Nasdaq 100 Forecast: Likely To Continue Seeing Volatility As Trump Suggest Action

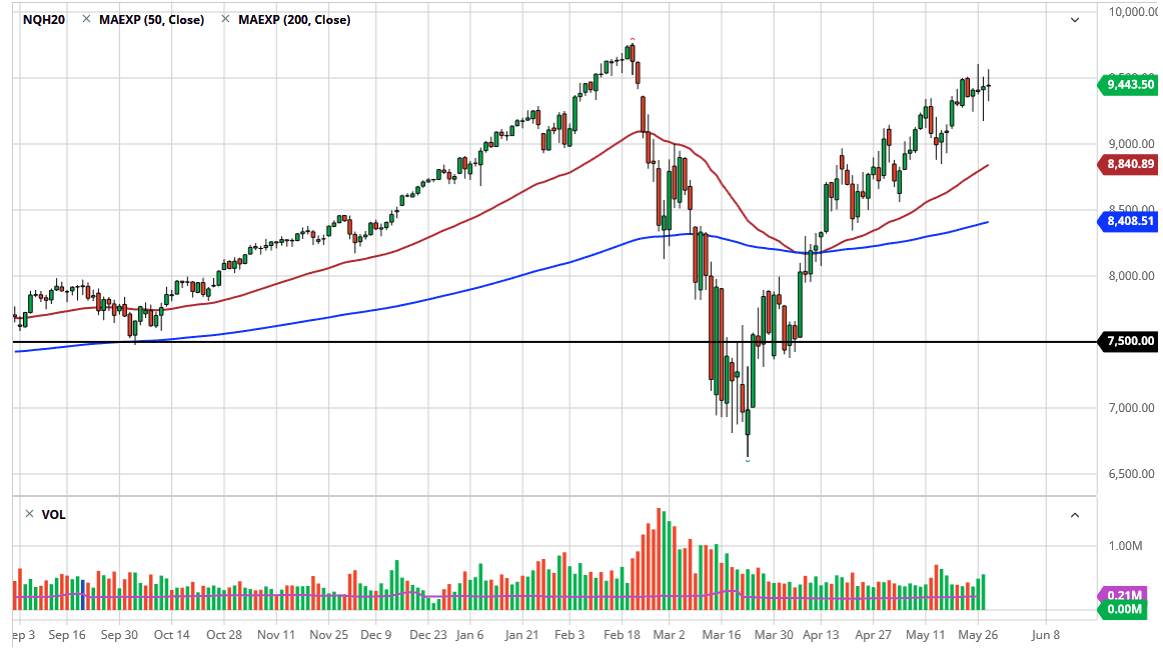

Donald Trump is signing an executive order looking into policing the social media companies in the United States, and while it may or may not actually produce anything of purpose, the reality is that it did shake the Nasdaq 100 a bit. Furthermore, he also has a news conference on Friday when it comes to the US/China situation, and then of course has a major effect on technology as well. In other words, this is a market that is running into trouble at the wrong time as we are sitting in the gap that had been filled but have not been able to break out from here. With this, the question then becomes whether or not we continue to see noisy behavior, or if we finally make a decision. If we can break down below the hammer from the Wednesday session, that would be an extraordinarily negative sign and send this market towards the 50 day EMA.

On the other hand, if we were to break above the highs from the Tuesday session, then we could continue to go higher, perhaps reaching towards the all-time highs again. This will be based upon a daily close, and not intraday as intraday is not as reliable. Quite frankly, with as volatile as the markets have been, you need to see a close in order to make some type of serious decision.

Remember though, the “Wall Street darlings” make up most of this index, so you cannot think that it is going to fall extremely far. Quite frankly, the Nasdaq 100 only falls apart when the entire market falls apart. In other words, if we do start seeing this market break down, I would probably be quicker to reach over towards the Russell 2000 and start shorting, or perhaps the Dow Jones Industrial Average, or even the S&P 500. If we start to see a lot of bullish action in the stock market’s overall, then this will probably be the place to be. However, going into the weekend and concerns about the US/China situation could cause major issues during the day. Quite frankly, be careful as the market is overextended, but then again so is anything else that has any type of risk premium. It seems as if the market is simply refusing to acknowledge bad news at this point so do not be surprised if the buyers jump all over it again.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more