Nasdaq 100 To Find Buyers At 8000

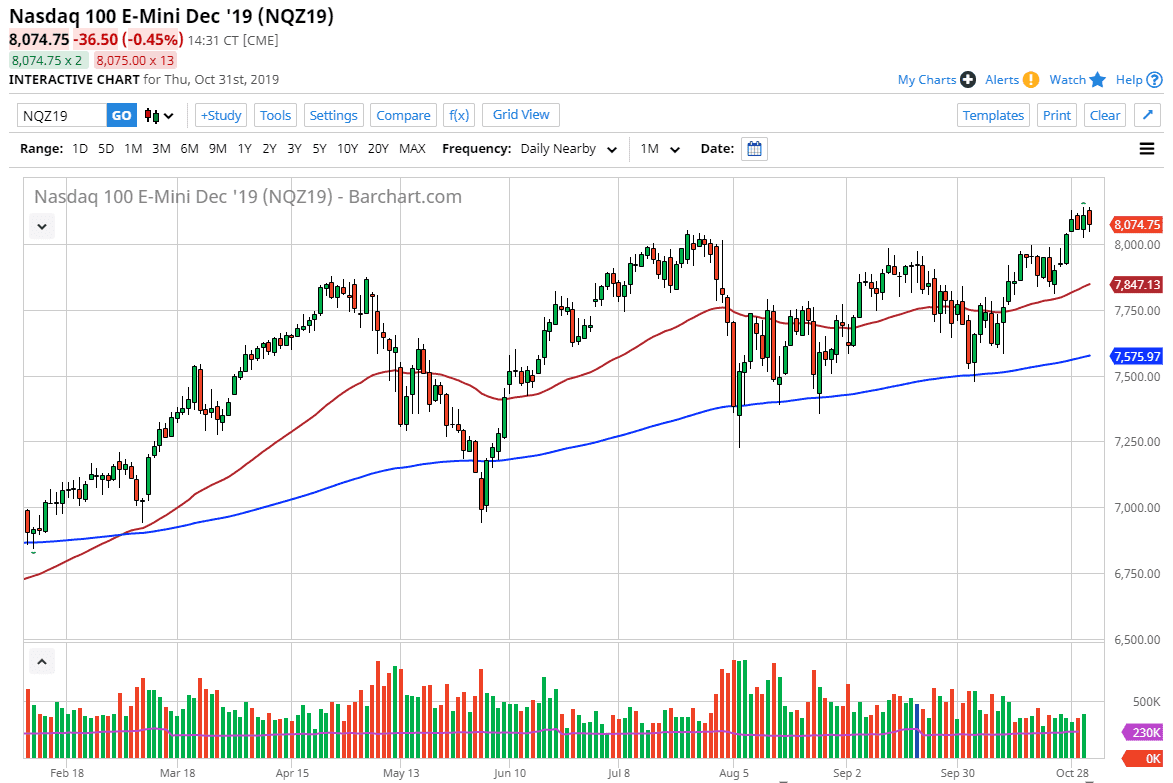

The Nasdaq 100 fell during the trading session on Thursday, giving back most of the gains during the previous session on Wednesday after the FOMC statement. This being the case, the market looks very likely to see a bit of value hunting as there was a surge higher later in the day on Wednesday that should continue to see volume in this general vicinity. The psychologically and structural support level at the 8000 handle as a parent at this point, and therefore it’s very likely that the buyers will be interested in this area.

Looking at the chart, breaking above the 8000 handle was a significant move, and therefore it should show a continued bullish pressure to the upside and a continuation of the longer-term uptrend. The 50 day EMA is below at the 7850 handle, and at that point I would expect to see a lot of buying pressure as well. When you look at the chart, it is obviously in a bullish trend, so I don’t want to fight this type of momentum and stubborn tenacity. That being said, the jobs number is coming out and that could cause a bit of volatility. Regardless though, this one data point won’t necessarily change the entirety of the trend, so I think that if we get a knee-jerk reaction to the downside it should be thought of as value. At this point, the market would more than likely attract a lot of value hunters.

We could have seen a little bit of a negative reaction to the United States and China struggling to find a place to sign the deal. Beyond that, the Chinese don’t look as likely to bend on some of the more important issues, that could continue to cause a bit of a negative reaction here. Remember, the Nasdaq 100 is highly sensitive to the US/China trade situation as the major companies on the Nasdaq 100 are highly exposed to both economies. That being said, we are still very much in an uptrend and should not be traded against when you see this type of mounting upward momentum. I like the idea of buying short-term pullbacks, as this market continues to offer several opportunities. These opportunities will continue to present themselves short-term pullbacks, where people will want to join in what has been an obvious break out of the last several sessions.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more