Morning Call For Wednesday, July 12

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 +0.20%) this morning are up +0.18% and European stocks are up +0.78% as energy stocks climb with the price of Aug WTI crude oil (CLQ17 +1.60%) up +1.62%. Crude oil rallied after API data released late Tuesday showed U.S. crude inventories last week fell by -8.13 million bbl. European stocks also garnered support on signs of strength in industrial activity after Eurozone May industrial production rose +1.3% m/m, the largest increase in 6-months. Trading activity was muted ahead of Fed Chair Yellen's testimony before the U.S. House Financial Services Committee about the economy and to when the Fed plans to shrink its balance sheet. Asian stocks settled mixed: Japan -0.48%, Hong Kong +0.64%, China -0.17%, Taiwan +0.05%, Australia -0.98%, Singapore -0.31%, South Korea unch, India +0.18%. Chinese stocks retreated and the yuan rose to a 1-week high against the dollar after China Jun new yuan loans rose by +1.54 trillion yuan, the biggest increase in 5 months, which reduces the chances of additional government stimulus.

The dollar index (DXY00 +0.07%) is up +0.11%. EUR/USD (^EURUSD) is down -0.06%. USD/JPY (^USDJPY) is down -0.39%.

Sep 10-year T-note prices (ZNU17 +0.11%) are up +4.5 ticks.

China Jun new yuan loans rose by +1.54 trillion yuan, stronger than expectations of +1.30 trillion yuan and the biggest increase in 5 months. Jun aggregate financing rose +1.78 trillion yuan, higher than expectations of +1.50 trillion yuan.

Eurozone May industrial production rose +1.3% m/m, stronger than expectations of +1.0% and the largest increase in 6-months.

U.S. STOCK PREVIEW

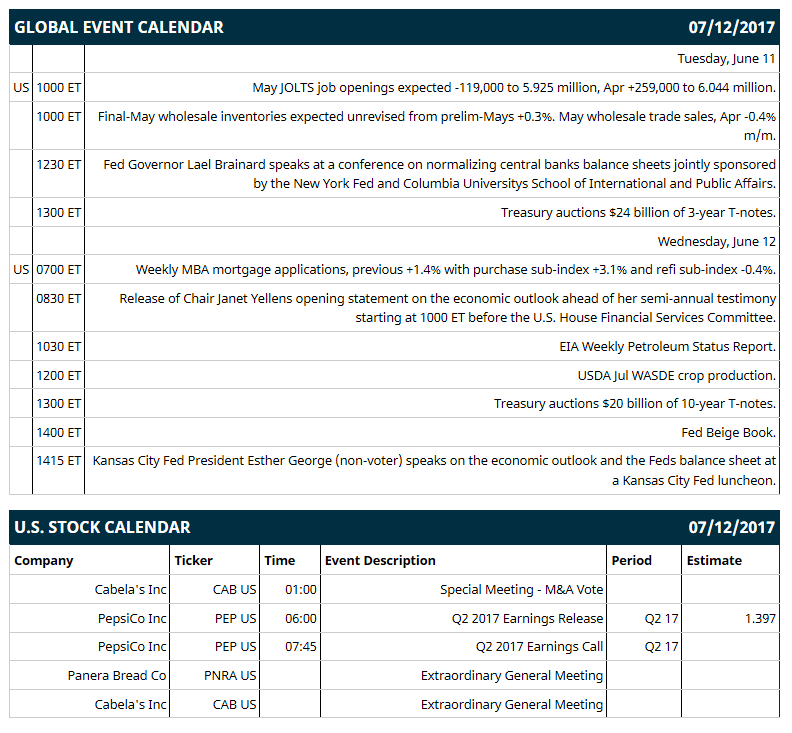

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +1.4% with purchase sub-index +3.1% and refi sub-index -0.4%), (2) release of Chair Janet Yellen’s opening statement on the economic outlook ahead of her semi-annual testimony starting at 1000 ET before the U.S. House Financial Services Committee, (3) Treasury auctions $20 billion of 10-year T-notes, (4) Fed Beige Book, (5) Kansas City Fed President Esther George (non-voter) speaks on the economic outlook and the Fed’s balance sheet at a Kansas City Fed luncheon, (6) EIA Weekly Petroleum Status Report, (7) USDA Jul WASDE crop production.

Notable Russell 3000 earnings reports today include: Fastenal (consensus $0.50), Bank of the Ozarks (0.73), MSC Industrial Direct (1.09).

U.S. IPO's scheduled to price today: none.

Equity conferences this week: none.

OVERNIGHT U.S. STOCK MOVERS

Nvidia (NVDA +1.42%) is up over 1% in pre-market trading after it was upgraded to 'Buy' from 'Neutral' at SunTrust Robinson Humphrey with a price target of $177.

JBG Smith Properties ({=JBGS-W=}) may move to the upside today after it was announced that it will replace Chico's Fas in the S&P MidCap 400 before the open on Wednesday, July 19.

AAR Corp. (AIR +3.94%) climbed 3% in after-hours trading after it reported Q4 sales of $492.3 million, above consensus of $487.0 million.

Casey's General Stores (CASY +0.56%) was initiated with a recommendation of 'Outperform' at William Blair & Co. with a price target of $119.55.

SeaWorld (SEAS -2.82%) was rated a new 'Buy' at GARP Research with a price target of $19.89.

United Continental Holdings (UAL -1.71%) rose almost 1% in after-hours trading after it said June traffic was up +3.4%, capacity was up 5%, and preliminary Q2 consolidated passenger unit revenue was up about 2% y/y, the midpoint of its original 1%-3% guidance range.

Healthcare Services Group (HCSG +1.11%) gained 1% in after-hours trading after it reported Q2 revenue of $470.9 million, higher than consensus of $424.0 million.

Arena Pharmaceuticals (ARNA +41.38%) slipped 2% in after-hours trading after it announced that it intends to offer $150 million of its common stock in an underwritten public offering.

Cohu (COHU +2.39%) jumped over 8% in after-hours trading after it reported Q2 preliminary sales were $93 million, above prior guidance of $86 million and better than consensus of $86.2 million.

Alder Biopharmaceuticals (ALDR +3.39%) sold-off over 8% in after-hours trading after it announced that it intends to offer $12.5 million shares of its common stock in an underwritten public offering.

Kindred Biosciences (KIN -7.65%) dropped 3% in after-hours trading after it announced a proposed public offering of its common stock, although no size was given.

Ocular Therapeutix (OCUL +17.10%) plunged 30% in after-hours trading after the FDA denied Ocular's Dextenza's NDA eye pain drug in its current form.

MARKET COMMENTS

Sep E-mini S&Ps (ESU17 +0.20%) this morning are up +4.25 points (+0.18%). Tuesday's closes: S&P 500 -0.08%, Dow Jones unch, Nasdaq +0.27%. The S&P 500 on Tuesday closed lower on the weak U.S. May JOLTS job openings report of -301,000 to 5.666 million (weaker than expectations of -94,000 to 5.950 million) and political uncertainty after Donald Trump Jr. released politically damaging emails related to the Russian investigation. On the plus side, energy stocks were supported by the +1.44% rally in crude oil prices.

Sep 10-year T-notes (ZNU17 +0.11%) this morning are up +4.5 ticks. Tuesday's closes: TYU7 +3.00, FVU7 +1.75. Sep 10-year T-notes on Tuesday closed higher on dovish comments from Fed Governor Brainard who said she wants to "monitor inflation developments carefully and move cautiously on further rate increases." T-notes were undercut by supply pressures as the Treasury sells $56 billion of T-bonds and T-notes this week.

The dollar index (DXY00 +0.07%) this morning is up +0.109 (+0.11%). EUR/USD (^EURUSD) is down -0.0007 (-0.06%) and USD/JPY (^USDJPY) is down -0.44 (-0.39%). Tuesday's closes: Dollar index -0.353 (-0.37%), EUR/USD +0.0068 (+0.60%), USD/JPY -0.10 (-0.09%). The dollar index on Tuesday closed lower on the weaker-than-expected U.S. May JOLTS job openings report and on position squaring ahead of Wednesday's testimony on the economy by Fed Chair Yellen before the U.S. House Financial Services Committee.

Aug WTI crude oil prices (CLQ17 +1.60%) this morning are up +73 cents (+1.62%) and Aug gasoline (RBQ17 +0.57%) is +0.0113 (+0.74%). Tuesday's closes: Aug crude +0.64 (+1.44%), Aug gasoline +0.0176 (+1.17%). Aug crude oil and gasoline on Tuesday closed higher on a weaker dollar and the increase in the crack spread to a 2-1/2 month high, which may boost refinery demand for crude oil to refine into gasoline. Crude oil prices were also boosted by expectations that Wednesday's EIA data will show U.S. crude inventories fell -2.75 million bbl.

(Click on image to enlarge)

Disclosure: None.