Natural Gas Forecast: Ready To Rally Again

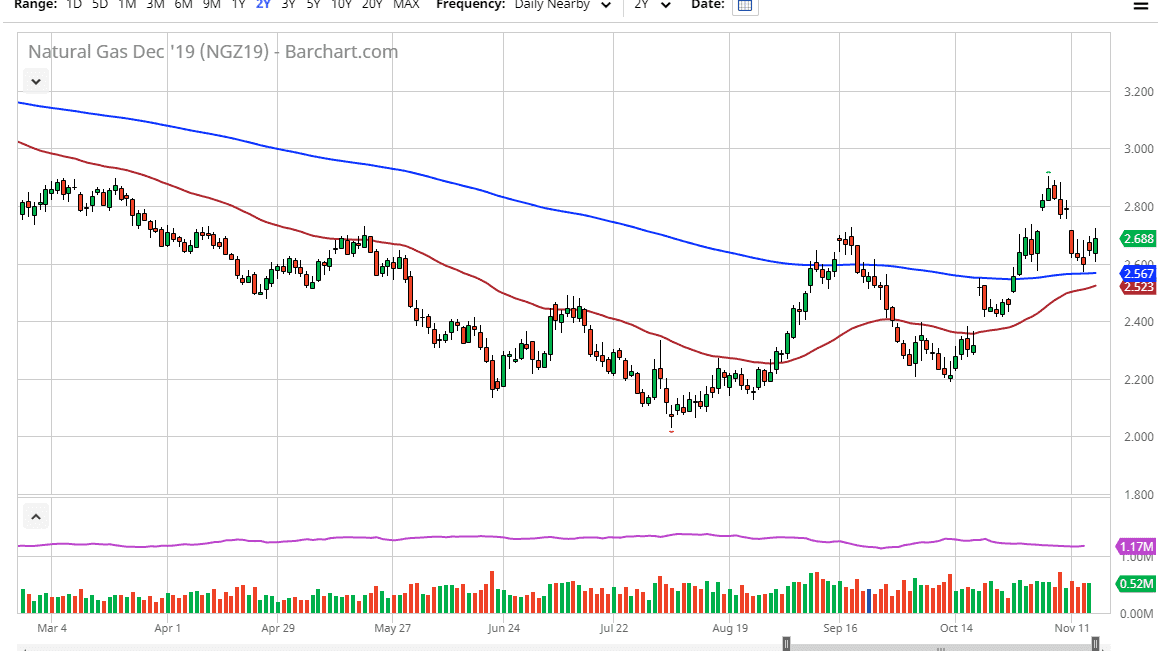

Natural gas markets have been all over the place during the trading session on Friday, initially gapping lower by just a bit and then drifting down to test the $2.60 level. However, later in the day we turned around and rallied and even spiked towards the gap from a couple of days ago although we weren’t able to break through it. Colder temperatures in the United States continue to be on the forefront of most traders' mindset, so it makes sense that natural gas would rally.

By the price action during the day, it shows that there is a lot of volatility coming, and as a result, you can expect a rather significant move somewhat soon in this market. That makes sense because typically this time a year there is a cyclical trend of buying as demand will pick up in places like Boston, Cleveland, Philadelphia, Washington DC, and so on. Natural gas is used extensively in the northeastern part of the United States that heat homes, and as temperatures plummet it makes sense that more of those homes will be using it. Local weather reports for most of these cities suggest that it’s going to stay cold longer than originally thought, and we haven’t even reached the peak of colder temperatures yet.

That being said, this is typically a cyclical trade and by the time we get to the middle of January, the sellers reappear as futures markets will start to focus on spring contracts. Between now and then though, I like the idea of buying short-term pullbacks as they offer a bit of value in which should be a relatively steady move. I believe that the 50 day EMA underneath that is starting to curl higher and reach towards the 200 day EMA has a lot to say about where we go next as well, so I do like the idea of buying dips. I think you can start to build up a core position and I would also point out that recently we have made “higher lows” and “higher highs.” Once we get the golden cross of the 50 day crossing the 200 day EMA, it will probably kick off more algorithmic trading and therefore send this market higher. I anticipate that the gap at the $2.75 level will get filled in broken through, and then eventually we will go looking towards the $3.00 level above and beyond. I have no interest in shorting natural gas.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more