Morning Call For Tuesday, Feb. 14

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH17 -0.02%) are little changed, down -0.05%, and European stocks are up +0.07% ahead of this morning's testimony from Fed Chair Yellen to the Senate Banking Committee on clues as to the direction of U.S. monetary policy. European stocks found support on strength in automakers on possible increased M&A activity after Peugeot SA said it was exploring an acquisition of General Motor's European business. Gains in equities were held down after Eurozone Q4 GDP was revised downward and after the Eurozone Dec industrial production posted its biggest decline in 10 months. Asian stocks settled mostly lower: Japan -1.13%, Hong Kong -0.03%, China +0.03%, Taiwan +0.09%, Australia -0.09%, Singapore -1.26%, South Korea -0.34%, India -0.04%. Chinese stocks relinquished most of their gains on the prospects that increased inflation risks may prompt the government to tighten monetary policy after China Jan CPI rose at the fastest pace in 2-1/2 years and Jan PPI rose at the fastest pace in 5-1/3 years.

The dollar index (DXY00 -0.18%) is down -0.20%. EUR/USD (^EURUSD) is up +0.26%. USD/JPY (^USDJPY) is down -0.30%.

Mar 10-year T-note prices (ZNH17 -0.10%) are down -3.5 ticks.

Eurozone Q4 GDP was revised downward to +0.4% q/q and +1.7% y/y, weaker than expectations of +0.5% q/q and +1.8% y/y.

Eurozone Dec industrial production fell -1.6% m/m, weaker than expectations of -1.5% m/m and the biggest decline in 10 months.

The German Feb ZEW survey expectations of economic growth fell -6.2 to 10.4, weaker than expectations of -1.6 to 15.0 and a 4-month low.

China Jan CPI rose +2.5% y/y, stronger than expectations of +2.4% y/y and the fastest pace of increase in 2-1/2 years. Jan PPI rose +6.9% y/y, stronger than expectations of +6.5% y/y and the fastest pace of increase in 5-1/3 years.

U.S. STOCK PREVIEW

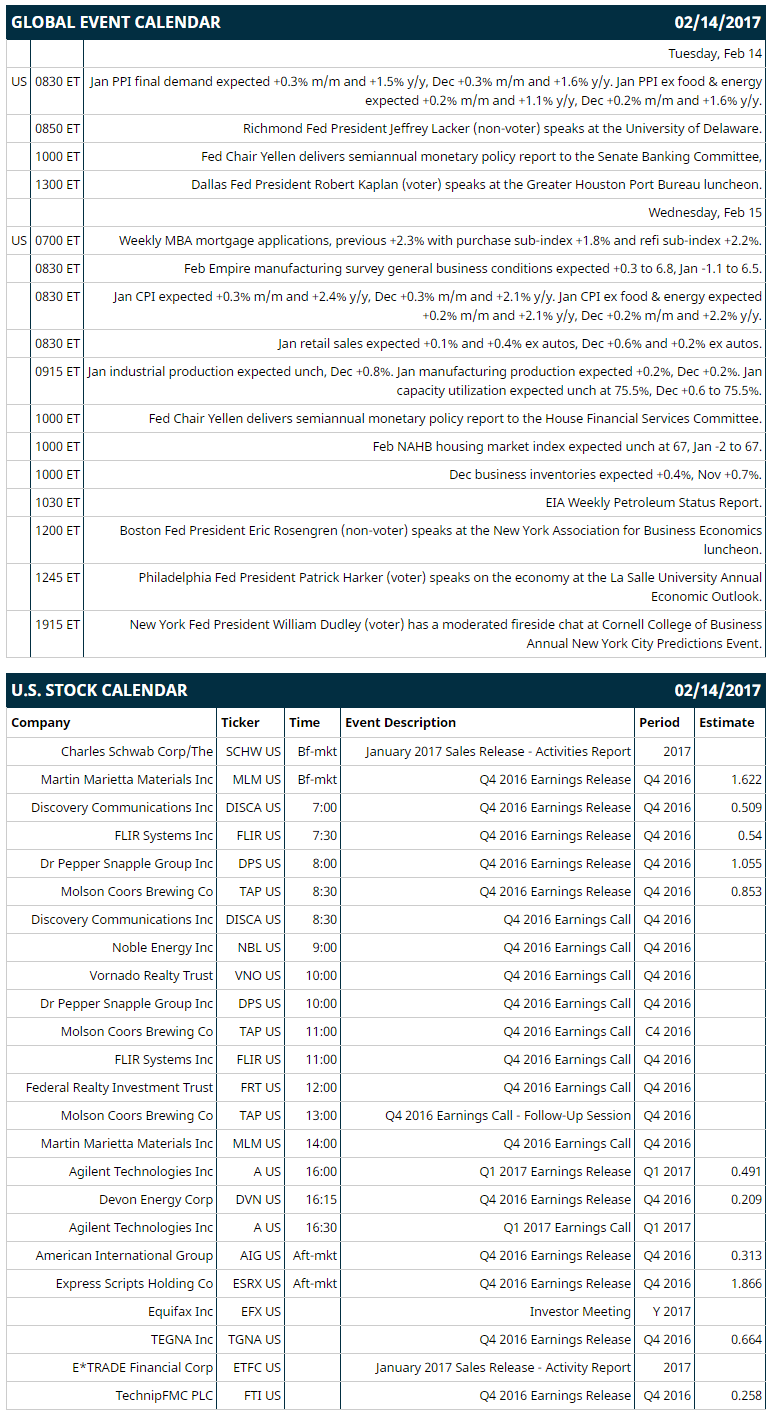

Key U.S. news today includes: (1) Jan PPI final demand (expected +0.3% m/m and +1.5% y/y, Dec +0.3% m/m and +1.6% y/y) and Jan PPI ex food & energy (expected +0.2% m/m and +1.1% y/y, Dec +0.2% m/m and +1.6% y/y), (2) Richmond Fed President Jeffrey Lacker (non-voter) speaks at the University of Delaware, (3) Fed Chair Yellen delivers semiannual monetary policy report to the Senate Banking Committee, (4) Dallas Fed President Robert Kaplan (voter) speaks at the Greater Houston Port Bureau luncheon.

Notable S&P 500 earnings reports today include: Noble Energy (consensus $-0.10), HCP (0.57), Federal Realty Trust (1.44), Vornado Realty Trust (1.31).

U.S. IPO's scheduled to price today: none.

Equity conferences: Credit Suisse Energy Summit on Mon-Wed, RSA Security Conference on Mon-Thu, Stifel Transportation and Logistics Conference on Tue-Wed, Goldman Sachs Technology and Internet Conference on Tue-Thu, Bank of America Merrill Lynch Insurance Conference on Wed-Thu, Leerink Partners Global Health Care Conference on Wed-Thu.

OVERNIGHT U.S. STOCK MOVERS

Goldman Sachs Group (GS +1.46%) was downgraded to 'Market Perform' from 'Market Outperform' at Vining Sparks with a target price of $255.

PulteGroup (PHM -0.46%) was upgraded to 'Outperform' from 'Market Perform' at FBR Capital Markets with a 12-month target price of $26.

Hostess Brands (TWNK -1.75%) was rated a new 'Strong Buy' at CL King with a 12-month target price of $20.

Quantena Communications (QTNA +3.82%) climbed 3% in after-hours trading after it reported Q4 adjusted EPS of 3 cents, better than consensus of 1 cent.

Brookdale Senior Living (BKD -2.05%) slid 3% in after-hours trading after it reported Q4 revenue of $1.21 billion, less than consensus of $1.22 billion.

Cornerstone OnDemand (CSOD -4.90%) rose 3% in after-hours trading after it reported Q4 billings of $156.3 million, higher than consensus of $135.5 million.

Golar LNG Ltd (GLNG -1.97%) dropped 5% in after-hours trading after it announced a proposed offering of $350 million in convertible senior notes due 2022.

PDF Solutions (PDFS -0.62%) rallied 6% in after-hours trading after it reported Q4 revenue of $28.4 million, above consensus of $28.3 million.

Amkor Technology (AMKR +4.71%) tumbled nearly 10% in after-hours trading after it said it sees Q1 EPS of down -11 cents a share to up 5 cents, well below consensus of 14 cents.

Chegg (CHGG +2.92%) lost over 1% in after-hours trading after it reported Q4 adjusted EPS of 10 cents, below consensus of 11 cents.

Guidance Software (GUID +4.52%) climbed over 4% in after-hours trading after it reported Q4 adjusted EPS of 9 cents, above consensus of 6 cents.

Hibbett Sports (HIBB -0.60%) slumped 14% in after-hours trading after it reported preliminary Q4 comparable sales unexpectedly fell -2.2%, weaker than expectations of up +1.3%, and then said it sees 2018 EPS at $2.65-$2.85, below consensus of $3.06.

GigPeak (GIG +7.54%) jumped over 12% in after-hours trading after Integrated Devices said it will purchase the company for $250 million, or $3.08 a share.

MARKET COMMENTS

Mar E-mini S&Ps (ESH17 -0.02%) this morning are down -1.25 points (-0.05%). Monday's closes: S&P 500 +0.52%, Dow Jones +0.70%, Nasdaq +0.58%. The S&P 500 on Monday climbed to a new record high and settled higher on a rally in bank and financial stocks on expectations that the Trump administration will cut banking regulations and scale back Dodd-Frank reforms, which could boost bank earnings. There was also a rally in commodity-producing stocks as the price of copper rose 0.54% to a 1-1/2 year high.

Mar 10-year T-notes (ZNH17 -0.10%) this morning are down -3.5 ticks. Monday's closes: TYH7 -6.00, FVH7 -3.50. Mar 10-year T-notes on Monday closed lower on reduced safe-haven demand with the rally in the S&P 500 to a new all-time high and long liquidation pressure ahead of Tuesday's semiannual monetary policy report to the Senate Banking Committee from Fed Chair Yellen.

The dollar index (DXY00 -0.18%) this morning is down -0.20 (-0.20%). EUR/USD (^EURUSD) is up +0.0028 (+0.26%). USD/JPY (^USDJPY) is down -0.34 (-0.30%). Monday's closes: Dollar index +0.18 (+0.18%), EUR/USD -0.0045 (-0.42%), USD/JPY +0.52 (+0.46%). The dollar index on Monday rallied to a 3-week high and closed higher on strength in USD/JPY which climbed to a 2-week high as a rally in the S&P 500 to a new record high undercut the safe-haven demand for the yen.

Mar WTI crude oil prices (CLH17 +0.85%) this morning are up +40 cents (+0.76%) and Mar gasoline (RBH17 +1.39%) is +0.0188 (-1.22%). Monday's closes: Mar crude -0.93 (-1.73%), Mar gasoline -0.0450 (-2.83%). Mar crude oil and gasoline on Monday closed lower on the rally in the dollar index to a 3-week high and on Friday's news from Baker Hughes showing that active U.S. oil rigs rose to their highest number in 1-1/4 years.

Disclosure: None.