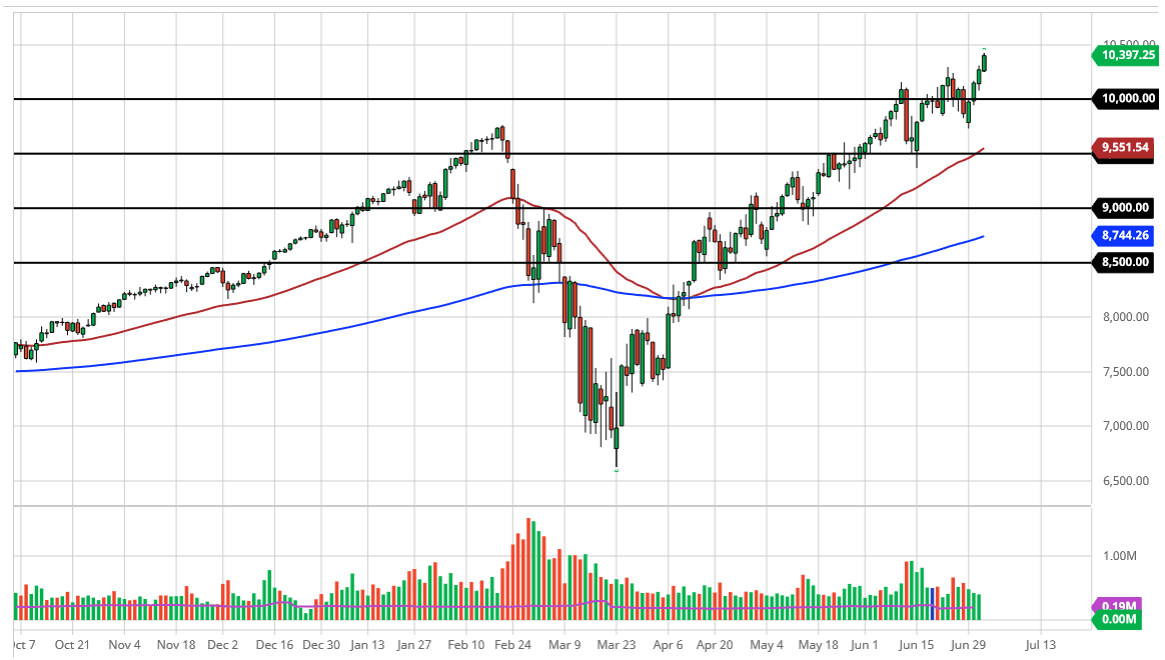

Nasdaq 100 Forecast: At All-Time Highs Yet Again

The Nasdaq 100 has rallied quite significantly during the trading session on Thursday as the jobs number came out better than anticipated. Ultimately, this is a market that has seen a lot of buying pressure more than once, so it does suggest that we are going to continue the overall uptrend. The Nasdaq 100 of course is an amalgamation of a handful of stocks of people pay attention to. After all, even though there are 100 stocks in this market, there is only a handful of them that matter. All of those are the ones that Wall Street likes the by continually, such as Amazon, Netflix, Microsoft, Google, and Apple. After that, which we are already talking about 35% of the index, then you get cult stocks like Tesla. In other words, this is an index that should never be sold.

This does not mean that we buy it anytime it moves, but will we be looking for is short-term pullbacks to give us an opportunity to pick up value. The 10,000 level underneath should be a significant support level, and I do think that a lot of traders will be looking at that as a potential buying opportunity. Even if we were to break down below there, I think there is plenty of support, extending all the way down to at least the 50 day EMA which is at roughly 9500 right now.

We are essentially in a well-defined uptrend channel, and I think it is only a matter of time before we continue to find buyers due to that. To the upside, the 10,500 level is probably a bit of a barrier, but I think it is only a temporary one. If we were to break below the 50 day EMA, then there should be plenty of support next as the market approaches 9000. I do not think that happens anytime soon, so it is only a matter of time before dips present enough value that Wall Street continues to buy it. After all, with the Federal Reserve protecting them no matter what, it makes quite a bit of sense that we would see buyers continuing to pick up stocks, because there is nothing else to do with that money as the Federal Reserve continues to buy bonds and drive down the interest rate. In other words, it is a “TINA” type of market, which of course means “There is no other alternative.”

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more