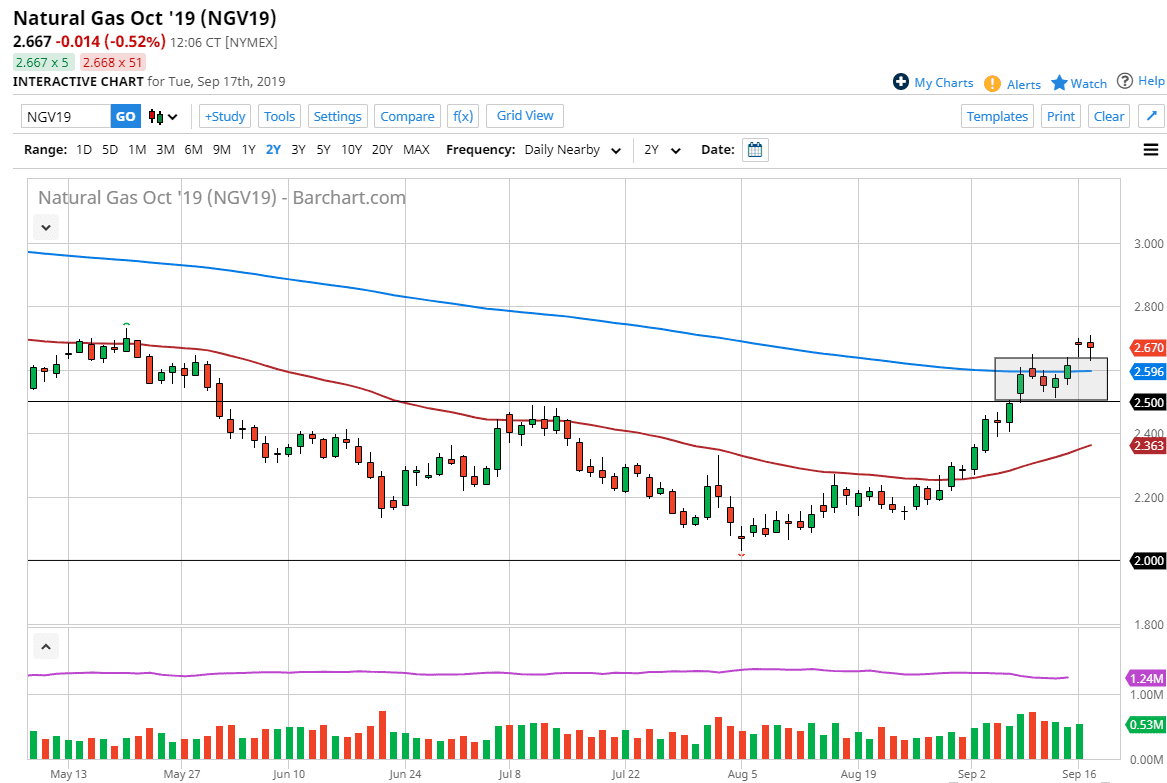

Natural Gas Forecast: Market Moving Higher

Natural gas markets fell a bit during the trading session on Tuesday, trying to fill the gap yet again. However, we have bounced nicely from the 200 day EMA and the top of the consolidation area that we had been in previously. Because of this, we ended up forming a bit of a hammer, and if we can break above the top of the hammer is likely that we could go higher, perhaps reaching towards the $3.00 level after that.

If we were to break down below the $2.50 level, then the market could unwind quite a bit, perhaps reaching down towards to the 50 day EMA. All things been equal though, the natural gas markets are very likely to go higher though based upon the bullish flag that has just been broken, perhaps reaching towards the $3.00 level. Looking at this chart, it’s obvious that we are starting the winter rush already, and at this point it’s likely that the dips are going to continue to be bought. At this point, if we were to break above the $3.00 level, then we will continue to go much further.

Ultimately though, the natural gas markets will continue to move right along with weather, as it gets colder, natural gas will go higher. Having said that though, we have also gotten a little bit of a boost due to the disruption to the petroleum markets, so ultimately the natural gas markets look as if they are primed for a big move. Even if we did break down from here, it would only be a matter of time before the market would get picked back up. It tends to move until we get to the middle of January, and I gives us an opportunity to place a longer-term trade. However, you should probably use very little in leverage, and therefore be able to hang onto a larger move. CFD markets might be a perfect outlet, unless of course you have a large enough account. This is a market that is very cyclical, and this is the time it shines, with longer-term traders jumping in now that we are well above the 200 day EMA. Expect volatility due to the issues with the petroleum market, but again this is a “buy on the dips” scenario, using sensible position size in leverage of course.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more