Nasdaq 100 Forecast: Index Rallies Into Weekend

At this point in time, I think that the first couple of days of this week will be interesting, but nonetheless there will be plenty of buyers to get involved.

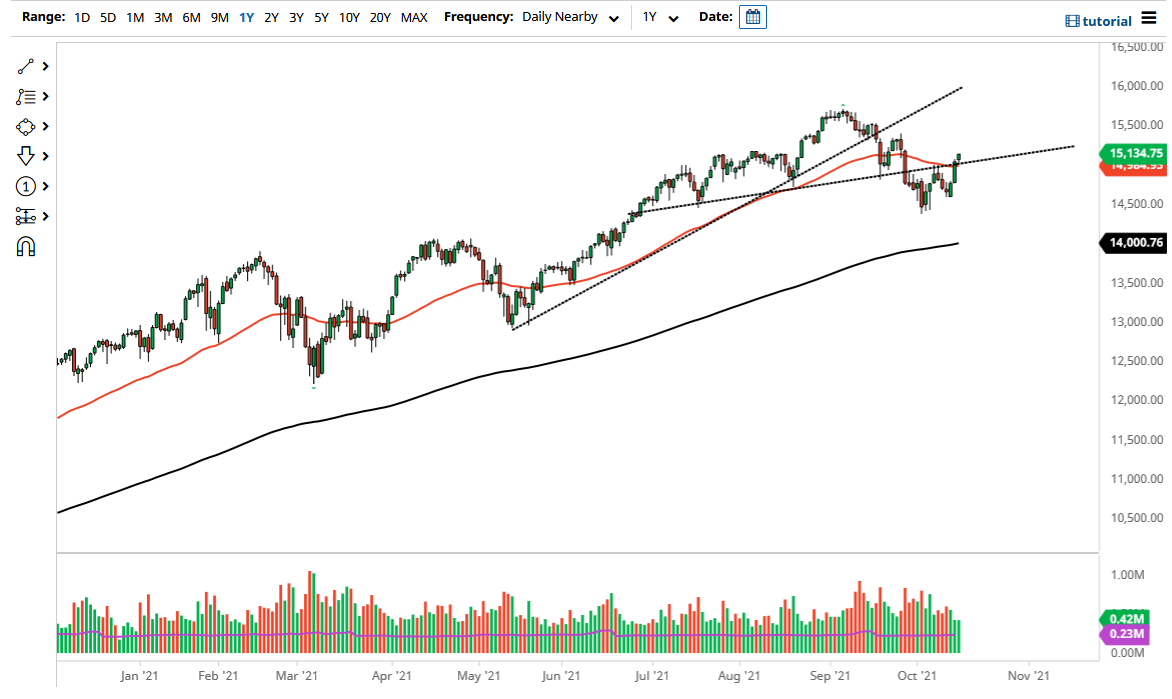

The Nasdaq 100 rallied again on Friday as traders were willing to go into the weekend long. That being the case, the market is likely to continue seeing buyers as the Nasdaq 100 has clearly left the 50-day EMA and the 15,000 level. The fact that we are closing at the top of the range for the session does suggest that there should probably be further momentum, but at this point we could see a little bit of a pullback. That's okay - I like the idea of buying pullbacks in a market that has clearly turned around.

Furthermore, we have seen earnings season in the banking sector do fairly well, which leads people to believe that we will continue to see expansion in other markets as well. The 15,500 level is the target, and then after that we will go looking towards the 16,000 level. This is a market that continues to be very noisy, with the 50-day EMA being a bit of a magnet for price, but I do think that eventually we are going to see plenty of reasons to go higher.

Having said that, if the market breaks down below the 14,500 level, then we could see a significant amount of selling pressure. It is not that I would be a short seller, but if we were to break down below the 14,500 level, then I would be a buyer of puts. The market falling is not that big of a deal, but I would not be short of the market due to the fact that the Federal Reserve is so quick to manipulate the markets one way or another. After all, the liquidity issue continues to be a major driver of this market. We have also broken above a short-term trendline in order to show signs of strength yet again.

At this point in time, I think that the first couple of days of this week will be interesting, but nonetheless there will be plenty of buyers to get involved. The market has pulled back and has been painful for the last several weeks, but we have not pulled back that far from all-time highs, even though it feels like it. When you look at the longer-term chart, it is but a blip on the radar.

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more