Mr. Market Seems Asleep When It Comes To American Axel Post-2016

The Street has had a lot to worry about when it comes to auto-parts supplier American Axel (AXL), most notably a big drop-off in business with mega-customer GM and a lot of debt. But the stock’s valuation doesn’t seem close to reflecting the extent to which the company has and continues to progress beyond its challenges.

Why this Stock is Being Considered

It’s important before you start to read about or evaluate a stock, to know why it came under consideration be comfortable soundness of those reasons. American Axle (AXL), got into my radar as a result of the small-cap value screen I created on Portfolio123 that looks among the constituents of a Russell 2000-like universe that looks for stocks with relatively low valuation metrics but only from a universe that has been prequalified to exclude the lowest quality stocks and stocks viewed unfavorably by the Street. Details of the approach are described in an 8/15/18 blog post.

Retrieved from the Dumpster

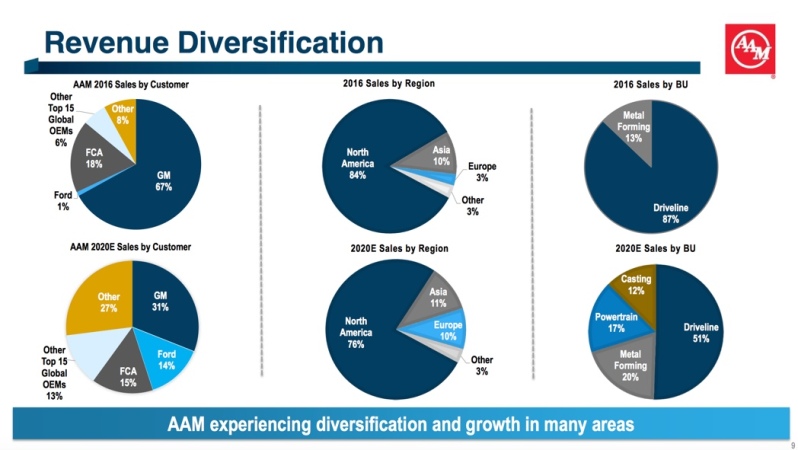

Back in 2016, shares of this vehicle-parts supplier (drivelines, powertrains, metal formed products and casting of components) plunged quickly from a high of nearly $23 to around $13 and then edged toward a bottom just below $12. The catalyst was an announcement by General Motors (GM) that it would bring a lot of the work done by Axle in-house; not all of it but enough to pose something of a crisis considering that the company had relied upon GM for 67% of its sales.

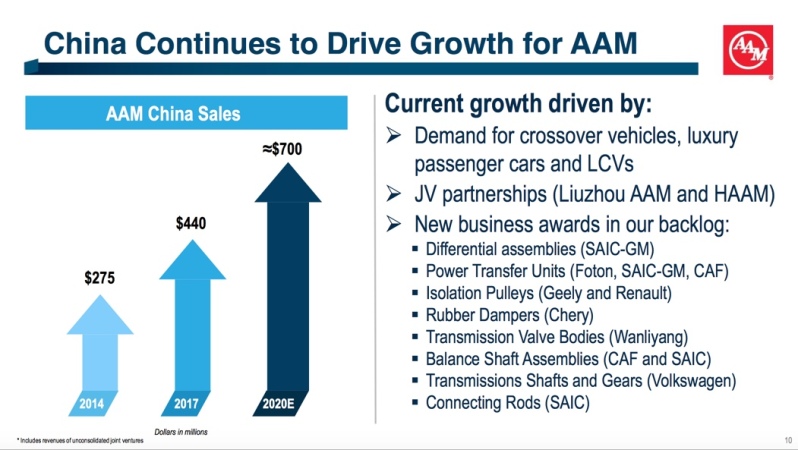

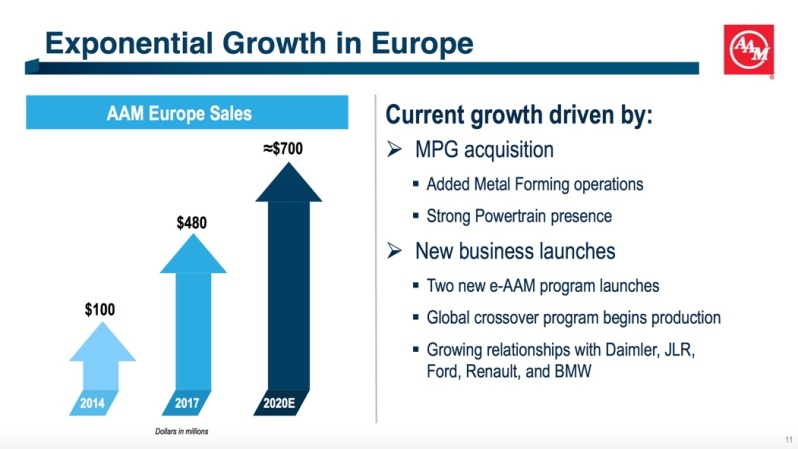

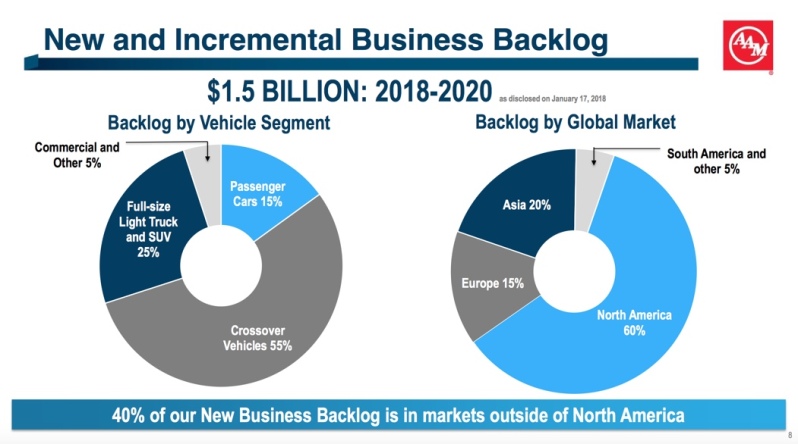

Since then, Axel has been working to diversify its customer base and has accomplished quite a bit due to successful efforts to do more business in Europe and China.

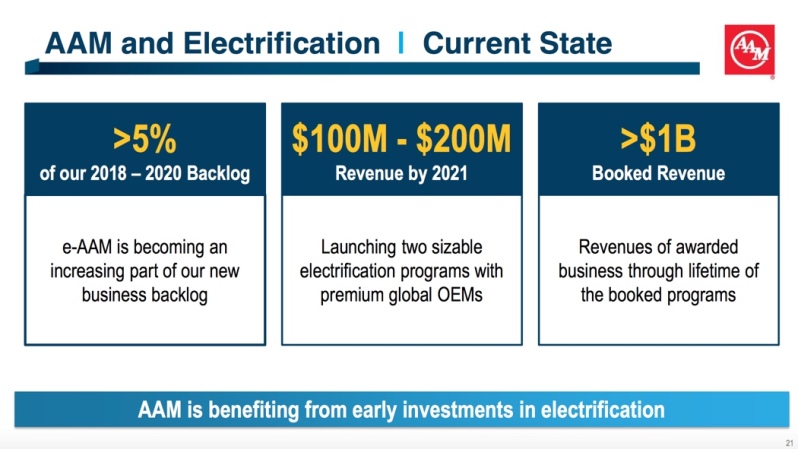

(From American Axle’s 8/18/18 J.P. Morgan Automotive Conference Presentation.)

This isn’t just a matter of hopes and wishes. Approximately two-years beyond the GM-induced trauma, Axle is already showing tangible progress.

(Click on image to enlarge)

(Click on image to enlarge)

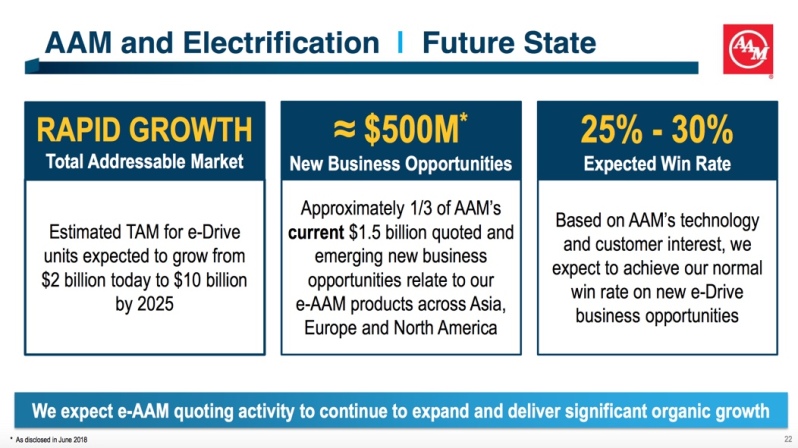

(From American Axle’s 8/18/18 J.P. Morgan Automotive Conference Presentation.)

Polishing the Product Line

As with many parts of the economy, the auto parts business isn’t what it used to be. Technology is more prevalent not just in things drivers and passengers see and enjoy (GPS, intelligent consoles, etc. but in vital functions that are part of the guts of the vehicle.

Axel isn’t the only company adding technology to what used to be basic products, and some argue that this company, having lagged for a while, is playing catchup. Be that as it may, it is clearly in investment mode and was so even without counting the early-2017 acquisition of Metaldyne Performance Group.

As we see in Table 1, the auto parts industry as a whole has been topping peer comparisons in terms of Capital Spending to Depreciation (a company is presumed to be staying in place if annual capex matches annual depreciation) and in terms of capex-plus-R&D to Sales (since R&D cannot be treated as a multi-period depreciable expense, R&D should be added to capex when technology is prominent).

(Click on image to enlarge)

Axle benefits from the reality that consumers are showing marked preferences to upsize vehicles, notwithstanding wishes on the part of some intellectuals favoring “smart cars” and other smaller vehicles. At one time, considerations of performance and cost punished those who favored SUVs and other big crossover vehicles. That, however, is changing,

Axle’s’ proprietary EcoTrac AWD (all-wheel drive) system monitors and analyzes road conditions and when less than full AWD is needed, automatically disconnects many rotating components from the driveline, thus allowing large portions of the driveline to stop rotating. This provides safety and maneuverability of AWD with minimal fuel-economy drag. A 2017 new generation of EcoTrac enhanced economy and performance.

There’s also the emergence of electric powering as a mass phenomenon. Hybrids are already well established. All-electric battery-powered vehicles are still in their early days, but the trend in their favor is in place. Axle is in this market.

(From American Axle’s 8/18/18 J.P. Morgan Automotive Conference Presentation.)

Core Fundamentals

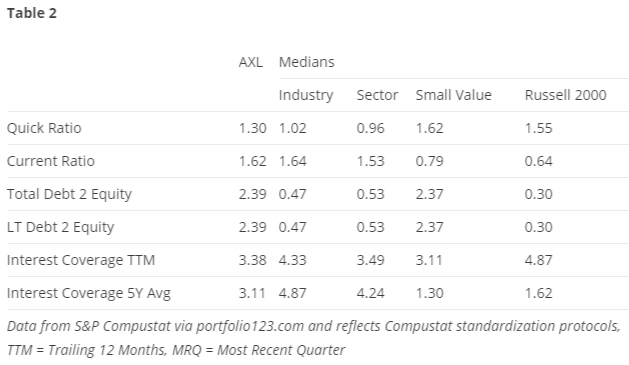

We must interpret historical numbers in a generalized manner considering the changes being experienced by the company in terms of customer concentration and product line, as well as the balance-sheet altering Metaldyne acquisition. The latter added a lot of debt to Axel, but not a worst-case scenario; a substantial portion of the purchase was financed with equity. Still, in terms of leverage, Axel is up there now.

(Click on image to enlarge)

The above-par leverage is clear. What’s also interesting is that the company’s liquidity ratios (quick ratio and current ratio) are in line with peer medians as is interest coverage (even the TTM figure, which includes considerable impact from the Metaldyne purchase). Meanwhile, the company has already started to reduce debt and given that it is cash flow positive, expects to make further progress along these lines. Helping, too, are reductions in fixed costs that have already been achieved.

Meanwhile, margins, turnover, and return on assets are respectable by comparative standards (given the extent to which Return on Equity is pumped by the heavy debt leverage, I chose to omit it form the table).

(Click on image to enlarge)

The Stock

By most measures this stock is cheap.

(Click on image to enlarge)

|

* Click here further information about the concept of P=V+N (Price = Value + Noise) |

The three things that really stand out to me are:

- The low EV/Sales ratio: we expect a low P/S ratio given this company’s debt-heavy balance sheet, but EV/Sales adjusts for that and can be compared apples-to-apples across companies with different degrees of leverage

- The very low forward P/E: This means what one expects it to mean, that investors anticipate pretty-much nothing from the future, an observation vigorously confirmed by the last row of the Table . . .

- The breathtakingly low Noise-to-Market Cap ratio: This unusual approach presumes a stock’s price starts at the company’s here-and-now “standstill” value and allows nothing for the future. That part of market cap in excess of standstill value is attributed to “noise,” which is usually a positive number. It can be negative, however, if the Street is pessimistic enough, as it is here. (Click here for more on this iconoclastic approach to valuation analysis.)

And as per the demands of my atypical value screen (I need value stocks that have at least some support on the part of the Street — I like the notion of catching the absolute bottom as much as anyone but that’s much easier said than done so I cherish the benefits of confirmation via Street action), the Technicals range from OK to pretty good (the stock has been outperforming the market over the past 13 weeks and the above-par Chaikin AD shows recent relatively positive “accumulation” or money flow (i.e. buyers more motivated than sellers).

(Click on image to enlarge)

|

Conclusion

I don’t mean here to minimize the concerns presented by Axel’s having been caught flat-footed by GM’s 2016 embrace of do-it-yourself, the company’s debt burden or its playing catchup in new era product offerings. But let’s remember I found the stock on a value screen. Low ratios never make for automatic “Buy.” Value works when investors are going too far in naively assuming past difficulties will persist. I think that’s the case here. Axel has baggage, but I believe the current valuation is overdoing things, by a lot.

Disclosure: None.