My IWM Short Mistake, Rising Rates And Real Estate

S&P 500 up 2.6% this week at an historic high with 10-year yields over 1.6%, highest in over a year? Could it be the market is finally getting comfortable that higher yields is reflective of a stronger, “normalized” economy and not runaway inflation? @CNBC $SPY #markets

— Bob Pisani (@BobPisani) March 12, 2021

The 10 Year Treasury Yield jumped 11 basis points to 1.635% yesterday (Friday) – and is now up 72 basis points YTD – but stocks shrugged it off. While the indexes got hit hard in the morning, especially the Nasdaq (QQQ), they rallied back to finish the day strong.

The S&P was +0.10%, the Nasdaq -0.59% and the Russell +0.61% on the day.

The idea now is that rising rates won’t kill the bull because while they might hit Growth stocks, the rotation into Value stocks will continue to push the market higher:

Rising interest rates are the reason for the volatility. But higher rates aren’t a signal that investors should sell now. The market could well rise higher still. The stocks leading the market, however, might be a little different than the ones that led it to records in 2020.

[Andrew] Slimmons, [Senior Portfolio Manager at Morgan Stanley], sees value stocks continuing their momentum. Analysts’ earnings estimates for the coming year are rising faster among financial and industrial companies than tech names. Such revisions are a useful way to see which sectors are getting better, or worse, and at what rate. Big positive earnings revisions typically mean good things for stocks down the road (“Higher Rates Won’t Kill The Stock Market. What To Do Now”, Al Root, Barron’s, The Trader Column [SUBSCRIPTION REQUIRED]).

The problem with this argument, as I’ve mentioned many times previously, is that Value doesn’t make up a big enough proportion of the market capitalization of the major indexes to drive them much higher if Growth/Tech has topped.

Nevertheless, I made a mistake by including IWM to start my short campaign on Thursday. Even though what I’ve called Reopen Value stocks, which are all the rage right now and make up a big proportion of the Russell 2000, are ridiculously overvalued, they are not showing any signs of technical breakdown like Tech. Therefore, the time to short them has not yet arrived. I will cover this position on Monday.

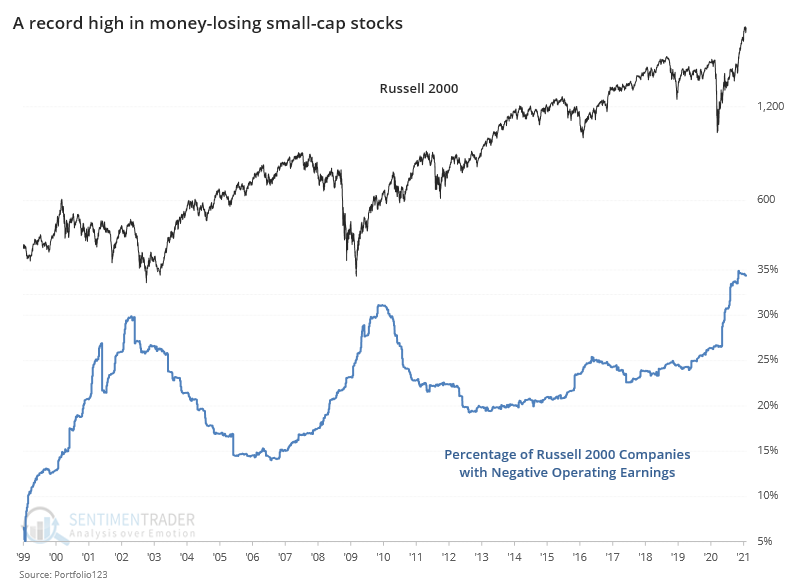

If only there were signs of historic excess and distortions in the market.$RUT pic.twitter.com/z9VSNJgoJP

— Sven Henrich (@NorthmanTrader) March 12, 2021

$LYFT - stock held up really well during NASDAQ correction - great short term RS - early turn on long term trend - I have a position -- https://t.co/7NiHKuPACd

— Mark Minervini (@markminervini) March 12, 2021

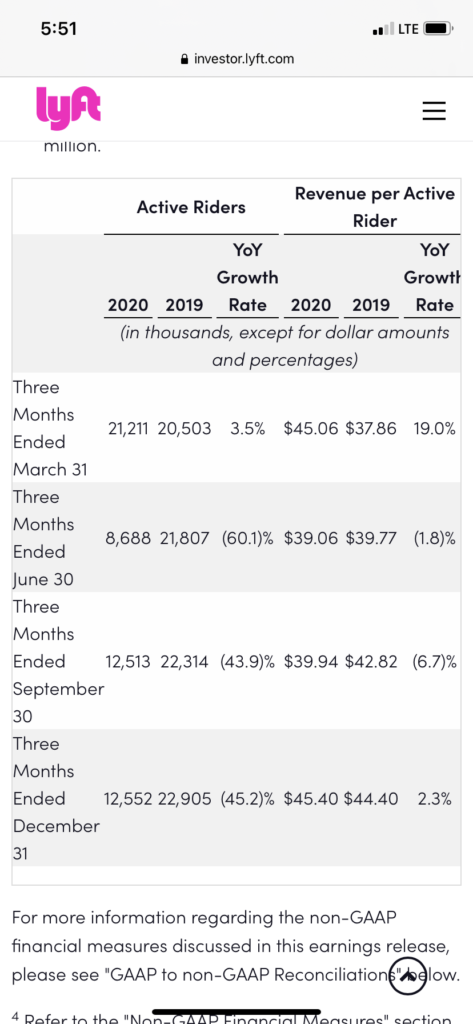

Lyft (LYFT, Market Cap $22 Billion) is a perfect example of a raging hot Reopen Value stock. The stock has tripled in the last 4 1/2 months with the announcement of the Pfizer vaccine on Monday, November 9 and the subsequent rotation into reopen names.

This move has nothing to do with LYFT’s improving fundamentals and everything to do with investor expectations that the reopening will be great for its business. LYFT reported a 45.2% decrease in Active Riders for 4Q20 and lost $185 million in the quarter on an adjusted basis.

But the CFO said: “While the first quarter of 2021 continues to be uncertain primarily due to COVID-19 headwinds, based on current recovery expectations, we should experience a growth inflection beginning in the second quarter that strengthens in the second half of the year.” Based off of that mere assertion the stock jumped the following day (February 10, 2021).

Stock markets are exciting... But the bigger impact, and the bigger risks, are in a larger and slower-moving market: real estate.... Real estate is typically the largest source of wealth in an economy, especially for households - @Birdyword https://t.co/bpV2pb4buz

— Top Gun Financial (@TopGunFP) March 12, 2021

While we typically focus on the stock market, real estate is actually a bigger share of our national wealth and rising rates are highly bearish for real estate. According to the WSJ’s Mike Bird, real asset wealth, which includes real estate, was $44,349 per adult in 2019 compared to $34,008 in financial assets in 2019 (“The Real Rally To Watch Isn’t In Stocks”, Mike Bird, WSJ, Friday March 12, 2021 [SUBSCRIPTION REQUIRED]). So while we’re focused on the effects of rising rates on Growth stocks we shouldn’t forget their impact on real estate as well.

Of the 56 stocks in the flagship innovation fund, 36 generated no earnings during their latest fiscal years - @4BetterOrWurst WSJ B1

— Top Gun Financial (@TopGunFP) March 12, 2021

We are not in a bubble - @CathieDWood $ARKK https://t.co/7qHBGniliF

In another WSJ article yesterday (“Cathie Wood’s Ark Finds Gains and Pain in Money-Losing Companies”, WSJ BI [SUBSCRIPTION REQUIRED]), Michael Wursthorn pointed out that 36 of the 56 holdings of the Ark Innovation ETF (ARKK) were not profitable during their latest fiscal year. In other words, ARKK is the ultimate Speculative Growth stock vehicle with the vast majority of its portfolio companies’ profits forecast to come in the distant future. That’s why rising rates have hit it so hard. I’m happy with my 15% short position initiated Thursday.

IMO, covering your small cap short is compounding your mistake. Let it pull back.