Nasdaq 100 Forecast: Market Ready To Make Fresh Highs Again

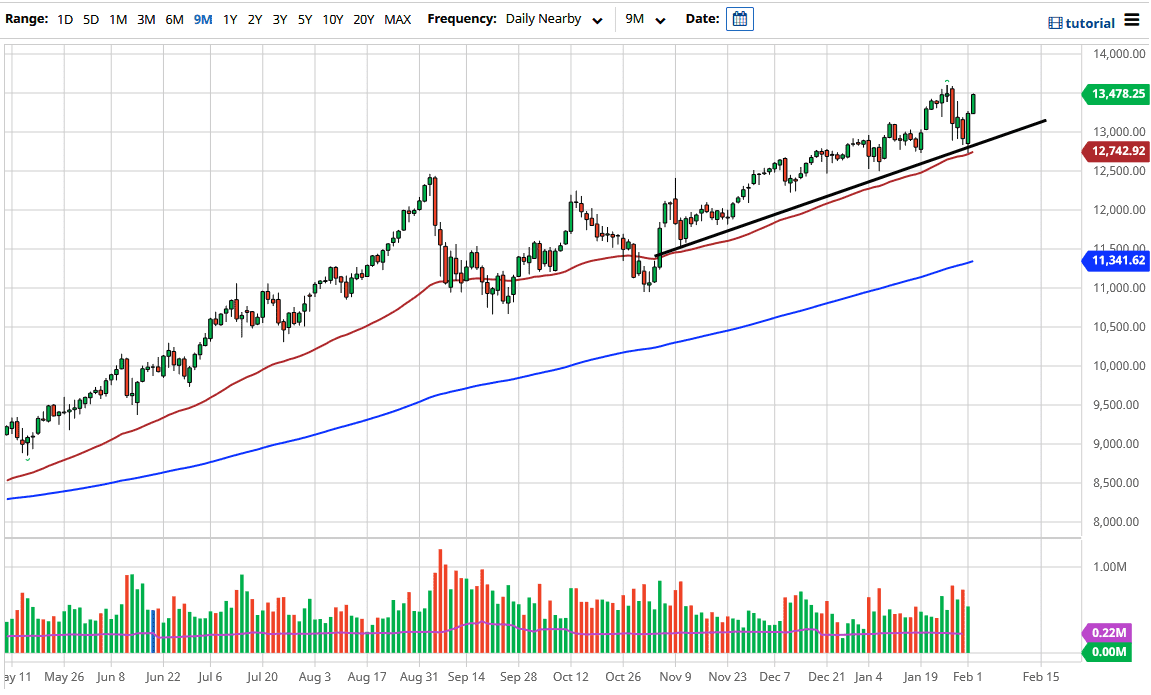

The Nasdaq 100 rallied a bit during the trading session on Tuesday to reach towards the 13,500 level again. That is an area that had been resistance previously and an area from which we have pulled back. If we can break above there, then the market is ready to continue the overall long-term uptrend to reach towards the 15,000 level.

Furthermore, you need to keep in mind that the market is currently going through earnings season, so we could get the occasional shakeout. I do think that a pullback from here offers a buying opportunity to take advantage of what has been a longer-term trend. The liquidity out there will continue to push money into the same stocks, and it should be noted that Amazon has earnings overnight. But at this point, even if it were to push the Nasdaq 100 (NDX) down, it is likely that we are going to see buyers close to the 13,000 level, as it is not only a large, round, psychologically significant figure, but also where we see a nice uptrend line. Beyond that, the 50-day EMA is underneath, and it should continue to push higher.

I have no interest whatsoever in selling this index, because the US indices are over-weighted in a handful of companies that everybody on Wall Street continues to buy. In other words, you simply cannot try to fight the Nasdaq 100 or the S&P 500 (SPX) because everybody is engaged in “groupthink” as they always have been. We are in the midst of a bubble, and I think everybody understands this. Trying to step in front of the Nasdaq 100 and short it would be akin to stepping in front of a runaway train. In other words, you can either go with the trend or you can fight it. If you fight it, you are going to lose money and eventually blow up your account. If the market drops 20%, then you go looking for a buying opportunity eventually. 15,000 is more likely to be seen in the short term than 12,000.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more