Nasdaq Jumps To New Intraday High

Markets have jumped hard today on a variety of good news for equities. The Nasdaq has reached a level not seen since the dotcom boom of 2000 and both the S&P 500 and the Dow have also jumped up in early trading today.

Investors have reacted positively to the latest news from the Fed that the economy is firming up and while it is looking like rates are going up, the central bank is not quite ready to boost them just yet and may let the economy run a bit more before easing off the throttle.

Highlights from the Fed's latest FOMC meeting included the following:

Economic activity has been expanding moderately after having changed little during the first quarter. The pace of job gains picked up while the unemployment rate remained steady.

Market-based measures of inflation compensation remain low; survey-based measures of longer-term inflation expectations have remained stable.

The Committee expects that, with appropriate policy accommodation, economic activity will expand at a moderate pace, with labor market indicators continuing to move toward levels the Committee judges consistent with its dual mandate.

Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of earlier declines in energy and import prices dissipate.

The Committee today reaffirmed its view that the current 0 to 1/4 percent target range for the federal funds rate remains appropriate. In determining how long to maintain this target range, the Committee will assess progress--both realized and expected--toward its objectives of maximum employment and 2 percent inflation

The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

The Committee currently anticipates that, even after employment and inflation are near mandate-consistent levels, economic conditions may, for some time, warrant keeping the target federal funds rate below levels the Committee views as normal in the longer run. (emphasis added)

We thus see a Fed that is properly balancing inflation concerns with efforts to promote full employment. While it is often tough to read the tea leaves, here we have a clear restatement of the Fed's dual mandate (manage inflation and promote employment) and a clear indication that they are prepared to keep rates low until they are sure the labor market has properly recovered. Thus it appears as though equities will remain the only game in town for a while longer.

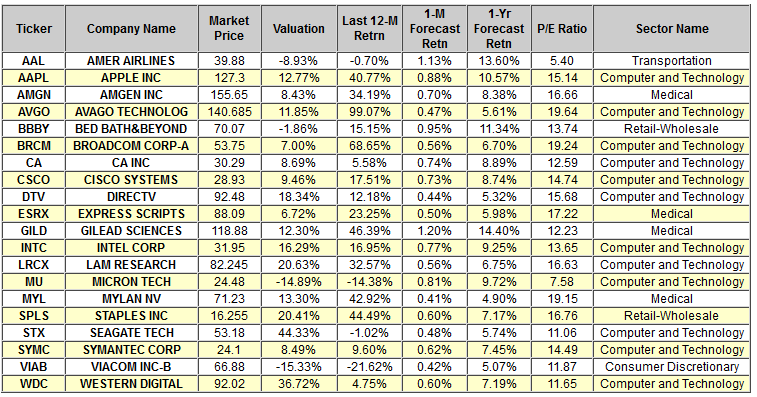

Below, we present the top-twenty stocks that trade on the NASDAQ 100. They were selected according to their one-year forecast figures. Members can always screen for these stocks using our advanced screening page HERE.

Read our Complete Detailed Valuation Report on Gilead Sciences HERE.

Below is today's data on GILD:

Gilead Sciences, Inc. (GILD) is an independent biopharmaceutical company that seeks to provide accelerated solutions for patients and the people who care for them. They have a broad-based focus on developing and marketing drugs to treat patients with infectious diseases, including viral infections, fungal infections and bacterial infections, and a specialized focus on cancer. They have expertise in liposomal drug delivery technology, a technology that the company uses to develop drugs that are safer, easier for patients to tolerate and more effective.

The company is currently ranked at the top in the NASDAQ 100 based on one-year forecast return. Biotech firms like Gilead have been leading the NASDAQ rally today and helped set the new intraday high.

VALUENGINE RECOMMENDATION: ValuEngine continues its STRONG BUY recommendation on GILEAD SCIENCES for 2015-06-17. Based on the information we have gathered and our resulting research, we feel that GILEAD SCIENCES has the probability to OUTPERFORM average market performance for the next year. The company exhibits ATTRACTIVE Company Size and Sharpe Ratio.

|

ValuEngine Forecast |

||

|

Target |

Expected |

|

|---|---|---|

|

1-Month |

120.30 | 1.20% |

|

3-Month |

121.53 | 2.23% |

|

6-Month |

125.47 | 5.55% |

|

1-Year |

136.00 | 14.40% |

|

2-Year |

136.42 | 14.75% |

|

3-Year |

85.91 | -27.73% |

|

Valuation & Rankings |

|||

|

Valuation |

12.30% overvalued |

Valuation Rank |

|

|

1-M Forecast Return |

1.20% |

1-M Forecast Return Rank |

|

|

12-M Return |

46.39% |

Momentum Rank |

|

|

Sharpe Ratio |

1.44 |

Sharpe Ratio Rank |

|

|

5-Y Avg Annual Return |

36.66% |

5-Y Avg Annual Rtn Rank |

|

|

Volatility |

25.52% |

Volatility Rank |

|

|

Expected EPS Growth |

10.01% |

EPS Growth Rank |

|

|

Market Cap (billions) |

179.35 |

Size Rank |

|

|

Trailing P/E Ratio |

12.23 |

Trailing P/E Rank |

|

|

Forward P/E Ratio |

11.12 |

Forward P/E Ratio Rank |

|

|

PEG Ratio |

1.22 |

PEG Ratio Rank |

|

|

Price/Sales |

6.53 |

Price/Sales Rank |

|

|

Market/Book |

32.32 |

Market/Book Rank |

|

|

Beta |

0.72 |

Beta Rank |

|

|

Alpha |

0.26 |

Alpha Rank |

|

VALUATION WATCH: Overvalued stocks now make up 63.55% of our stocks assigned a valuation and 26.77% of those equities are calculated to be overvalued by 20% or more. ALL sectors are calculated to be overvalued--with eight at or near double digits.

|

VE View vs. S&P 500 Index Past Five Years |

||

|

VE View |

S&P 500 |

|

|---|---|---|

|

Ann Return |

19.75% | 14.13% |

|

Ann Volatility |

21.06% | 11.13% |

|

Sharpe Ratio |

0.94 | 1.27 |

|

Sortino Ratio |

1.55 | 1.56 |

|

Max Drawdown |

-34.94% | -11.14% |

ValuEngine Market Overview

|

Summary of VE Stock Universe |

|

|

Stocks Undervalued |

36.45% |

|

Stocks Overvalued |

63.55% |

|

Stocks Undervalued by 20% |

12.73% |

|

Stocks Overvalued by 20% |

26.77% |

ValuEngine Sector Overview

|

Sector |

Change |

MTD |

YTD |

Valuation |

Last 12-MReturn |

P/E Ratio |

|

-0.47% |

1.24% |

14.25% |

21.20% overvalued |

14.80% |

30.19 |

|

|

0.05% |

0.59% |

5.69% |

18.58% overvalued |

-4.43% |

21.81 |

|

|

-0.32% |

0.52% |

8.00% |

15.06% overvalued |

6.94% |

31.17 |

|

|

-0.16% |

1.60% |

5.45% |

14.64% overvalued |

4.11% |

24.50 |

|

|

-0.50% |

-0.74% |

2.85% |

13.00% overvalued |

0.70% |

22.47 |

|

|

0.07% |

0.10% |

1.55% |

12.99% overvalued |

7.73% |

26.22 |

|

|

-0.07% |

1.03% |

5.37% |

11.64% overvalued |

1.30% |

24.36 |

|

|

-0.01% |

0.66% |

9.42% |

10.93% overvalued |

1.19% |

27.73 |

|

|

0.02% |

1.09% |

4.34% |

7.58% overvalued |

3.08% |

17.69 |

|

|

-0.78% |

-1.12% |

-0.54% |

7.00% overvalued |

-34.63% |

24.54 |

|

|

-0.22% |

-0.34% |

4.44% |

5.46% overvalued |

-4.76% |

16.86 |

|

|

-0.44% |

0.47% |

4.34% |

4.95% overvalued |

-4.32% |

20.60 |

|

|

-0.15% |

-0.16% |

1.06% |

4.07% overvalued |

0.72% |

18.46 |

|

|

-0.03% |

0.75% |

3.03% |

2.43% overvalued |

0.93% |

24.58 |

|

|

-0.26% |

-0.09% |

1.72% |

2.38% overvalued |

-14.40% |

24.24 |

|

|

-0.47% |

-0.79% |

1.44% |

2.15% overvalued |

-5.66% |

21.91 |

Disclosure: None.

ValuEngine subscribers can easily check out all of our top-rated STRONG BUY stocks with our "5-Engine ...

more