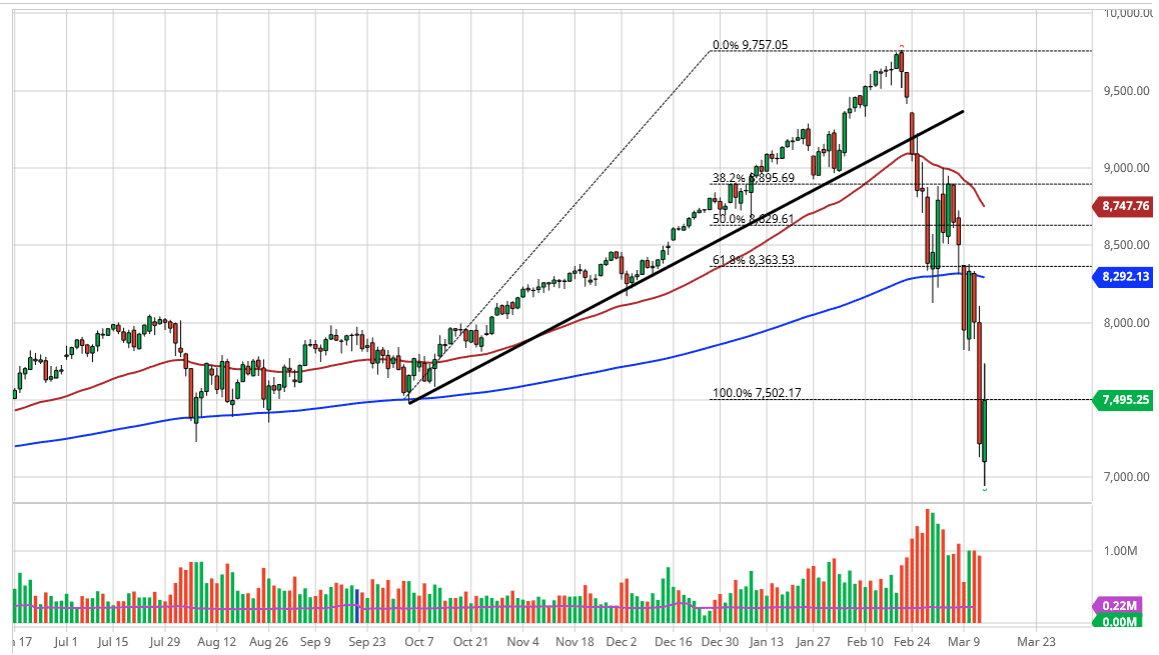

Nasdaq 100 Forecast: Has Relief Rally To Close Out The Week

The Nasdaq 100 has rallied slightly during the trading session on Friday, in what would normally be considered pretty impressive. However, in the environment that we are in, a simple 4.5% gain isn’t much to look at. After all, we have broken down rather significantly over the last couple weeks, so this probably was more or less going to be something along the lines of short covering, and of course, people trying to get their position squared out ahead of the weekend. With the weekend offering who knows what in headlines, it makes quite a bit of sense that we will continue to see volatility and I would be shocked if we didn’t get some type of gap at the opening, so at this point, we need to see which direction the gap forms, as a gap higher should send this market looking towards the 8000 level and a gap lower could send it down to the 7000 level. Quite frankly, where we go is pretty much anybody gas. While some analysts will try to tell you, what’s going to happen next, in this environment it’s going to come out based upon whatever headline grabs the market's attention.

To the upside, I believe that somewhere around the 8000 level we will see sellers. It’s not until we break above the 200 day EMA that I would be interested in hanging onto a trade to the upside. At this point, we would need a boatload of good news in order for the market to turn around for a bigger move. All things being equal though, I think that selling market bounces that show signs of exhaustion should be the way to go. Furthermore, if we gap lower I will probably short immediately and go down towards the 7000 handle, perhaps even the 6500 level. I don’t believe that the market has finished destroying accounts yet, so keep your position very small and aim for bigger targets. This is not the time to be pressing buttons in order to get your latest facts. I have been bombarded with people wanting to know what the next 15 minutes bring, and that is how you blow out an account in some type of financial crisis like we have right now. This market is acting very much like the 2008 market, and it is leaving a wake of destruction behind it. Capital preservation is your number one job right now.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more