Nasdaq Up 73% Since March Low, Short Squeeze Helps – Bruised Tech Shorts Unfazed

It is easy to see why bears get tempted to short. Fundamentally, things are ugly. At the same time, the Federal Reserve has essentially backstopped stock prices. Shorts have gotten squeezed over and over. Bruised tech shorts are still not giving up.

To say that tech is on fire will be an understatement. Since the March 23rd low, the Nasdaq Composite (COMP) is up 73 percent – in mere five months!

The index has shown a tendency to rally, pause and then break out. From that trough, one after another resistance fell. The prior high from February was surpassed two and a half months ago, in early June.

A month ago, a rising trend line from March was breached, but before bears could build on this in earnest, bulls defended horizontal support at 10200s. Since then, the index (11466.47) has pretty much rallied along the underside of the broken trend line (Chart 1). This could also be viewed as a wedge breakdown, but, once again, bears have been unable to make much out of this. Arguably, they themselves are to blame.

For a while now, longs have consistently received help from zealous shorts, who look around and find plenty of reason to go short. Fundamentally, their bearish thesis is not out of whack. But they are also fighting a central bank – the Fed, that is – that is sold on the wealth effect and has essentially provided a backstop to equity prices.

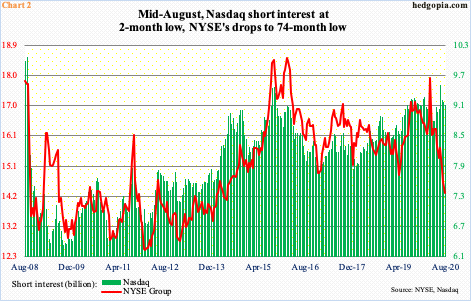

The result is a rolling short squeeze. By the end of June, Nasdaq short interest had risen to 9.51 billion, which was the highest since mid-September 2008. Shortly afterwards, as previously mentioned, bulls defended 10200s. Already-hurting shorts decided to step out of the way. By the middle of this month, short interest stood at 9.11 billion, which is a two-month low. In contrast, on the NYSE, short interest has fallen to a 74-month low (Chart 2).

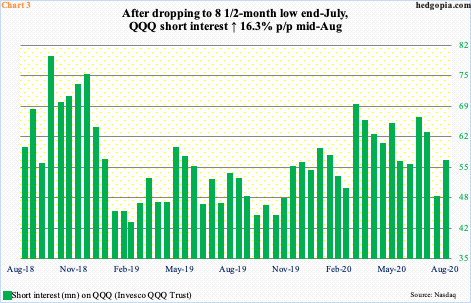

It is easy to get tempted to short the Nasdaq, or the Nasdaq 100, for that matter – if nothing else just because they have rallied so much in the past five months. The S&P 500 is trading 11.9 percent above its 200-day. In comparison, the Nasdaq Composite is 24 percent from the average, while the Nasdaq 100 is 26.9 percent away. Even within tech, the likes of Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG) and Facebook (FB) are doing the heavy lifting. Leadership is narrow, which encourages shorts to get aggressive.

Thus far, it has been a losing proposition. At the end of July, short interest on QQQ (Invesco QQQ Trust) fell to an eight-and-a-half-month low, as shorts got out of the way. The Nasdaq 100 has continued higher, with August-to-date up another 7.5 percent. By the middle of the month, QQQ shorts were adding – again (Chart 3).

At some point, shorts will have a field day – like the one that came their way during the February-March collapse in stocks – but unless tech bulls run out of momentum and the cycle reverses, a rise in short interest in due course only raises squeeze odds.

Thanks for reading!