Morning Call For Wednesday, June 7

OVERNIGHT MARKETS AND NEWS

Jun E-mini S&Ps (ESM17 +0.04%) this morning are up +0.02% and European stocks are up +0.51%. Moves in equity prices were constrained ahead of Thursday's UK general election and the congressional testimony from former FBI director Comey. U.S. stock indexes followed European stocks higher after the ECB was said to cut its inflation outlook through 2019 and boost its GDP forecast. Stocks rose, EUR/USD (^EURUSD) fell and the 10-year German bund yield dropped to a 6-week low of 0.245% after Eurozone officials familiar with the matter said the ECB on Thursday will forecast CPI growth of 1.5% for 2017, 2018 and 2019, lower than a Mar forecast of 1.7% for 2017, 1.6% for 2018 and 1.7% for 2019. The ECB will also raise its GDP forecasts by +0.1 of a point from 2017 through 2019, according to the officials. Asian stocks settled mixed: Japan +0.02%, Hong Kong -0.09%, China +1.23%, Taiwan +0.04%, Australia -0.01%, Singapore -0.16%, South Korea -0.54%, India +0.26%.

The dollar index (DXY00 +0.32%) is up +0.35%. EUR/USD (^EURUSD) is down -0.60%. USD/JPY (^USDJPY) is up +0.03%.

Sep 10-year T-note prices (ZNU17 -0.06%) are down -1.5 ticks.

The Japan Apr leading index CI fell -1.2 to 104.5, stronger than expectations of -1.2 to 104.3. The Apr coincident index rose +3.3 to 117.7, stronger than expectations of +3.1 to 117.5 and the highest in 9-1/2 years.

German Apr factory orders fell -2.1% m/m, weaker than expectations of -0.3% m/m.

U.S. STOCK PREVIEW

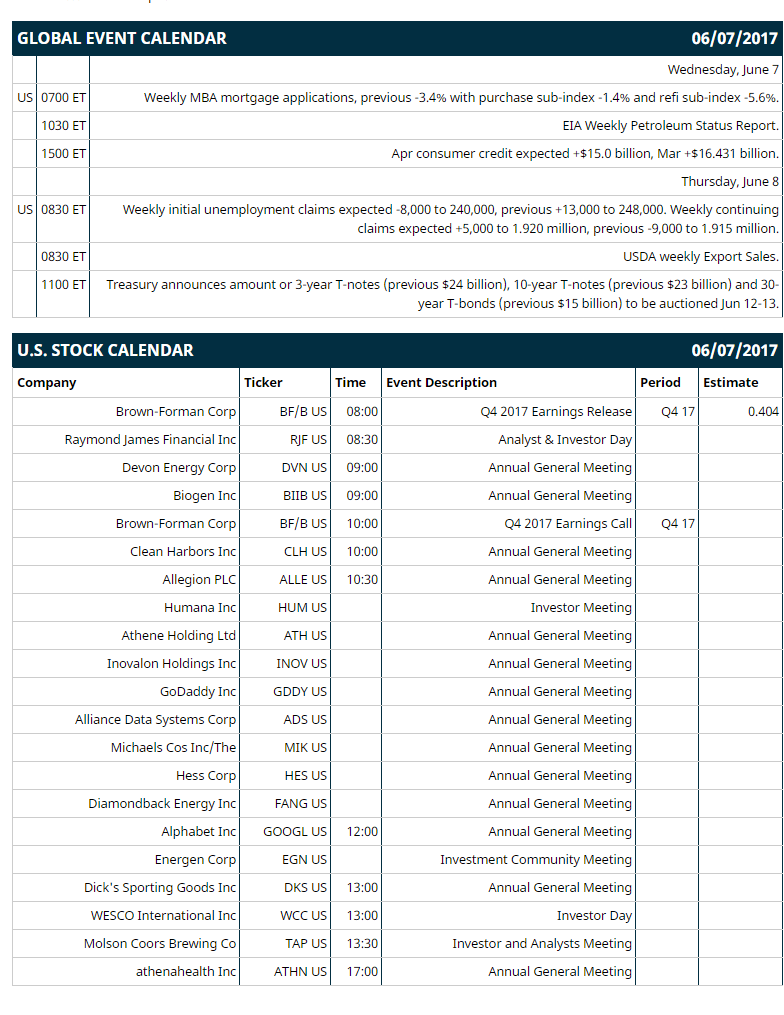

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -3.4% with purchase sub-index -1.4% and refi sub-index -5.6%), (2) Apr consumer credit (expected +$15.0 billion, Mar +$16.431 billion), (3) EIA Weekly Petroleum Status Report.

Notable Russell 2000 earnings reports today include: Brown-Forman (consensus $0.40).

U.S. IPO's scheduled to price today: none.

Equity conferences: Bank of America Merrill Lynch Global Technology Conference on Tue-Wed, NAREIT REITWeek Investor Forum on Tue-Wed, RBC Global Energy & Power Executive Conference on Tue-Wed, Stephens Spring Investment Conference on Tue-Wed, Robert W. Baird Global Consumer, Technology & Services Conference on Tue-Thu, Jefferies Global Health Care Conference on Tue-Fri, Deutsche Bank Global Industrials and Materials Summit on Wed-Thu, Sandler O'Neill Global Exchange and Brokerage Conference on Wed-Thu, Goldman Sachs European Financial Conference on Wed-Fri, Macquarie Group Ltd Canadian Energy Conference on Thu, Gabelli & Company Entertainment Conference on Thu, Citi Small and Mid Cap Conference on Thu-Fri.

OVERNIGHT U.S. STOCK MOVERS

Humana (HUM +0.32%) was rated a new 'Overweight at Morgan Stanley with a price target of $262.

UnitedHealth Group (UNH +0.81%) was rated a new 'Overweight at Morgan Stanley with a price target of $202.

Cigna (CI +0.45%) was rated a new 'Overweight at Morgan Stanley with a price target of $184.

Dave & Buster's Entertainment (PLAY +2.95%) lost nearly 3% in after-hours trading after it reported Q1 comparable same-store sales were up +2.2%, below consensus of +2.7%.

Analogic (ALOG -0.60%) sank 10% in after-hours trading after it said it sees full-year revenue down low to mid-single digits and lowered guidance on full-year adjusted EPS to $2.40-$2.70 from a prior view of $3.00-$3.45.

Oxford Industries ({=OXM =}) slid 2% in after-hours trading after it said it sees Q2 adjusted EPS of $1.35-$1.45, weaker than consensus of $1.54.

Ambarella (AMBA +1.31%) dropped over 6% in after-hours trading after it said it see Q2 revenue of $69 million-$72 million, below consensus of $72.52 million.

Keysight Technologies (KEYS +0.83%) climbed over 6% in after-hours trading after it said it sees Q3 adjusted revenue of $840 million-$880 million, the midpoint above consensus of $842.86 million.

United Natural Foods (UNFI -1.14%) slid 2% in after-hours trading after it reported Q3 revenue of $2.37 billion, less than consensus of $2.42 billion, and then said it sees full-year revenue of $9.29 billion-$9.34 billion, below consensus of $9.36 billion.

Exact Sciences (EXAS -1.29%) fell over 2% in after-hours trading after it announced an agreement to sell 7.0 million shares of its common stock in an underwritten public offering.

Duluth Holdings (DLTH -0.29%) tumbled 11% in after-hours trading after it reported Q1 EPS of 1 cents, much weaker than consensus of 5 cents.

Sigma Designs (SIGM +0.81%) dropped almost 5% in after-hours trading after it reported a Q1 adjusted loss per share of -25 cents, wider than consensus of -21 cents.

Golub Capital BDC Inc (GBDC -1.60%) lost over 1% in after-hours trading after it announced that it plans to make a public offering on 1.75 million shares of its common stock.

Carvana (CVNA +5.89%) jumped almost 10% in after-hours trading after it reported Q1 net sales and operating revenues of $159.1 million, above consensus of $157.6 million, and sad it sees 2017 revenue of $850 million-$910 million, the mid-point well above consensus of $854.4 million.

Dynavax Technologies (DVAX +1.45%) rose nearly 3% in after-hours trading after holder Point72 Asset Management boosted its passive stake in the company to 5.2% from 1.5%.

MARKET COMMENTS

June E-mini S&Ps (ESM17 +0.04%) this morning are up +0.50 points (+0.02%). Tuesday's closes: S&P 500 -0.28%, Dow Jones -0.23%, Nasdaq -0.36%. The S&P 500 on Tuesday closed lower on risk aversion ahead of Thursday's UK general election and Thursday's congressional testimony from former FBI Director Comey. There was also weakness in mining stocks after copper prices fell to a 2-week low. Stocks were supported by signs of strength in the U.S. labor market after Apr JOLTS job openings rose +259,000 to a record 6.044 million (data from 2000), stronger than expectations of +7,000.

Sep 10-year T-notes (ZNU17 -0.06%) this morning are down -1.5 ticks. Tuesday's closes: TYU7 +9.50, FVU7 +5.00. Sep 10-year T-notes on Tuesday rose to contract high and the 10-year T-note yield fell to a 6-3/4 month low. T-note prices were boosted by a report that China may increase its holdings of U.S. Treasuries as U.S. yields are more attractive than other sovereign debt, and by reduced inflation expectations after the 10-year T-note breakeven inflation expectations rate fell to a 2-week low.

The dollar index (DXY00 +0.32%) this morning is up +0.34 (+0.35%). EUR/USD (^EURUSD) is down -0.0068 (-0.60%) and USD/JPY (^USDJPY) is up +0.03 (+0.03%). Tuesday's closes: Dollar index -0.163 (-0.17%), EUR/USD +0.0023 (+0.20%), USD/JPY -1.04 (-0.94%). The dollar index on Tuesday tumbled to a 6-3/4 month low and closed lower on the slide in USD/JPY to a 6-week low on increased safe-haven demand for the yen on risk aversion ahead of Thursday's elections in the UK. The dollar also fell on the decline in the 10-year T-note yield to a 6-3/4 month low, which undercuts the dollar's interest rate differentials.

Jul WTI crude oil prices (CLN17 -0.75%) this morning are down -29 cents (-0.60%) and July gasoline (RBN17 -1.52%) is -0.0224 (-1.44%). Tuesday's closes: Jul crude +0.79 (+1.67%), Jul gasoline +0.0164 (+1.07%). Jul crude oil and gasoline on Tuesday closed higher on the slump in the dollar index to a 6-3/4 month low, and on expectations for Wednesday's EIA data to show U.S. crude inventories fell -3.0 million bbl. Gains were limited after the EIA raised its U.S. 2017 crude output forecast to 9.33 million bpd from a May forecast of 9.31 million bpd and raised its U.S. 2018 crude production forecast to a record 10.01 million bpd.

Disclosure: None.