Natural Gas Economics: An Update

In my first energy economics textbook, ENERGY ECONOMICS: A MODERN INTRODUCTION (2000), the title of the chapter on natural gas was A Fuel of the Future: Natural Gas. The purpose of that chapter (and some of the remainder of the book) was to convince readers that when oil and coal were on the downward slopes of their cumulative production curves – i.e. annual output was declining –natural gas would still be going strong. My goal was to demonstrate some useful aspects of economics to students and others, and my arguments apparently made sense to many readers. Unfortunately, all of them no longer make sense to me.

In the book I often refer to as Energy Economics 101, David Goodstein – professor of thermodynamics at the California Institute of Technology – suggests that the beautiful natural gas future I had in mind, but did not specify in detail, is unlikely to last much past the middle of the present century, even though shale natural gas (and oil) have made a dramatic appearance in the United States (U.S.), and large shale reserves are to be found elsewhere.(This might also be the place to note that natural gas or oil ‘reserves’ are the amount of these resources that supposedly can be profitably extracted given current technological limitations.)

Professor Goodstein’s logic is quite clear, and similar to the hypothesis that I always offer students when discussing items like crude oil: even if the reserve-production ratio – (RESERVES/PRODUCTION) = (Q/q) –for natural gas in the U.S. is about 100 years, which is an estimate quoted by the President of the United States on a number of occasions, there are excellent reasons to doubt that the present annual output could be made available for an entire century.

Before looking at this and similar topics, a few commonplace items need to be mentioned. The CIA Fact-book tells me what I want to know about natural gas reserves, and can also tell you if you turn to their site. For instance, the leading countries where natural gas reserves are concerned are Russia, Iran, Qatar, the United States, Saudi Arabia, Turkistan, the United Arab Emirates, Venezuela, Nigeria and Algeria, in that order. Remember this when the conversation turns from football or fashion to energy, and do not ignore some of the oddball talk about the U.S. exporting large amounts of energy resources, even though at the present time that country is a significant importer ofnatural gas and oil.

The importing roster for natural gas runs as follows. Germany and Japan are at the top, followed by Italy, the U.K., South Korea, France, the U.S., Russia, Turkey, Spain, China, and a long list of less prominent importers. If you examine a list of natural gas exporters, you will note that many countries are both exporters and importers. Geography and price explain this phenomenon.

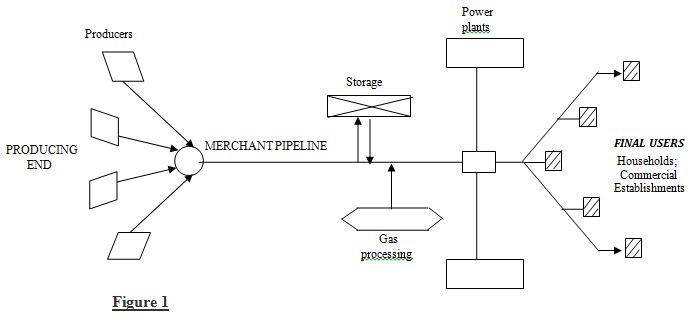

I have the impression that a number of subjects have not received the attention they deserve in the teaching of energy economics, but as I explained to students in my course on oil and natural gas economics at the Asian Institute of Technology (Bangkok, Thailand), certain things should be learned perfectly, and a few of those items are in this contribution. For instance, reproducing the following diagram is an exercise that students will encounter on many of my examinations.

Sadly, my skill with a computer goes no further than basics, because the block in the above diagram that says power plants should also indicate that that designation applies to the box of similar size directly below, and is intended to denote large consumers of natural gas (like power plants). At the producing end of this scheme the intention is to show gas from various ‘wells’ going into what are called (large) ‘merchant’ pipelines, and eventually – after perhaps some processing and storage – reaching large and small consumers. In addition it should be understood that there is a difference between the size of the merchant pipeline and smaller pipelines taking gas to homes and small businesses.

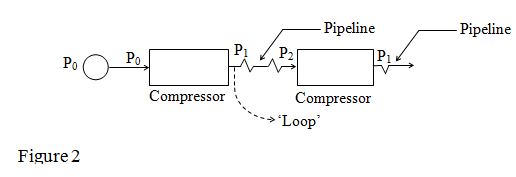

The exact nature of that difference is unknown to me, and I have never been sufficiently curious to alleviate this shortcoming, but such is not the case with the following diagram that deals with the gas transmission process. Here I can mention that most of my students at the Asian Institute of Technology were graduates in some branch of engineering, however a full comprehension of the next topic requires only some elementary economic theory, or the willingness to acquire a fraction of that background, especially the part outlined in the pages on production theory that you can find fairly early in a textbook on Economics 101.

As you might be aware, the first course in economics is composed of consumption and production theory, with the emphasis on the first. When I complained about this arrangement to Professor Paul Samuelsson, the first American winner of the Nobel Prize in economics, and probably the most respected American economist of the 20th Century, he informed me that anyone who had an intense preference forthelatter should study engineering.

That may or may not be good advice, but the opinion here is that the production theory taught in an introductory book like Lancaster (1974) should and does provide more than enough background to make it possible for readers to comprehend what comes in the remainder of this section, beginning with Figure 2.

In this figure the P’s are pressures, and we begin with gas coming out of the ground at a pressure of P0, and soon after going into the first compressor at about the same pressure, which is definitely possible, but is not always the case. It would not be likely if the compressor were some distance from the gas well, because inits passage to the first compressor, the gas loses some of its momentum as a result of friction in the pipe. In any event, continuing with the approach shown in the diagram,the compressor raises the pressure to P1, and in the next stretch of pipe it declines to P2, following which the compressor boosts it again to P1…and so on and so forth, assuming also that the pipe lengths are equal.

As for the loop in the diagram, its purpose is to raise the capacity of the pipeline, and sometimes looping is called “twinning”. Check GOOGLE on this!

In order to obtain a paper suitable for an economics as compared to an engineering journal (1949), Professor Hollis B. Chenery of Harvard University constructed a model emphasizing the diameter of a pipeline (with equal lengths between compressors),and the energy required to transmit the gas, where the latter is obtained from sophisticated equipment called compressors that transfer mechanical energy from e.g. the compressor’s motor to the gas that is to be transported. It is also the case that the gas could provide fuel for the compressor.

I discussed much of this in my natural gas book (1987), beginning with the implicit equation q = f(P,D), where P is pipeline pressure, and D is the pipeline’s diameter. Explicit forms of this equation can be quite complicated, and where engineering is concerned the thickness of the pipe and length of pipe between compressors has to be taken into consideration. Personally, my favorite pipeline is the 1,222 kilometers Nord Stream gas pipeline, which isoperated by a consortium led by Russia's Gazprom (OGZPY), and pumps 55 billion cubic meters of natural gas a year under the Baltic to Greifswald, Germany. If it were not available to fuel German generators, the electricity I consume would cost more, because Germany would increase its imports of electricity from many countries (to include Sweden).

Issues of the above sort are important for many reasons. For instance, in my work I reject the belief that globally there cannot be an oil or gas peak , although it will not arrive next month or next year. But as the brilliant researcher Gail Tverberg has noted (2014), some politicians in the U.S. insist on an expansion of oil and natural gas because of the unexpected appearance of technology that made possible the exploitation of very large amounts of shale resources. As noted earlier however, the fact that the U. S. is a significantimporter of natural gas (and oil) suggests that in the very long run the U.S. may not be as energy rich as some people believe, and given the expected future population of the country, and domestic energy requirements, energy exports should not be excessive.

Natural Gas Storage, Hubs And Market Centers

The natural gas production-consumption process begins withlifting gas from a ‘field’ or ‘deposit’, and as shown in Figure 1 proceeds to a large diameter transmission or ‘merchant’ pipeline, with perhaps a small amount gas siphoned off to ‘run’compressors.After that there might be some sort of processing and often a portion of the gas diverted into storage and/or sales to very large consumers such as manufacturing industries and power plants (i.e. generators of electricity). Eventually the gas goes into distribution systems where pipes are smaller, and via these pipes to ‘final consumers’ (e.g. households and small businesses). In Germany, there might still be many local distribution companies (LDCs), but since that country has no domestic gas production, they rely on major natural gas producers such as Holland, Norway and Russia.

Storage is another of those subjects which submits to an interesting theoretical treatment. On this occasion the exposition will be non-technical, although readers who want to impress others are advised to pay close attention to the terminology.Strangely enough, storage is almost completely ignored in microeconomics textbooks, despite its importance, because when storage is absent or insufficient,prices often tend to be extremely volatile. This is one reason why more storage facilities are being constructed in some countries.

The amount of natural gas in storage is a carefully observed statistic, particularly in the run-up to winter. Low storage levels mean to buyers and governments that palpable shortages of gas that may appear during the coming monthscould impact heavily on gas prices, as well as the availability (and price) of other fuels, such as heating oil, which is one of the fuels that substitutes for gas in various uses. Oftenthe strategy here reduces to buying natural gas when it is cheap and storing it. A short, easily read and valuable article on this subject is Lee Van Atta (2007), published on the siteEnergyPulse (www.energypulse.net). He mentions that the majority of present storage development in the U.S. have to do with salt caverns, while much of the rest is in depleted reservoirs.

Just as transport involves moving a commodity through space, storage performs a similar function with respect to time – ‘similar’ but not identical, because time runs in only one direction. By putting goods into inventory, we move from the present to the future at finite cost, but the option exists for returning all or a part of these goods to the present if it is deemed profitable.

This suggests that we have a consistency problem, in that at time ‘t’ we make a plan for t+1, t+2,…, t+x,…,t+N, where N is the terminal date, but it might happen that at e.g. t + x, we perceive that the decision taken at ‘t – y’ was sub-optimal. While conceivably we would have been happier if we had gotten things right in the first place, holding inventories might be judged an element in a strategy which takes into consideration the possibility of making and –if lucky –correcting expensive mistakes. This strategy not only features storing more or less of the commodity, but relying more heavily on such things as futures and forward markets. Naturally, obtaining increased flexibility generally involves a cost.

An important and accessible article on storage is that of Benoit Esnault (2003), although it contains one implication that I have some difficulty accepting. Namely, in a natural gas market deregulation is a logical precursor to a decrease in prices and improvement in service. Such was the theory when electric deregulation was adopted, but if it was true that the ultimate object of deregulation was to obtain lower prices, then I take enormous pleasure in noting that electric deregulation has failed, is failing, or will fail just about everywhere.

What we also have here – at least in some countries– isa nice example of an aspect of the consistency problem mentioned above. By that I mean the absence of a strategy for automatically reversing a sub-optimal venture (e.g. deregulation), and thereby mitigating the bad news that might unexpectedly appear.

A concept that is unique for storage is the convenience yield. This is explained in some detail in my first energy economics textbook (2000), but roughly it is the yield (i.e. gain) associated with greater flexibility that might devolve on the owners of inventories. For example, the availability of inventories permits output to be increased without incurring the expenses that are often unavoidable when it is necessary to resort to spot purchases in order to fulfill contract stipulations, or for that matter to purchase futures or options contracts at prices that are regarded as unfavorable.

The theory here is straightforward: an additional unit put into inventory can provide a sizable marginal convenience yield if inventories are small, while with very large inventories, the marginal convenience yield (associated with adding another unit) might be zero (although the convenience yield would still be positive and could be very large).Another way of viewing this is to say that having access to storage encourages the transfer of consumption from periods in which the value of a commodity is low to those periods when it is higher (e.g. peak periods).

In examining this issue, it can be argued that gas storage can not only moderate upward price movement, but also function as an excellent hedge against price and volume uncertainty. With natural gas – as with electricity – one of the key issues is peak demand. If a storage option is available, the exposition above indicates that gas is stored during off-peak periods and, if peak demand(or a ‘glitch’ of some sort in transmissionor distribution) jeopardizes the ability to deliver desired quantities to end users, then gas is removed from storage. (Electricity cannot be stored, and so this procedure cannot be employed, but peak demand is satisfied by holding some equipment idle during off-peak hours.) An expression that might appear here is ‘peak shaving’, which sometimes brings a frown to the faces of energy economics students, but it means no more than releasing gas from storage into a pipeline during periods of maximum demand (i.e. peak periods). Possessing this option might make investment in additional producing or transmission capacity unnecessary.

Quality can also be brought into the storage picture. Depleted reservoirs are often used, but withdrawal is relatively slow from these structures. Salt caverns are better and allow rapid injections and withdrawal, which as Van Atta (2007) points out makes them attractive for traders who want to “capture value from price volatility”. What this means is that when they have an opportunity to make some serious money, they do not want to be hindered by an inability to obtain the commodity that they are holding in storage and can be sold at premium prices.

Hubs are physical transfer points that are sometimes called ‘pipeline interchanges’. They make it possible to redirect gas from one pipeline into another. However, at the present time, I prefer not to accept a recent report which claimed that spotprices at Henry Hub, which is one of the largest and best know gas market hubs in the world (and is close to the Lake Charles (Louisiana) LNG terminal) have assumed the role of international reference prices. This kind of claim is sometimes tied to the belief that a large expansion in the trade of liquefied natural gas (LNG )will eventually lead to an international market that is capable of replacing regional markets of one type or another. In the very long run, this hypothetical international gas market would comprise – via uniform net prices – both pipeline gas and LNG.

Disclosure: None.