Nasdaq 100 Forecast: Consolidating Into The Weekend

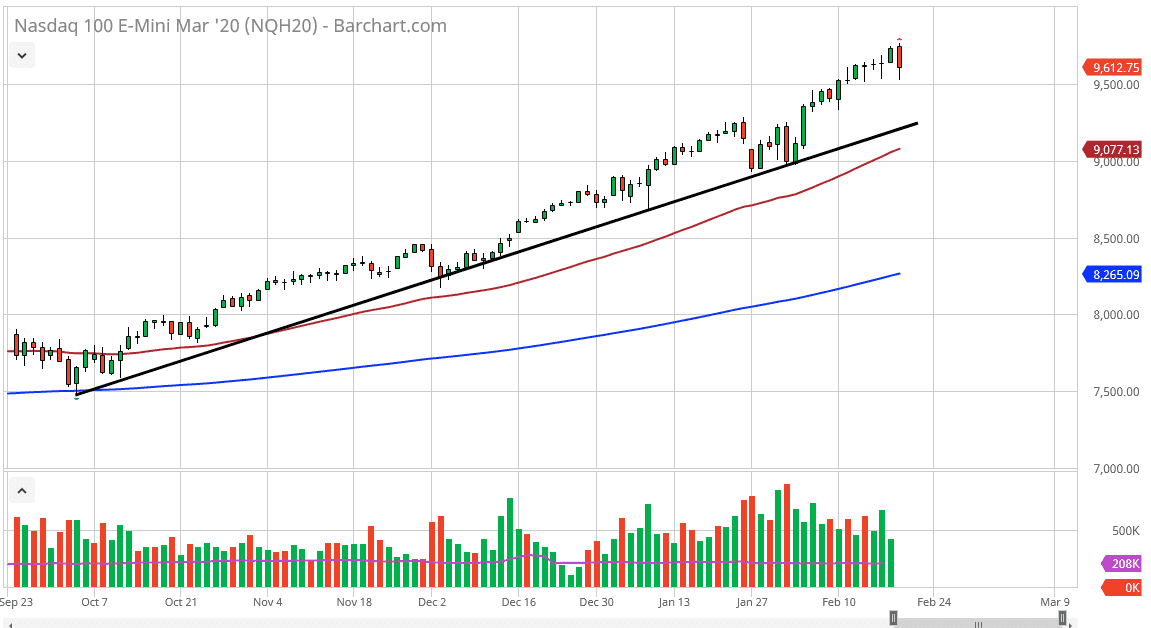

The Nasdaq 100 has fallen a bit during the trading session on Thursday, as we continue to see a bit of cautious behavior coming out of the marketplace. Ultimately, this is a market that is highly sensitive to things going on in China, as the Nasdaq 100 is full of technology companies that do a lot of business in both the US and that country. With that being the case, it’s very likely that we will continue to see this market move based upon the latest headline. The 9500 level was tested during the trading session, but it should be noted that there was a bit of support in that region.

It was a very volatile session, going back and forth, but ultimately spinning most of the day on its back foot. This isn’t a huge surprise, because the market has been quite bullish, so it needs to take a bit of a breather. It is a bit difficult to imagine a scenario where people wish to jump in with both feet heading into the weekend anyway, so Friday may be a little bit more of the same.

To the downside, I think there is plenty of support at the uptrend line and the 50 day EMA that is starting to reach towards that uptrend line. If the market sniffs out any weakness, we could see a significant pullback heading into the weekend. That being said though, I also believe that there are plenty of buyers underneath to pick up a bit of value. After all, the United States represents one of the first places people are looking to throw money in this type of environment, as there are concerns around the world as to where we go next. The United States is one of the few economies in the world that is growing significantly, so therefore people in places like Asia are looking to throw money at this index and other American index as growth is something that comes at a premium. At this point, the market would need to break down below the 50 day EMA to even consider shorting, and that something that isn’t going to happen during the Friday session. Look at pullbacks as potential buying opportunities but be cautious in don’t put in too much money right away. Let the market prove itself to and continue to build up little bits and pieces of a larger position.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more