Morning Call For Wednesday, August 9

OVERNIGHT MARKETS AND NEWS

Sep E-mini S&Ps (ESU17 -0.38%) this morning are down -0.33% at a 1-1/2 week low and European stocks are down -1.40% as global equity markets slide on heightened geopolitical tensions between the U.S. and North Korea. President Trump warned that North Korea would face "fire and fury" from the U.S. if North Korea continued to make threats against the U.S. and North Korean President Kim Jong-Un countered by saying North Korea was examining an operational plan for firing a ballistic missile toward Guam. The saber-rattling between the two countries pushed the VIX volatility index up to a 1-month high. Asian stocks settled mostly lower: Japan -1.29%, Hong Kong-0.35%, China -0.19%, Taiwan -0.93%, Australia +0.38%, Singapore closed for holiday, South Korea -1.24%, India -0.68%. Japan's Nikkei Stock Index tumbled to a 2-1/4 month low as exporter stocks sold off due to strength in the yen. USD/JPY (^USDJPY) dropped to a 1-3/4 month low as increased geopolitical risks between the U.S. and North Korea fueled safe-haven demand for the yen. The Chinese yuan rose to a 10-1/4 month high against the dollar after the PBOC raised its daily reference rate by +0.16%.

The dollar index (DXY00 -0.04%) is down -0.03%. EUR/USD (^EURUSD) is down -0.16%. USD/JPY (^USDJPY) is down -0.43% at a 1-3/4 month low.

Sep 10-year T-note prices (ZNU17 +0.27%) are up +8.5 ticks.

China Jul CPI rose +1.4% y/y, weaker than expectations of +1.5% y/y. Jul PPI rose +5.5%, weaker than expectations of +5.6% y/y.

U.S. STOCK PREVIEW

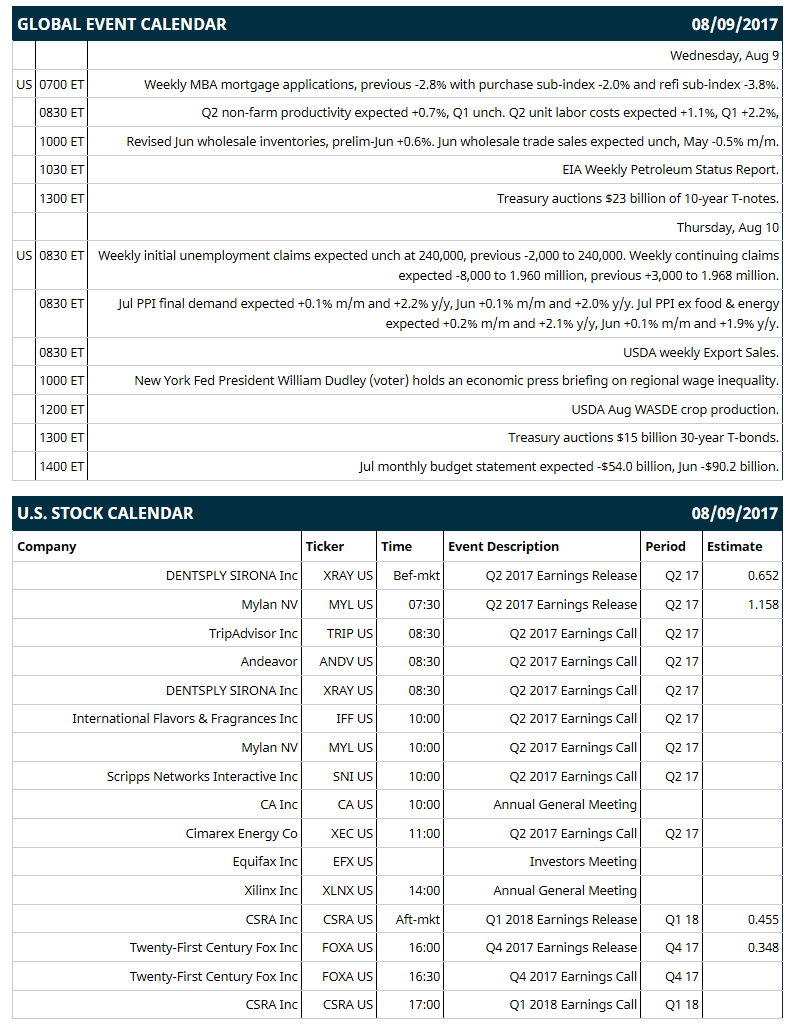

Key U.S. news today includes: (1) weekly MBA mortgage applications (previous -2.8% with purchase sub-index -2.0% and refi sub-index -3.8%), (2) Q2 non-farm productivity (expected +0.7%, Q1 unch) and Q2 unit labor costs (expected +1.0%, Q1 +2.2%), (3) revised Jun wholesale inventories (prelim-Jun +0.6%) and Jun wholesale trade sales (expected unch, May -0.5% m/m), (4) Treasury auctions $23 billion of 10-year T-notes, (5) EIA Weekly Petroleum Status Report.

Notable S&P 500 earnings reports today include: Twenty-First Century Fox (consensus $0.35), CSRA (0.46), DENTSPLY SIRONA (0.65), Mylan (1.16).

U.S. IPO's scheduled to price today: Contura Energy (CNTE).

Equity conferences this week: Oppenheimer Technology, Internet and Communications Conference on Tue-Wed, J.P. Morgan Auto Conference on Wed, Canaccord Genuity Growth Conference on Wed-Thu, Goldman Sachs Power, Utilities MLP and Pipeline Conference on Thu.

OVERNIGHT U.S. STOCK MOVERS

Priceline Group (PCLN +0.31%) dropped over 6% in pre-market trading after it said it sees Q3 adjusted EPS of $32.40-$34.10, weaker than consensus of $34.14.

Netflix (NFLX -1.64%) fell nearly 4% in pre-market trading after Disney said it will end its distribution agreement with Netflix for subscription streaming beginning in 2019.

Walt Disney (DIS +0.59%) lost 4% in after-hours trading after it reported Q3 revenue of $14.24 billion, below consensus of $14.42 billion, and said it will end its partnership with Netflix and launch its own streaming service.

Starbucks (SBUX -2.00%) was downgraded to 'Market Perform' from 'Outperform' at BMO Capital Markets.

Monster Beverage (MNST -0.45%) slid 4% in after-hours trading after it reported Q2 EPS of 39 cents, below consensus of 40 cents.

Jazz Pharmaceuticals PLC (JAZZ -2.10%) dropped 8% in after-hours trading after it reported Q2 adjusted EPS of $2.56, below consensus of $2.75.

Alarm.com Holdings (ALRM +0.74%) rose 7% in after-hours trading after it reported Q2 revenue of $86 million, higher than consensus of $81 million, and then raised its full-year revenue estimate to $326.3 million-$327.8 million from a prior view of $325.6 million.

Nuance Communications (NUAN +0.12%) fell 3% in after-hours trading after it reported Q3 adjusted revenue of $495.6 million, weaker than consensus of $498 million, and then cut its view on full-year adjusted revenue guidance to $1.95 billion-$1.98 billion from a May estimate of $2.03 billion-$2.07 billion.

Hostess Brands (TWNK -1.37%) dropped over 6% in after-hours trading after it reported Q2 revenue of $203.2 million, below consensus of $205 million.

MaxLinear (MXL +0.04%) sank 12% in after-hours trading after it reported Q2 net revenue of $104.2 million, weaker than consensus of $107.9 million, and then said it sees Q3 revenue of $114 million-$118 million, below consensus of $123.9 million.

ACADIA Pharmaceuticals (ACAD -3.37%) rallied over 10% in after-hours trading after it reported Q2 revenue of $30.5 million, better than consensus of $20.0 million.

OPKO Health (OPK -2.85%) lost 1% in after-hours trading after it reported Q2 revenue of $314.2 million, below consensus of $322.6 million.

Fossil Group (FOSL +5.71%) plunged 20% in after-hours trading after it reported Q2 net sales of $596.8 million, weaker than consensus of $618 million, and then lowered guidance for full-year net sales to a loss of -4.5% to -8.5%, weaker than a previous forecast of -1.5% to -6.0%.

ShotSpotter (SSTI -2.98%) jumped 14% in after-hours trading after it reported Q2 gross margins of 54%, stronger than expectations of 49.1%, and then raised its full-year revenue forecast to $21.5 million-$22.5 million from a prior view of $21 million.

MARKET COMMENTS

Sep S&P 500 E-mini stock futures (ESU17 -0.38%) this morning are down -8.25 points (-0.33%) at a 1-1/2 week low. Tuesday's closes: S&P 500 -0.24%, Dow Jones -0.15%, Nasdaq -0.14%. The S&P 500 on Tuesday rallied to a fresh all-time high, but then gave up its gains and closed lower. Stocks were undercut by geopolitical risks after President Trump said further threats from North Korea would be met with "fire and fury." Stocks were also undercut by the overnight news that China Jul exports rose +7.2% y/y, weaker than expectations of +11.0% y/y and the smallest increase in 5 months. There was also weakness in energy stocks as crude oil prices fell -0.45%. A bullish factor was the +461,00 increase in U.S. Jun JOLTS job openings to a record 6.163 million, much stronger than expectations of +84,000 to 5.75 million.

Sep 10-year T-note prices (ZNU17 +0.27%) this morning are up +8.5 ticks. Tuesday's closes: TYU7 -5.0, FVU7 -2.75. Sep 10-year T-notes on Tuesday closed lower on the +461,000 surge in U.S. Jun JOLTS job openings to a record 6.163 million and on supply pressures from the Aug quarterly refunding as the Treasury auctions $62 billion in T-notes and T-bonds this week.

The dollar index (DXY00 -0.04%) this morning is down -0.032 (-0.03%). EUR/USD (^EURUSD) is down -0.0019 (-0.16%) and USD/JPY (^USDJPY) is down -0.47 (-0.43%) at a 1-3/4 month low. Tuesday's closes: Dollar Index +0.215 (+0.23%), EUR/USD -0.0043 (-0.36%), USD/JPY -0.43 (-0.39%). The dollar index on Tuesday climbed to a 1-week high and settled higher on the increase in U.S. Jun JOLTS job openings to a record high, which bolsters the case for tighter Fed monetary policy, and on the unexpected -2.8% m/m decline in German Jun exports that was EUR/USD negative.

Sep crude oil (CLU17 +0.57%) this morning is up +30 cents (+0.61%). Sep gasoline (RBU17 -0.46%) is -0.0049 (-0.30%). Tuesday's closes: Sep WTI crude -0.22 (-0.45%), Sep gasoline -0.0091 (-0.56%). Sep crude and gasoline on Tuesday closed lower with Sep gasoline at a 1-week low. Crude oil prices were undercut by the rally in the dollar index to a 1-week high and by the fall in the crack spread to a 1-week low, which reduces the incentive for refiners to purchase crude to refine into gasoline. Losses were limited on expectations that Wednesday's EIA crude inventories report will show a decline of -2.0 million bbl.

(Click on image to enlarge)

Disclosure: None.