Morning Call For Wednesday, Jan 24

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.20%) this morning are up +0.13% at a new record nearest-futures high after U.S. Treasury Secretary Mnuchin endorsed a plunge in the dollar index to a 3-year low when he said the dollar's decline provides a boost to the U.S. economy through trade. European stocks are down by -0.10% as a rally in EUR/USD (^EURUSD) to new 3-year high undercut European exporters. Losses in European equities were contained on signs of economic strength after the Eurozone Jan Markit composite PMI unexpectedly rose +0.5 to 58.6, an 11-1/2 year high. The markets will scour comments from world leaders who have gathered in Davos, Switzerland for the annual World Economic Forum. Asian stocks settled mixed: Japan -0.76%, Hong Kong +0.08%, China +0.37%, Taiwan -0.90%, Australia +0.29%, Singapore +0.48%, South Korea -0.01%, India +0.06%. China's Shanghai Composite rose to a new 2-year high after President Xi Jinping, speaking in Davos, said China will introduce more reform measures to open up its economy this year and "some measures will exceed the expectations of the international community." Japanese stocks retreated after USD/JPY (^USDJPY) tumbled to a 4-1/4 month low, which undercut Japanese exporter stocks.

The dollar index (DXY00 -0.55%) is down -0.53% at a new 3-year low after U.S. Treasury Secretary Mnuchin said, "obviously a weaker dollar is good for us as it relates to trade and opportunities." EUR/USD (^EURUSD) is up +0.30% at a 3-year high. USD/JPY (^USDJPY) is down -0.64% at a 4-1/4 month low.

Mar 10-year T-note prices (ZNH18 -0.10%) are down -4 ticks.

Comments from U.S. Treasury Secretary Mnuchin fueled losses in the dollar index to a new 3-year low when he said, "obviously a weaker dollar is good for us as it relates to trade and opportunities" and that the dollar's short-term value is "not a concern of ours at all."

The Eurozone Jan Markit composite PMI unexpectedly rose +0.5 to 58.6, stronger than expectations of -0.2 to 57.9 and the fastest pace of expansion in 11-1/2 years.

The Eurozone Jan Markit manufacturing PMI fell -1.0 to 59.6, weaker than expectations of -0.3 to 0.3.

The German Jan Markit/BME manufacturing PMI fell -2.1 to 61.2, weaker than expectations of -0.3 to 63.0.

The Japan Jan Nikkei manufacturing PMI rose +0.4 to 54.4, the fastest pace of expansion since the data series began in 2015.

U.S. STOCK PREVIEW

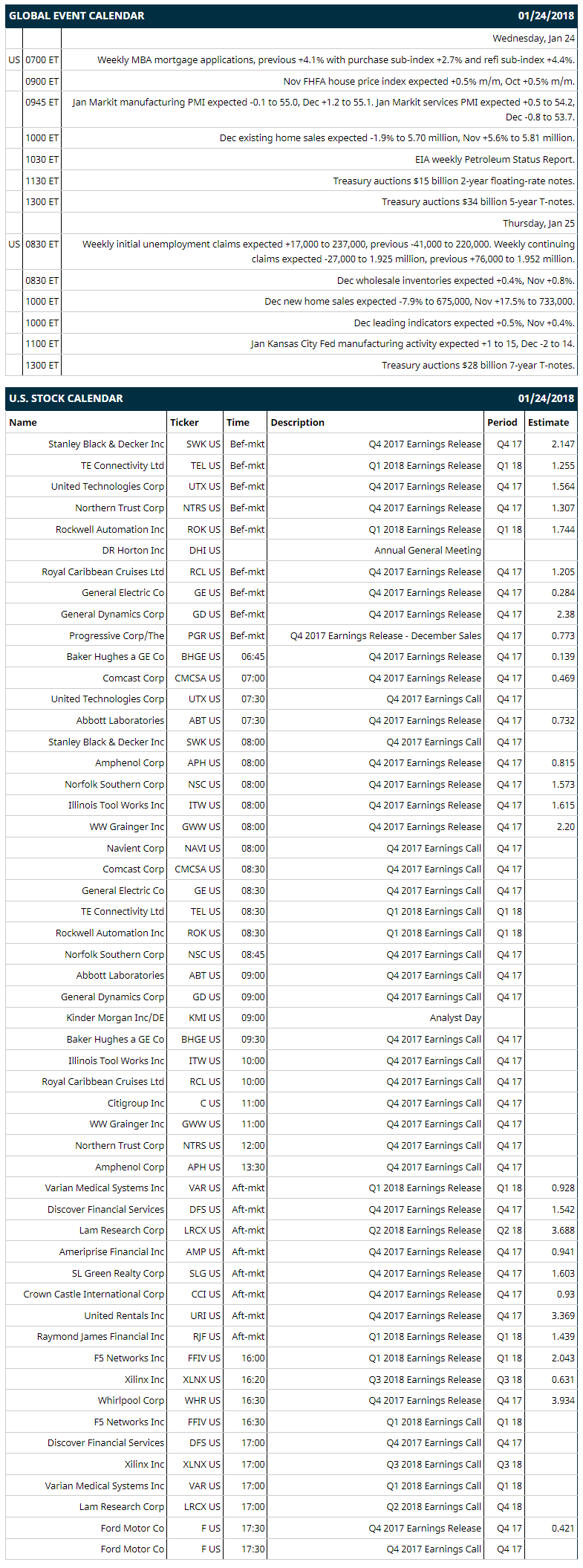

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous +4.1% with purchase sub-index +2.7% and refi sub-index +4.4%), (2) Nov FHFA house price index (expected +0.5% m/m, Oct +0.5% m/m), (3) Jan Markit manufacturing PMI (expected -0.1 to 55.0, Dec +1.2 to 55.1), (4) Dec existing home sales (expected -1.9% to 5.70 million, Nov +5.6% to 5.81 million), (5) EIA weekly Petroleum Status Report, (6) Treasury auctions $15 billion of 2-year floating-rate notes and $34 billion 5-year T-notes, (7) USDA Dec Cold Storage.

Notable S&P 500 earnings reports today include: GE (consensus $0.28), Ford (0.42), Comcast (0.47), Baker Hughes (0.14), Abbott Labs (0.73), Northern Trust (1.31), Discover Financial (1.54), Norfolk Southern (1.57), Illinois Tookworks (1.62), General Dynamics (2.38).

U.S. IPO's scheduled to price today: Solid Biosciences (SLDB), Gates Industrial Corp (GTES), Menlo Therapeutics (MNLO).

Equity conferences this week: National Business Aviation Association Regional Conference on Wed.

OVERNIGHT U.S. STOCK MOVERS

McKesson (MCK -1.36%) was upgraded to 'Buy' from 'Hold' at Jeffries with a price target of $205.

United Continental Holdings (UAL +1.43%) gave up a 3% advance in after-hours trading and dropped 6% after it forecast capacity growth of as much as 6% this year, which may expand seat supply and cut gains in a gauge of pricing power by half a percentage point. UAL had initially moved higher after it reported Q4 adjusted EPS of $1.40, higher than consensus of $1.34.

Total System Services (TSS +0.20%) rose over 2% in after-hours trading after it reported Q4 adjusted EPS of 82 cents, above consensus of 79 cents, and then said it sees full-year adjusted EPS from continuing operations of $4.10 to $4.20, better than consensus of $3.94.

Capital One Financial (COF +0.21%) slid almost 2% in after-hours trading after it reported Q4 adjusted EPS of $1.62, weaker than consensus of $1.87.

Texas Instruments (TXN +0.38%) fell over 5% in after-hours trading after it said it sees Q1 EPS of $1.01 to $1.17, the midpoint below consensus of $1.15.

Puma Biotechnology (PBYI -3.25%) plunged over 28% in after-hours trading after the Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) communicated a negative trend vote after meeting to discuss the Marketing Authorization Application for Puma's Neratinib for treatment of early stage HER2-positive breast cancer.

Qiagen NV (QGEN +1.51%) gained almost 2% in after-hours trading after it received clearance from the FDA for expanded use of its Jak2 test in diagnosis of myeloproliferative neoplasms.

Arrie Pharmaceuticals (AERI +1.75%) lost over 1% in after-hours trading after it proposed to sell $75 million of shares of its common stock in an underwritten public offering.

Mercury Systems (MRCY -0.45%) slid almost 6% in after-hours trading after it reported Q2 adjusted EPS of 28 cents, below consensus of 30 cents, and said it sees full-year adjusted EPS of $1.33 to $1.37, the midpoint below consensus of $1.37.

Audentes Therapeutics (BOLD -0.16%) fell 3% in after-hours trading after it proposed to sell $150 million of shares of its common stock in an underwritten public offering.

Five Prime Therapeutics (FPRX +0.63%) lost over 6% in after-hours trading after it proposed to sell $75 million of shares of its common stock in an underwritten public offering.

Rocket Pharmaceuticals (RCKT +14.47%) fell almost 8% in after-hours trading after it proposed an offering of $50 million in shares of its common stock.

Teekay Corp (TK +0.47%) dropped 7% in after-hours trading after it proposed a stock offering of 10 million shares of its common stock.

Accuray (ARAY +0.97%) rallied nearly 8% in after-hours trading after it reported a Q2 loss of -6 cents a share, narrower than consensus for -11 cents a share loss.

Sirius XM Holdings (SIRI +0.53%) gained 1% in after-hours trading after it added $2 billion to its stock buyback program.

Cerus (CERS +3.34%) surged 20% in after-hours trading after it said a Phase 3 transfusion study of chronic anemia evaluating INTERCEPT-treated red blood cells in thalassemia patents met primary endpoints.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.20%) this morning are up +3.75 points (+0.13%) at a fresh record nearest-futures high. Tuesday's closes: S&P 500 +0.22%, Dow Jones -0.01%, Nasdaq +0.83%. The S&P 500 on Tuesday rose to a new record high and closed higher on strength in technology stocks led by the 10% surge in Netflix to an all-time high after it reported stellar quarterly earnings. The market continued to receive support from strong earnings results as more than 80% of the S&P 500 companies that have reported quarterly earnings have beaten estimates. There was also strength in energy stocks as the price of crude oil climbed +1.42%.

Mar 10-year T-note prices (ZNH18 -0.10%) this morning are down -4 ticks. Tuesday's closes: TYH8 +10.50, FVH8 +6.00. Mar 10-year T-notes on Tuesday closed higher on carry-over support from a rally in German bunds to a 1-1/2 week high and from a rally in Japanese 10-year bonds to a 1-1/2 week high after BOJ Governor Kuroda said the BOJ must maintain its current monetary easing program since inflation is still distant from its 2% target. T-note prices also received a boost from the weaker than expected U.S. Jan Richmond Fed manufacturing index.

The dollar index (DXY00 -0.55%) this morning is down -0.478 (-0.53%) to a new 3-year low. EUR/USD (^EURUSD) is up +0.0037 (+0.30%) at a 3-year high and USD/JPY (^USDJPY) is down -0.71 (-0.64%) at a 4-1/4 month low. Tuesday's closes: Dollar Index -0.277 (-0.31%), EUR/USD +0.0037 (+0.30%), USD/JPY -0.61 (-0.55%). The dollar index on Tuesday slumped to a new 3-year low and closed lower on global trade concerns after President Trump slapped tariffs on U.S. imports of solar panels and washing machines. There was also strength in EUR/USD which gained after Eurozone Jan consumer confidence rose more than expected to a 17-1/3 year high.

Mar crude oil (CLH18 +0.25%) this morning is up +23 cents (+0.36%) and Mar gasoline (RBH18 -0.25%) is -0.0022 (-0.12%). Tuesday's closes: Mar WTI crude +0.90 (+1.42%), Mar gasoline +0.0274 (+1.46%). Mar crude oil and gasoline on Tuesday closed higher with Mar gasoline at a 4-3/4 month high. Crude oil prices were boosted by the sell-off in the dollar index to a 3-year low and expectations for Thursday's weekly EIA data at show U.S. crude inventories fell -2.0 million bbl, the tenth straight weekly decline.

Metals prices this morning are higher with Feb gold (GCG18 +1.00%) +11.8 (+0.88%) at a 4-1/2 month high, Mar silver (SIH18 +1.82%) +0.287 (+1.70%), and Mar copper (HGH18 +1.35%) +0.043 (+1.37%). Tuesday's closes: Feb gold +4.8 (+0.36%), Mar silver -0.076 (-0.45%), Mar copper -0.0875 (-2.74%). Metals on Tuesday settled mixed with Mar silver at a 3-week low and Mar copper at a 6-week low. Metals prices were undercut by increased copper supplies after LME copper inventories surged +36,300 MT to a 2-1/4 month high of 248,075 MT, and by Chinese copper demand concerns after Chinese customs data showed China 2017 unwrought copper imports fell -5.2% y/y to 4.69 MMT. Metals prices were supported by the decline in the dollar index to a 3-year low.

(Click on image to enlarge)

Disclosure: None.