Morning Call For Tuesday, Dec. 12

OVERNIGHT MARKETS AND NEWS

Mar E-mini S&Ps (ESH18 +0.07%) this morning are up +0.03% and European stocks are higher by +0.15% as gains in energy stocks lead the overall market higher. Jan WTI crude oil (CLF18 +0.83%) is up +0.62% at a 1-week high on carry-over support on a rally in Brent crude prices to a 2-1/2 year high of $65.75 a barrel. Brent crude continues to surge on supply concerns after the Forties Pipeline System, which carries 400,000 bbl of oil a day, was shut down due to a crack in one of the pipelines. The shutdown of the pipeline will last two weeks until repairs are made, and it forced Apache to suspend operations at its nearby Forties oil field. Gains in European stocks were limited after the German Dec ZEW survey expectations of economic growth fell more than expected. Asian stocks settled mostly lower: Japan -0.32%, Hong Kong -0.59%, China -1.25%, Taiwan -0.28%, Australia +0.25%, Singapore +0.15%, South Korea -0.31%, India -0.68%.

The dollar index (DXY00 -0.04%) is down -0.02%. EUR/USD (^EURUSD) is up +0.07%. USD/JPY (^USDJPY) is down -0.11%.

Mar 10-year T-note prices (ZNH18 -0.01%) are down -0.5 of a tick ahead of the 2-day FOMC meeting which begins later this morning.

The German Dec ZEW survey expectations of economic growth fell -1.3 to 17.4, weaker than expectations of -0.7 to 18.0. The Dec ZEW survey current situation unexpectedly rose +0.5 to a 6-1/2 year high of 89.3, stronger than expectations of -0.1 to 88.7.

UK Nov CPI of +0.3% m/m and +3.1% y/y was stronger than expectations of +0.2% m/m and +3.0% y/y with the +3.1% y/y gain the largest year-on-year increase in 5-1/2 years. The Nov core CPI rose +2.7% y/y, right on expectations.

Japan Nov PPI rose +0.4% m/m and +3.5% y/y, stronger than expectations of +0.2% m/m and +3.3% y/y, with the +3.5% y/y gain the largest year-on-year increase in 3 years.

U.S. STOCK PREVIEW

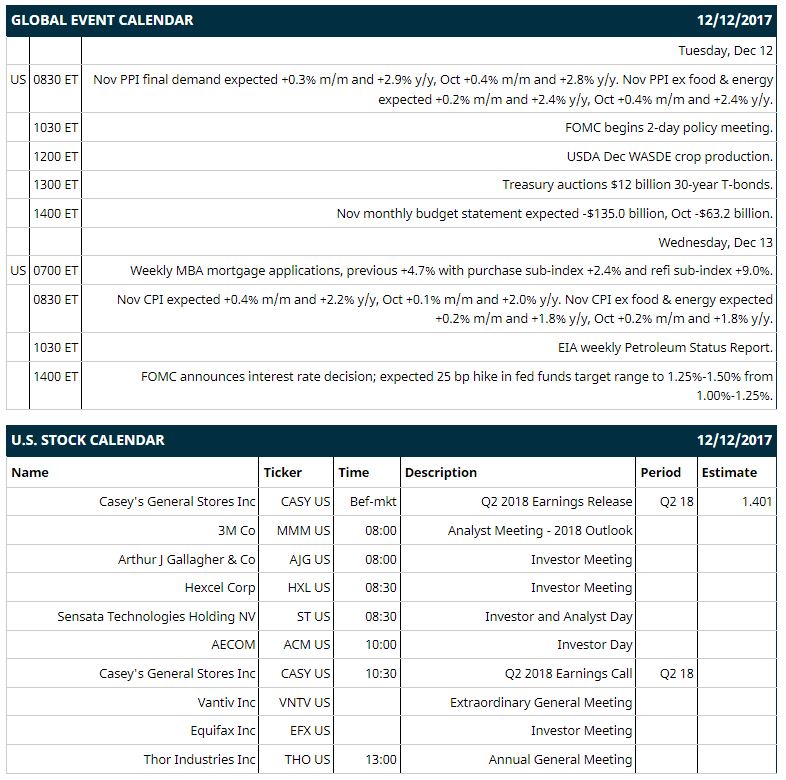

Key U.S. news today includes: (1) Nov PPI final demand (expected +0.3% m/m and +2.9% y/y, Oct +0.4% m/m and +2.8% y/y) and Nov PPI ex food & energy (expected +0.2% m/m and +2.4% y/y, Oct +0.4% m/m and +2.4% y/y), (2) FOMC begins 2-day policy meeting, (3) USDA Dec WASDE crop production, (4) Treasury auctions $12 billion of 30-year T-bonds, (5) Nov monthly budget statement (expected -$135.0 billion, Oct -$63.2 billion).

Notable Russell 1000 earnings reports today include: Casey's General Stores (consensus 1.40).

U.S. IPO's scheduled to price today: Adial Pharmaceuticals (ADIL).

Equity conferences this week: Cowen Technology, Media & Telecom Conference on Tue, TechTaipei Industry & Smart Factory Conference on Tue, Cowen Security and Networking Conference on Wed, Guggenheim Securities Boston Health Care Conference on Wed, BMO Capital Markets Prescriptions for Success Healthcare Conference on Thu, Jefferies Office & Industrial Summit on Thu, SunTrust Financial, Technology, Business & Government Services conference on Thu, Cowen Energy & Natural Resources Conference on Fri.

OVERNIGHT U.S. STOCK MOVERS

Boeing (BA -0.96%) gained over 1% in after-hours trading after it boosted its dividend by 20% to $1.71 a share from $1.42 a share and authorized a new $18 billion stock buyback plan to replace the $14 billion program they put in place a year ago.

Adobe Systems (ADBE +0.43%) fell 1% in pre-market trading after it was downgraded to 'Neutral' from 'Overweight' at JPMorgan Chase.

Casy's General Stores (CASY -2.85%) dropped 4% in after-hours trading after it reported Q2 EPS of $1.28, weaker than consensus of $1.40.

Hyatt Hotels (H -0.54%) lost over 1% in after-hours trading after a block of 2.7 million shares of Hyatt stock was offered at $71.00 to $71.25 via Morgan Stanley.

Blueprint Medicines (BPMC +22.91%) fell nearly 3% in after-hours trading after it announced that it had commenced an underwritten public offering of $275 million in shares of its common stock.

KMG Chemicals (KMG +0.25%) rose over 5% in after-hours trading after t reported Q1 adjusted EPS of 83 cents, better than consensus of 63 cents.

Argenx SE (ARGX +78.88%) slid over 1% in after-hours trading after it said it was offering $150 million of American Depositary Share (ADRs).

Until Corp. (UTL -0.80%) lost 2% in after-hours trading after it announced that it plans to make an underwritten public offering of 600,000 newly issued shares of common stock.

Semtech (SMTC -1.62%) was initiated as a 'Buy' at Needham & Co. with a 12-month target price of $42.

Agios Pharmaceuticals (AGIO +0.74%) gained 1% in after-hours trading after data from its Agios IGH-1 and IDH-2 inhibitors showed early signs of efficacy in acute myeloid leukemia.

Peregrine Pharmaceuticals (PPHM +1.71%) slumped nearly 18% in after-hours trading after it reported cash and cash equivalents of $27.7 million as of Oct 31 versus $46.8 million April 30 and said it plans to raise additional capital within the next six months to support its continued operations.

Oasis Petroleum (OAS unch) fell almost 3% in after-hours trading after it announced that it had commenced an underwritten public offering of 32 million shares of its common stock.

Proteostasis Therapeutics (PTI -2.49%) soared 75% in after-hours trading after it said results from studies of its PTI-428, PTI-808 and PTI-801 met efficacy endpoints in patients with Cystic Fibrosis.

MARKET COMMENTS

Mar S&P 500 E-mini stock futures (ESH18 +0.07%) this morning are .up +0.75 points (+0.03%). Monday's closes: S&P 500 +0.32%, Dow Jones +0.23%, Nasdaq +0.78%. The S&P 500 on Monday closed higher on carry-over support from a rally in Asian markets as Chinese stocks gained after credit growth improved in China last month and as Japan's Nikkei Stock Index rose to a 1-week high after the Japan Q4 BSI Q4 large company business conditions rose to a 2-year high. There was also strength in energy stocks as crude oil prices rose +1.10%.

Mar 10-year T-note prices (ZNH18 -0.01%) this morning are down -0.5 of a tick. Monday's closes: TYH8 unch, FVH8 -2.00. Mar 10-year T-notes on Monday closed little changed. T-note prices received support from a rally in German 10-year bunds to a 5-1/2 month high and from the unexpected decline in the U.S. Oct JOLTS job openings. T-note prices were undercut by strength in stocks, which reduced safe-haven demand for T-notes, and by weak demand for the Treasury's $20 billion 10-year T-note auction that had a bid-to-cover ratio of 2.37, below the 12-auction average of 2.44.

The dollar index (DXY00 -0.04%) this morning is down -0.018 (-0.02%). EUR/USD (^EURUSD) is up +0.0008 (+0.07%) and USD/JPY (^USDJPY) is down -0.13 (-0.11%). Monday's closes: Dollar Index -0.035 (-0.04%), EUR/USD -0.04 (-0.03%), USD/JPY +0.08 (+0.07%). The dollar index on Monday closed lower on the unexpected decline in U.S. Oct JOLTS job openings to the fewest in 5 months and on long liquidation in the dollar ahead of Tuesday's 2-day FOMC meeting.

Jan crude oil (CLF18 +0.83%) this morning is up +36 cents (+0.62%) and Jan gasoline (RBF18 +1.86%) +0.0282 (+1.63%), both at 1-week highs. Monday's closes: Jan WTI crude +0.63 (+1.10%), Jan gasoline +0.0100 (+0.58%). Jan crude oil and gasoline on Monday closed higher on a weaker dollar and on carry-over support from a 2% rally in Brent crude oil after the UK's Forties Pipeline System, which supplies 400,000 bpd of crude oil, was shut down due to a cracked pipe. Crude oil prices were also supported by the increase in the crack spread to a 1-week high, which gives incentive for refineries to increase their crude purchases to refine crude into gasoline.

Metals prices this morning are mixed with Feb gold (GCG18 -0.20%) -1.7 (-0.14%), Mar silver (SIH18 unch) +0.015 (+0.10%) and Mar copper (HGH18 -0.03%) -0.004 (-0.12%). Monday's closes: Feb gold -1.5 (-0.12%), Mar silver -0.038 (-0.24%), Mar copper +0.0330 (+1.11%). Metals on Monday settled mixed. Metals prices were supported by a weaker dollar and by stronger-than-expected China Nov credit growth, which was a sign of economic strength that may lead to increased industrial metals demand. Precious metals prices were undercut by reduced safe-haven demand with the strength in stocks and by long liquidation pressure ahead of an expected Fed interest rate increase on Wednesday.

(Click on image to enlarge)

Disclosure: None.