Mr. Market Is Not Thrilled With This Net Lease Merger, Neither Am I

I have been following the saga of Chambers Street Group (NYSE:CSG) since the company listed shares on the NYSE in May 2013. You may recall that CSG opened up the liquidity spigot on the worst day possible - May 21, 2013, just a day before Ben Bernanke announced the pullback in Fed funds, better known as "taper tantrum."

While CSG was new to the public markets, the company previously existed as a non-traded REIT that raised equity through a selling arm of CNL in Orlando. Over the course of CSG's public REIT existence the shares have underperformed - investors who purchased shares on the first day of trading have seen a price reduction of around 27%.

Obviously, the primary reason that I hit the eject button was because of share price underperformance, here's what I said in a recent article:

Nothing has really changed with Chambers Street since I purchased shares and (as far as my investment is concerned) I'm doing a tad better than even money. Even though there's no permanent CEO (today), my biggest fear is the multi-tenant office exposure and shorter duration leases.

I added,

With the recent departure of Jack Cuneo (former CEO) I'm not feeling the attraction.

As far as I was concerned, CSG was running out of options. Something was broken and with no experienced leadership I was compelled to suggest that the best alternative for Chambers Street was a sell. Here's what I wrote in April:

…maybe there's an M&A deal with Chambers Street? Remember, a large percentage of the Chambers Street's properties were acquired during the Great Recession (at attractive prices) and with no CEO in place, there could be an interesting opportunity for W.P. Carey (NYSE:WPC). Remember that Carey has a European platform in place already. Another long-shot is Gramercy Property Trust (NYSE:GPT). Dugan (CEO Of GPT) could craft a reverse-merger and add significant scale to Gramercy's platform (further integrating management).

Be Careful What You Ask For

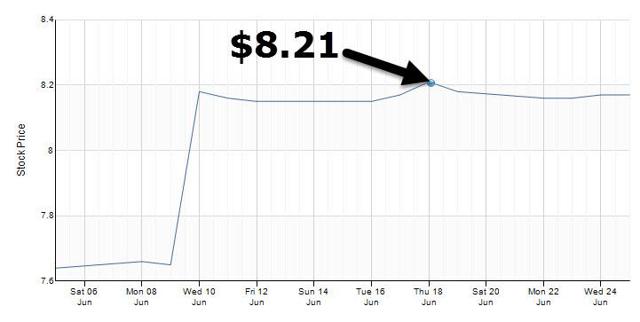

On June 10th, a Bloomberg article suggested that Chambers Street was considering putting itself on the block "after receiving at least one offer from a competitor." Shares in CSG immediately responded positively to the report.

The noise died down as CSG shares drifted back below $8.00.

Then yesterday, I opened up my laptop at 8:00 am to see that my prediction had come true (before Bloomberg's article I might add): Chambers Street and Gramercy Property Trust had entered into an agreement to merge into a combined entity that was expected to be valued at around $5.7 billion (enterprise value).

I began to ponder the benefits of the merger - whether or not these unique REITs could co-exist and create shareholder value. As I mentioned, I am no longer an investor in CSG but I am an investor in GPT (see my latest article on GPT HERE). Remember that CSG was a non-traded REIT and its equity is fueled by thousands of retail investors looking for monthly paying dividends. Alternatively, GPT is more of an institutional model owned by hedge funds and quasi-institutional investors.

I started thinking what it would be like to attend a shareholders' meeting for the combined REITs. On one side of the room, you would see my Aunt, my postman, and my kid's schoolteacher who are likely candidates for the high-yielding monthly dividends. On the other side of the room, you would see the Wall Street guys who are less interested in the dividend, but more so on share price appreciation. Remember, Gramercy has the lowest dividend yield in the net lease sector (excluding American Realty Capital Properties (NASDAQ:ARCP) that pays no dividend now).

Mr. Market wasn't too thrilled with the announcement today. Shares in CSG tumbled 8.9%.

What does that mean?

Under the terms of the stock-for-stock deal, GPT shareholders will receive 3.1898 shares of CSG for each share of GPT common stock they own. At closing, CSG shareholders will own approximately 56% of the combined company, and GPT shareholders will own approximately 44%. The transaction is expected to be tax free to shareholders.

Why then could CSG be trading at a discount?

I'll answer that in simple terms: COMPLEXITY DISCOUNT. CSG has been underwater (I'm referring to price) for over two years and GPT would have had to pay much more for a straight out acquisition. Mr. Market is telling us that the implied value of CSG is $7.28 (thankful I got out at $7.92).

What about Gramercy though?

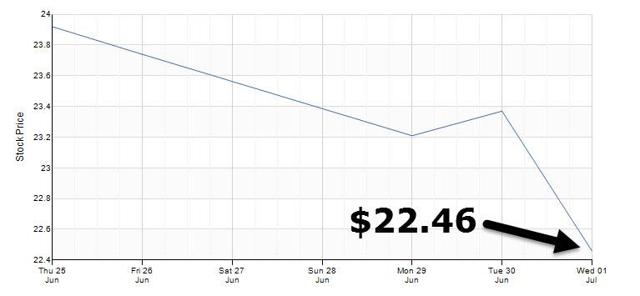

This is even more interesting. As noted, the merger is a fixed exchange transaction so if GPT shares decline, CSG gets less value. Mr. Market has spoken: There is no confidence in the transaction. GPT shares are down 3.89%.

I'll be honest. I thought Mr. Market would have bought into the "bigger is better" argument and reacted more favorably to the latest news. For CSG shareholders it's almost like pouring salt into the wound - the legacy (CNL) investors have been waiting over two years to get back to even and now they'll have to ride the train out even longer. How much longer?

The Combined New Gramercy 3.0

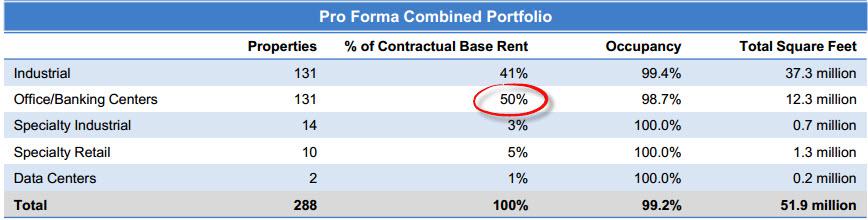

The combined companies' portfolio will comprise 288 properties aggregating 52 million square feet in major markets throughout the U.S. and Europe. The GPT management team will lead the combined company, with Gordon DuGan as CEO, Benjamin Harris as president and Jon Clark as CFO. CSG's interim president, interim CEO and CFO Martin Reid will be head of transition of the combined company.

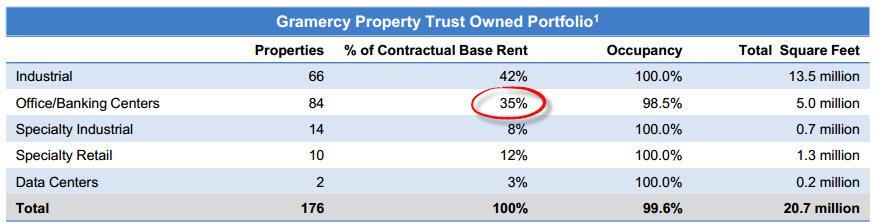

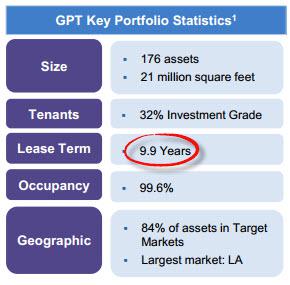

Let's take a quick look at the current GPT portfolio (remember that the company recently acquired a portfolio of Lifetime Fitness stores as referenced in my recent article):

As noted above, GPT owns 84 office/bank buildings that represent around 35% of ABR. More recently, GPT has entered the retail business, arguably a new sector for the REIT. While GPT is considered a traditional net lease REIT, I want to point out that the office properties are considered higher risk due to lack of diversification (with Bank of America (NYSE:BAC)) and higher cap-ex.

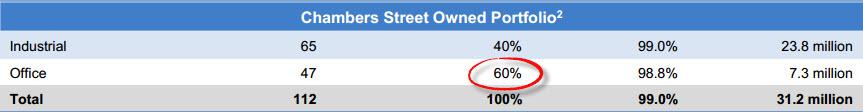

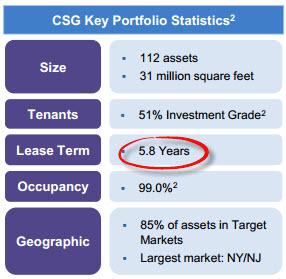

As I mentioned above, CSG owns a large number of office buildings (60% of ABR) and many are multi-tenant. That has been a big reason for the price overhang and modest earnings growth.

Keep in mind that Realty Income (NYSE:O) owns a few office buildings but most of their office properties were acquired with below market rents with more mission-critical characteristics. In other words, Realty Income has selectively acquired office buildings and CSG and GPT have a much higher concentration (so they are higher risk).

The combined exposure for CSG and GPT will result in 50% office concentration, over 12.3 million square feet. GPT expects to reduce the exposure to around 25% but that will take time.

Effectively, GPT must successfully recycle around 6 million square feet in office buildings and while GPT's management team appears to have the experience to execute, I am concerned that the GPT deal will be "quality dilutive." This reminds me of the similar situation with American Realty Capital Properties and its largest tenant, Red Lobster. It takes time to recycle - especially office deals - and this process could become a dilutive one. It kind of feels like GPT is inheriting the overhang that CSG has enjoyed.

GPT has amassed a portfolio of 176 properties with an average lease term of 9.9 years.

However, CSG has a portfolio of shorter-term leases (due to the office exposure).

Again, it appears that the transaction is "quality dilutive." CSG is gaining scale but appears to be sacrificing lease term.

In regards to diversification, the combined companies will definitely spread geographic risk (however, I am still concerned with the office exposure).

Continue reading this article here.

Disclosure: I was previously an investor in CSG - purchased shares on September 3, 2013 ($7.39), January 2, 2014 ($7.67), January 14, 2014 ($7.91), and ...

more