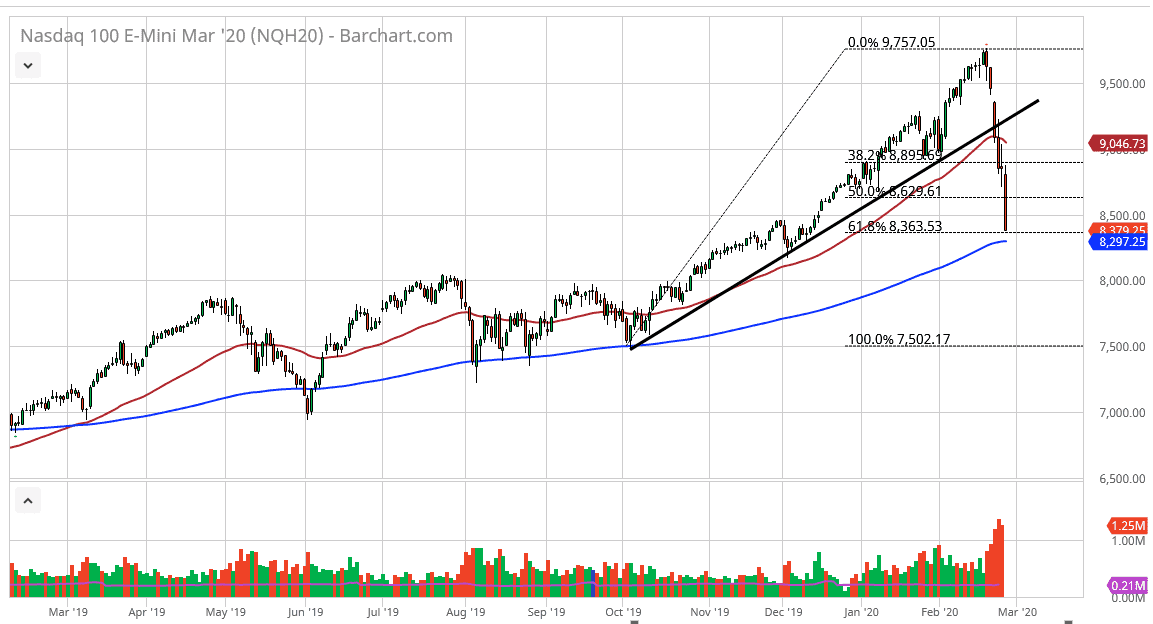

Nasdaq 100 Forecast: Challenging Major Levels

The Nasdaq 100 E-mini contract has broken down extraordinarily low during the trading session on Thursday, as we see a lot of massive negativity. The market is currently sitting at the 61.8% Fibonacci retracement level, and just above the 200 day EMA. Furthermore, the candlestick closed at the very low the range, which of course is very negative as well. At this point in time, there is nothing good about this chart beyond the idea of the Fibonacci retracement level and the moving average. If we break down below there, experience tells me that we typically go down towards the 100% Fibonacci retracement level.

At this point, there seems to be no end to the brutality of the selloff, and I think that rallies will probably get sold into for the time being. The biggest problem that we face now is that the coronavirus is hard to price and as far as risk is concerned, and as things like Japan closing down the entire school system for several weeks it shows just how the economy of the world could go lower and grind to a standstill.

At this point, the markets are trading on fundamentals or technicals. They are simply trading on fear. This is one of the most difficult things to trade in, because machines are liquidating positions to cover margin calls in other markets, and vice versa. There really is no rhyme or reason to it, it just comes down to mass liquidations and that, of course, is a very difficult and dangerous way to trade. At this point though, I do think that if we can continue to lose value, there does come a point where the buyers come back in to pick up a bit of value. The 8000 level could be an interesting place to buy, so could the 7500 level. I would not be a buyer here, not at least until we get a look at how Friday closes. It is possible that we get a bit of a bounce due to short covering into the weekend, but it just doesn’t feel like that this time. This year Friday’s have been a bit rough, which is quite impressive that things could actually be worse than they were on Thursday. I think at this point it’s likely we will continue to drift lower but obviously we have a lot of technical support in this area to deal with.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more