Morning Call For Wednesday, Sept. 20

OVERNIGHT MARKETS AND NEWS

Dec E-mini S&Ps (ESZ17 +0.03%) this morning are unchanged ahead of the conclusion of the 2-day FOMC meeting today and expected announcement by the Fed of how and when they will reduce their balance sheet. Strength in energy stocks is limiting losses in the overall market with Nov WTI crude oil (CLX17 +1.16%) up +1.16%. Crude prices rose after data late Tuesday from the API showed U.S. crude supplies rose +1.44 million bbl last week, less than expectations of a +3.9 million bbl increase. Also, API reported that U.S. gasoline stockpiles fell -5.06 million bbl last week, more than double expectations for a -2.09 million bbl draw. Global stock markets also found support on optimism in the world economy after the OECD predicted that global 2017 GDP will climb to 3.5%, up from 3.1% in 2016. European stocks are down slightly by -0.15%, as weakness in exporters leads the overall market lower after EUR/USD climbed to a 1-week high. Asian stocks settled mixed: Japan +0.05%, Hong Kong +0.27%, China +0.27%, Taiwan -0.54%, Australia -0.08%, Singapore -0.24%, South Korea -0.01%, India -0.01%. Japan's Nikkei Stock Index eked out a new 2-year high today and found support on strength in the Japanese economy after Japan Aug exports rose a more-than-expected +18.1% y/y, the biggest increase in 3-3/4 years.

The dollar index (DXY00 -0.13%) is down -0.10%. EUR/USD (^EURUSD) is up +0.10% at a 1-week high. USD/JPY (^USDJPY) is down -0.30%.

Dec 10-year T-note prices (ZNZ17 +0.09%) are up +5 ticks.

The Organization for Economic Cooperation and Development (OECD) said that the global economy is getting stronger and more stable and predicts global 2017 GDP of 3.5%, up from 3.1% in 2016, and expanding to 3.7% in 2018, the strongest since 2011.

German Aug PPI rose +0.2% m/m and +2.6% y/y, stronger than expectations of +0.1% m/m and +2.5% y/y.

The Japan Aug trade balance shrank to a surplus of 113.6 billion yen, wider than expectations of +104.4 billion yen. Aug exports rose +18.1% y/y, stronger than expectations of +14.3% y/y and the largest increase in 3-3/4 years. Aug imports rose +15.2% y/y, stronger than expectations of +11.6% y/y.

U.S. STOCK PREVIEW

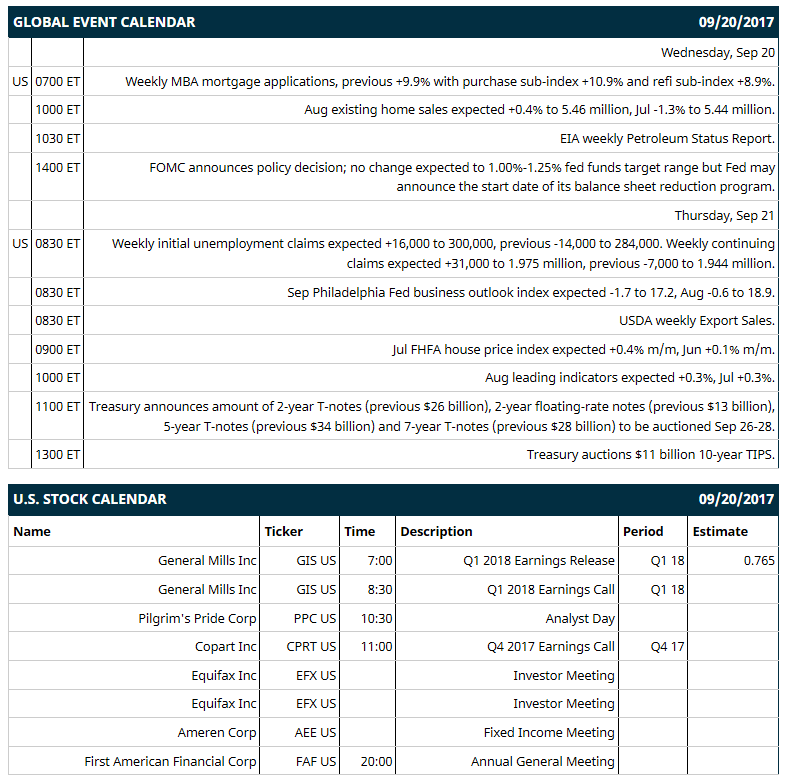

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +9.9% with purchase sub-index +10.9% and refi sub-index +8.9%), (2) Aug existing home sales (expected +0.4% to 5.46 million, Jul -1.3% to 5.44 million), (3) FOMC policy decision (no change expected to 1.00%-1.25% fed funds target range but Fed may announce the start date of its balance sheet reduction program), (4) EIA weekly Petroleum Status Report.

Notable Russell 1000 earnings reports today include: General Mills (consensus $0.77).

U.S. IPO's scheduled to price today: Oasis Mainstream Partners (OMP).

Equity conferences this week: D.A. Davidson Engineering & Construction Conference on Wed, Electronic Design Process Symposium on Thu.

OVERNIGHT U.S. STOCK MOVERS

Take-Two Interactive Software (TTWO +1.55%) was initiated as a 'Buy' at Buckingham Research Group with a 12-month target price of $120.

Activision Blizzard (ATVI +0.17%) was initiated as a 'Buy' at Buckingham Research Group with a 12-month target price of $79.

Intuit (INTU +1.07%) was recommended as a new 'Buy' at Argus Research with a price target of $165.

AAR Corp (AIR +3.17%) reported Q1 EPS from continuing operations of 31 cents, right on consensus, although Q1 sales of $439.2 million were better than consensus of $412 million

ServiceMaster Global Holdings (SERV +0.21%) was initiated a new 'Outperform' at Oppenheimer with a 12-month target price of $55.

Evolent Health (EVH -4.86%) was initiated a new 'Overweight' at KeyBanc Capital Markets with a 12-month target price of $23.

Bed Bath & Beyond (BBBY -0.99%) sank over 12% in after-hours trading after it reported Q2 EPS of 67 cents, below consensus of 95 cents as Q2 comparable sales fell -2.6%, weaker than expectations of -0.6%.

Adobe Systems (ADBE +0.53%) slid 3% in after-hours trading after it said it sees Q4 experience cloud revenue growth slowing to about 17% y/y compared with 26% y/y in Q3.

FedEx (FDX +0.43%) lost almost 2% in after-hours trading after it reported Q1 adjusted EPS of $2.51, well below consensus of $3.00, and then lowered on guidance on full-year adjusted EPS to $12.00 to $12.80 from a prior view of $13.20 to $14.00.

Analogic (ALOG -1.75%) fell 3% in after-hours trading after it reported Q4 net revenue of $111.6 million, below consensus of $115.5 million.

Cymabay Therapeutics (CBAY unch) rose almost 4% in after-hours trading after it was initiated a new 'Overweight' at Cantor Fitzgerald with a price target of $16.

Memphite Therapeutics (GEMP +5.93%) climbed 11% in after-hours trading after it said its gemcabene achieved the primary endpoint in two recently completed Phase 2b studies for the treatment of hypercholesterolemia.

Ivanka Therapeutics (IOVA +3.64%) tumbled 6% in after-hours trading after it announced that it intends to offer $50 million of its common stock.

CSci Therapeutics (KOOL +4.31%) surged 16% in after-hours trading after it said its full-year profit margin was 40% versus 23% y/y.

MARKET COMMENTS

Dec S&P 500 E-mini stock futures (ESZ17 +0.03%) this morning are unch. Tuesday's closes: S&P 500 +0.11%, Dow Jones +0.18%, Nasdaq +0.17%. The S&P 500 on Tuesday closed higher on reduced market anxiety after the VIX volatility index dropped to a 6-week low. Stocks were boosted by the unexpected +5.7% increase in U.S. Aug building permits, a proxy of future home construction, to a 2-year high of 1.3 million units, stronger than expectations of -0.8% to 1.22 million. Stocks were undercut by long liquidation pressures ahead of the results of the 2-day FOMC meeting on Wednesday where the Fed is expected to announce the start date for its balance sheet reduction program.

Dec 10-year T-note prices (ZNZ17 +0.09%) this morning are up +5 ticks. Tuesday's closes: TYZ7 -3.00, FVZ7 -1.50. Dec 10-year T-notes on Tuesday fell to a 1-month low and closed lower on the stronger-than-expected U.S. Aug building permits report of +5.7% to a 2-year high and on reduced safe-haven demand with the higher close in stocks.

The dollar index (DXY00 -0.13%) this morning is down -0.095 (-0.10%). EUR/USD (^EURUSD) is up +0.0012 (+0.10%) at a 1-week high and USD/JPY (^USDJPY) is down -0.33 (-0.30%). Tuesday's closes: Dollar Index -0.204 (-0.22), EUR/USD +0.0040 (+0.33%), USD/JPY +0.02 (+0.02%). The dollar index on Tuesday closed lower on strength in EUR/USD which rose to a 1-week high after the German Sep ZEW economic expectations index rose by a stronger-than-expected +7.0 to 17.0. The dollar was also undercut by the U.S. Q2 current account deficit report of -$123.1 billion, which was wider than expectations of -$116.0 billion and the largest deficit in 8-1/2 years.

Nov crude oil (CLX17 +1.16%) this morning is up +58 cents (+1.16%) and Nov gasoline (RBX17 +0.35%) is +0.0081 (+0.50%). Tuesday's closes: Nov WTI crude -0.45 (-0.89%), Nov gasoline -0.0107 (-0.66%). Nov crude oil and gasoline on Tuesday closed lower on expectations that Wednesday's EIA data will show U.S. crude inventories rose +3.4 million bbl and on weakness in the crack spread, which reduces incentive for refineries to purchase crude to refine into gasoline. Crude oil prices were supported by comments from Iraqi Oil Minister Jabbar al-Luaibi who said OPEC should cut its oil output by an additional 1% to help rebalance the global oil market.

Metals prices this morning are higher with Dec gold (GCZ17 +0.58%) +8.8 (+0.67%), Dec silver (SIZ17 +0.70%) +0.151 (+0.87%) and Dec copper (HGZ17 +0.42%) +0.014 (+0.45%). Tuesday's closes: Dec gold -0.2 (-0.02%), Dec silver +0.123 (+0.72%), Dec copper +0.0005 (+0.02%). Metals on Tuesday settled mixed. Metals prices were supported by the weaker dollar and by the unexpected increase in U.S. Aug building permits to the most in 2 years, which is positive for future copper demand. Gold closed lower as a rally in stocks reduced safe-haven demand for gold.

(Click on image to enlarge)

Disclosure: None.