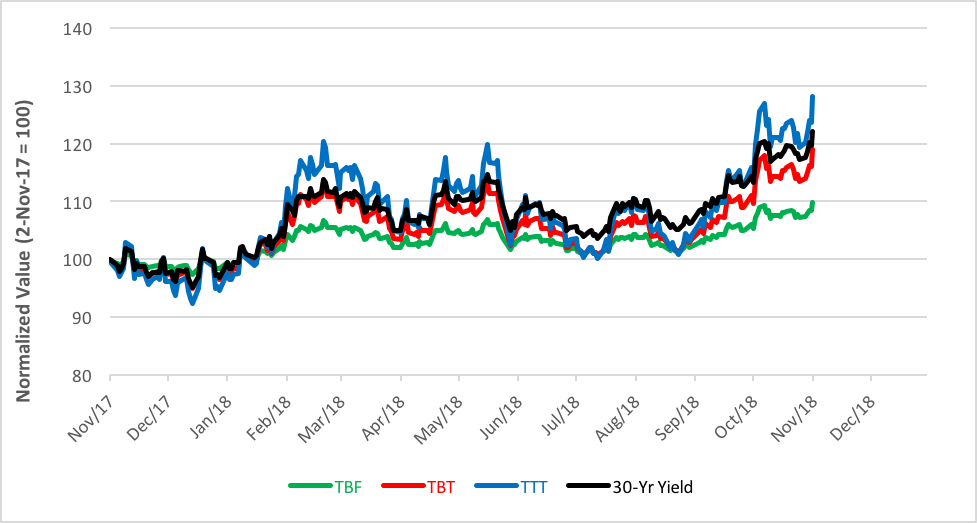

The return pattern for these funds is path dependent, meaning their daily resets could cause them to make more or less than their leverage factors would indicate over time. You can see how these funds fared over the past 12 months in the table below.

As you can see, the longer it takes you to unwind your bond position, the less reliable the hedge cover, especially as rate uncertainty builds. You can see how the ETFs’ tracking of the 30-year rate started diverging significantly in early February.

This divergence pattern has technical implications. All three of the ETFs have now broken to the upside of top formations, setting the stage for further double-digit gains. Chartwise, TBT is strongest with the mojo to rise as much as 24 percent from last Friday’s level. TBF could see a contemporaneous 11 percent gain while TTT has room on the upside for a 12 percent move.

In the end, TBT most closely tracks the performance of the 30-year rate, despite its 2x gearing. Hedge – or speculate – accordingly.

Disclosure: None.