My Favorite Trades For FOMC – Are You Ready?

Video Length: 00:45:00

We’re heading into FOMC Day on Wednesday, which means our window of trading opportunities will be a bit smaller.

But not worry – because today’s range-bound markets give us plenty of opportunities to catch breakout traders on the wrong side of the market…

Where’s the best place to look for entries? Let me show you…

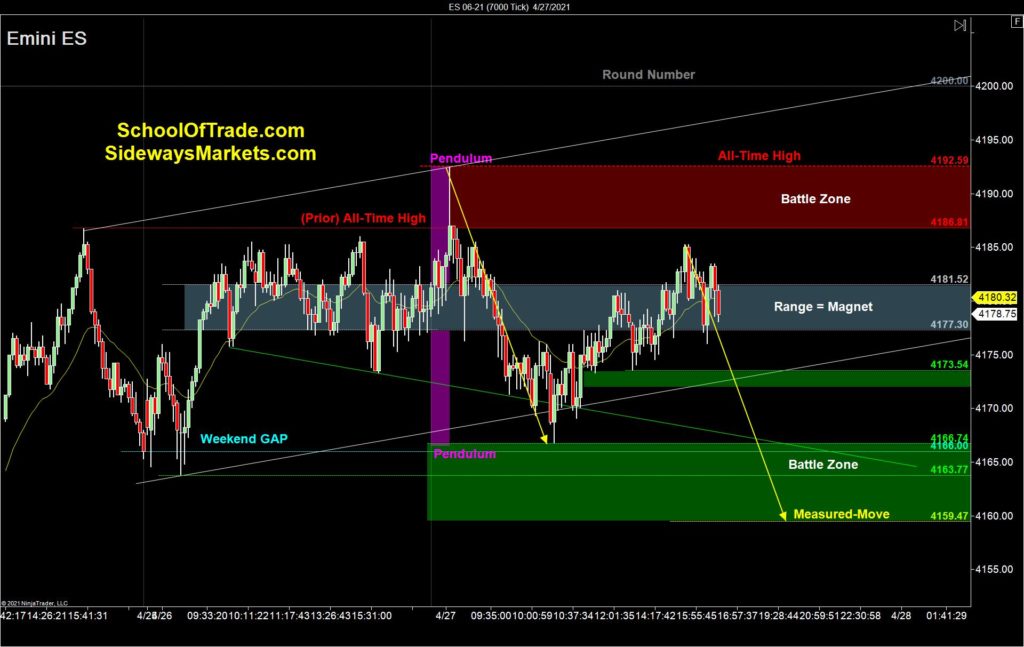

E-Mini S&P (ES):

(Click on image to enlarge)

E-Mini Keys to Success:

- Emini is bullish and rotating off the lows of Monday’s trading-range trying to complete a ‘pendulum swing’ rotation back to new all-time highs.

- Buyers will be looking to buy pullbacks around the lows of the range, or breakouts on strength going to new highs.

- Sellers can look for shorts using crown reversals off the range highs or wait for a 123-Reversal going lower.

Best Trades for Tomorrow:

- [UP] – 2-try trap to buy (or) nested failure to sell

- [DOWN] – nested failure to buy (or) 123-breakout to sell

- [SIDEWAYS] – sit on hands, wait to buy low with seller failures

E-Mini Nasdaq (NQ):

(Click on image to enlarge)

Nasdaq Keys to Success:

- Buyers were waiting to buy the pullback today but with such a strong run lower the sellers were just too much for the buyers to make a run back to the high, finishing the day with a bearish trading-range.

- Buyers will be looking for more buying opportunities below the trading-range or with a bull breakout going back to the highs.

- Sellers have a tough job tomorrow. They can’t really sell if the price rises higher, and they’re going to see a lot of buyers if we move below this range.

Best Trades for Tomorrow:

- [UP] – 2-try trap to buy (or) nested failure to sell

- [DOWN] – nested failure to buy (or) 123-breakout to sell

- [SIDEWAYS] – wait to buy below the range with seller failures.

Gold Futures (GC):

(Click on image to enlarge)

Gold Keys to Success:

- Market continues to trade sideways ahead of tomorrow’s FOMC Announcement, this time the bulls have the slight edge on momentum.

- Buyers will be looking for buying opportunities at support levels below the trading-range, working around the resistance trend-line coming down overhead.

- Sellers have an opportunity to grab control with a 123-breakout but they need to see some strength to prove the breakout.

Disclaimer: Join our Free Trading Course. Joseph James, SchoolOfTrade.com and United Business Servicing, Inc. are not registered investment or ...

moreComments

Please wait...

Comment posted successfully.

No Thumbs up yet!