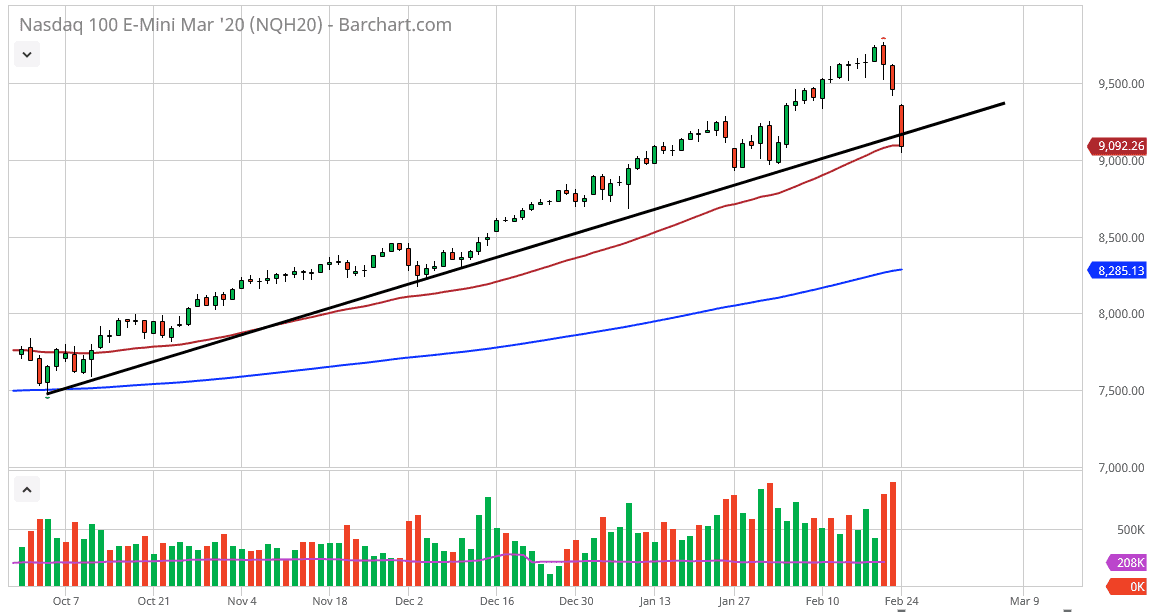

Nasdaq 100: To Test The 50 Day EMA

The Nasdaq 100 has broken down significantly during the trading session on Monday, gapping lower which of course is a very negative sign. Ultimately, this does suggest that we could see a little bit more negativity, but it is worth noting that the market has stopped right at the 50 day EMA, so that’s probably the best thing that you can say about the bullish case. At this point, the market looks like it could go lower though, and the 9000 level underneath should be thought of as a bit of a floor. If they were to push this market below there, then it’s very likely that the market could go down to the 8500 level.

The 200 day EMA underneath is looking to get to that area as well, and as a result it will be an interesting place to see what happens next. The Nasdaq 100 has gotten crushed during the trading session, losing 4%. The world has seen a lot of selling due to the fact that the coronavirus continues to expand its footprint, and the 4% loss in the Nasdaq 100 was very similar to several other markets around the world, as we had seen the DAX lose the same. The candlestick closed towards the very bottom of the range for the day, which of course is a very negative sign and typically means that there will be some type of continuation.

This doesn’t mean that we can’t turn around and reach towards the gap above, which should be massive resistance. The market rallying at this point will probably look at that as a viable target, but I think there is enough resistance in that region to push this market right back down. If we were to turn around a break above the gap from the early Monday session, that is obviously a very bullish sign. All things being equal though I believe that the market is likely to continue selling off, lease for the next couple of days. I don’t think that this is some type of massive change to the markets longer-term, but it clearly is the beginning of something that could be somewhat nasty. This is all about headlines coming out about the coronavirus, so pay attention to those headlines and numbers coming from various countries around the world. Obviously, we are in a very “risk-off” type of situation right now.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more